OPEN-SOURCE SCRIPT

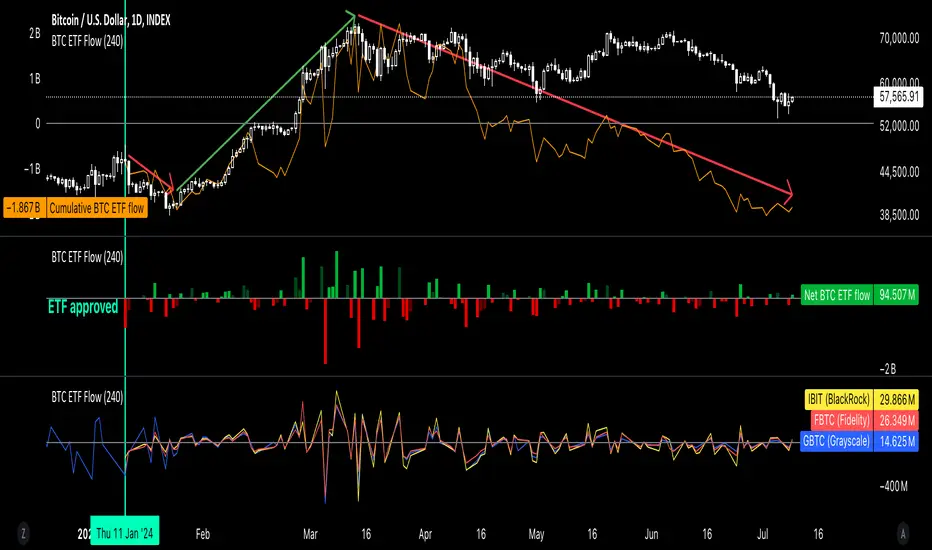

Bitcoin ETF Flow Tracker

GM 💎

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.