OPEN-SOURCE SCRIPT

Actualizado Sweep + MSS

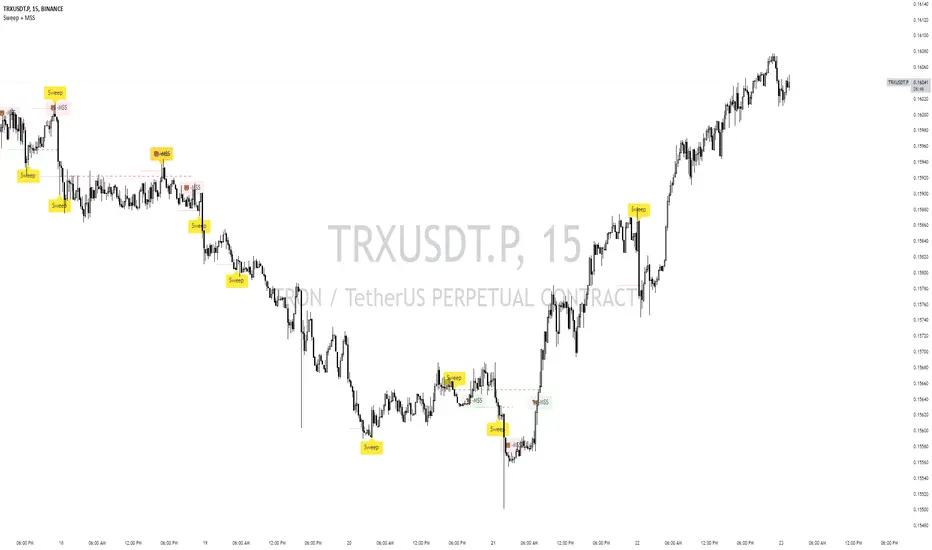

# Sweep + MSS Indicator

This indicator identifies market sweeps and Market Structure Shifts (MSS) to help traders recognize potential trend changes and market manipulations.

How it works:

1. Sweep Detection:

- Identifies when price briefly moves beyond a recent high/low (pivot point) and then reverses.

- Bullish sweep: Price drops below a recent low, then closes above it.

- Bearish sweep: Price rises above a recent high, then closes below it.

2. Market Structure Shift (MSS):

- Occurs when price action invalidates a previous sweep level.

- Bullish MSS: Price closes above a bearish sweep level.

- Bearish MSS: Price closes below a bullish sweep level.

Key Features:

- Customizable pivot lookback length for sweep detection

- Minimum bar requirement after a sweep before MSS can trigger

- One MSS per sweep level to avoid multiple signals

- Visual representation with lines connecting sweep points to MSS triggers

- Emoji labels for easy identification (🐂-MSS for bullish, 🐻-MSS for bearish)

Logic Behind MSS:

The MSS aims to identify potential trend changes by recognizing when the market invalidates a previous sweep level. This often indicates a shift in market structure, suggesting that the previous trend may be weakening or reversing.

- A bullish MSS occurs when the price closes above a bearish sweep level, potentially signaling a shift from bearish to bullish sentiment.

- A bearish MSS occurs when the price closes below a bullish sweep level, potentially signaling a shift from bullish to bearish sentiment.

By requiring a minimum number of bars between the sweep and the MSS, the indicator helps filter out noise and focuses on more significant structural changes in the market.

This indicator can be a valuable tool for traders looking to identify potential trend changes and entry/exit points based on market structure analysis.

This indicator identifies market sweeps and Market Structure Shifts (MSS) to help traders recognize potential trend changes and market manipulations.

How it works:

1. Sweep Detection:

- Identifies when price briefly moves beyond a recent high/low (pivot point) and then reverses.

- Bullish sweep: Price drops below a recent low, then closes above it.

- Bearish sweep: Price rises above a recent high, then closes below it.

2. Market Structure Shift (MSS):

- Occurs when price action invalidates a previous sweep level.

- Bullish MSS: Price closes above a bearish sweep level.

- Bearish MSS: Price closes below a bullish sweep level.

Key Features:

- Customizable pivot lookback length for sweep detection

- Minimum bar requirement after a sweep before MSS can trigger

- One MSS per sweep level to avoid multiple signals

- Visual representation with lines connecting sweep points to MSS triggers

- Emoji labels for easy identification (🐂-MSS for bullish, 🐻-MSS for bearish)

Logic Behind MSS:

The MSS aims to identify potential trend changes by recognizing when the market invalidates a previous sweep level. This often indicates a shift in market structure, suggesting that the previous trend may be weakening or reversing.

- A bullish MSS occurs when the price closes above a bearish sweep level, potentially signaling a shift from bearish to bullish sentiment.

- A bearish MSS occurs when the price closes below a bullish sweep level, potentially signaling a shift from bullish to bearish sentiment.

By requiring a minimum number of bars between the sweep and the MSS, the indicator helps filter out noise and focuses on more significant structural changes in the market.

This indicator can be a valuable tool for traders looking to identify potential trend changes and entry/exit points based on market structure analysis.

Notas de prensa

- Added New Filters- Upgraded Pine Version

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.