OPEN-SOURCE SCRIPT

Actualizado MTF Key Levels - Support and Resistance

This indicator shows how to Multi Time Frame (MTF) interpret levels:

Watch how price acts around these levels and how they can act as support/resistance and can be used as great confluence levels for your technical analysis.

This indicator displays:

VWAP Levels

Daily / Weekly / Monthly / Yearly

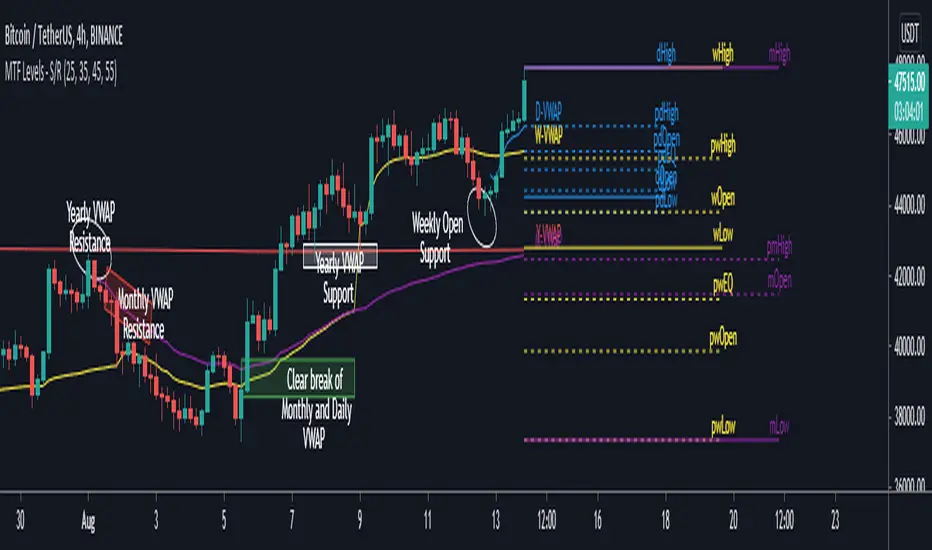

Within the chart above I have marked out how displaying these VWAP levels can provide support and resistance levels to be aware of.

Daily – Weekly - Monthly – Yearly Levels

O = Open / H = High / L = Low

pO = Previous Open / pH = Previous High / pL = Previous Low / pEQ = Previous Equlibrium

Having previous Low/High levels makes you aware of Swing Failure Patterns (SFP). Also the daily/weekly/monthly opening and previous opening can assist with the trend.

Daily Open: Gives you an idea who is in control for the day. This level very often acts as strong support or resistance.

Weekly Open: Indicates where the price is within the higher timeframe.

Monthly Open & Yearly Levels: Overview of direction for the whole month without looking at a monthly chart and Yearly chart

Line Options

Within the line options you can choose to have a clean chart and display a “short line”. These line length can be adjusted by the user.

Line just to the right.

Line across the screen.

Disclaimer: The Monthly and Yealy VWAP will only show on higher timeframes this is due to restriction of how many candles can be shown on the chart. The candles displayed need to go back to either the start of the month of year to be able to calculate their VWAPs.

Watch how price acts around these levels and how they can act as support/resistance and can be used as great confluence levels for your technical analysis.

This indicator displays:

VWAP Levels

Daily / Weekly / Monthly / Yearly

Within the chart above I have marked out how displaying these VWAP levels can provide support and resistance levels to be aware of.

Daily – Weekly - Monthly – Yearly Levels

O = Open / H = High / L = Low

pO = Previous Open / pH = Previous High / pL = Previous Low / pEQ = Previous Equlibrium

Having previous Low/High levels makes you aware of Swing Failure Patterns (SFP). Also the daily/weekly/monthly opening and previous opening can assist with the trend.

Daily Open: Gives you an idea who is in control for the day. This level very often acts as strong support or resistance.

Weekly Open: Indicates where the price is within the higher timeframe.

Monthly Open & Yearly Levels: Overview of direction for the whole month without looking at a monthly chart and Yearly chart

Line Options

Within the line options you can choose to have a clean chart and display a “short line”. These line length can be adjusted by the user.

Line just to the right.

Line across the screen.

Disclaimer: The Monthly and Yealy VWAP will only show on higher timeframes this is due to restriction of how many candles can be shown on the chart. The candles displayed need to go back to either the start of the month of year to be able to calculate their VWAPs.

Notas de prensa

Update:Added Watermark.

Notas de prensa

Watermark report by users as to bright. Transparency updated to meet user request. dVAL, dVAH, pdVAL, pdVAH as levels coming soon.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.