OPEN-SOURCE SCRIPT

Actualizado HTF Candle Highs and Lows with Labels + High Probability Signals

█ OVERVIEW

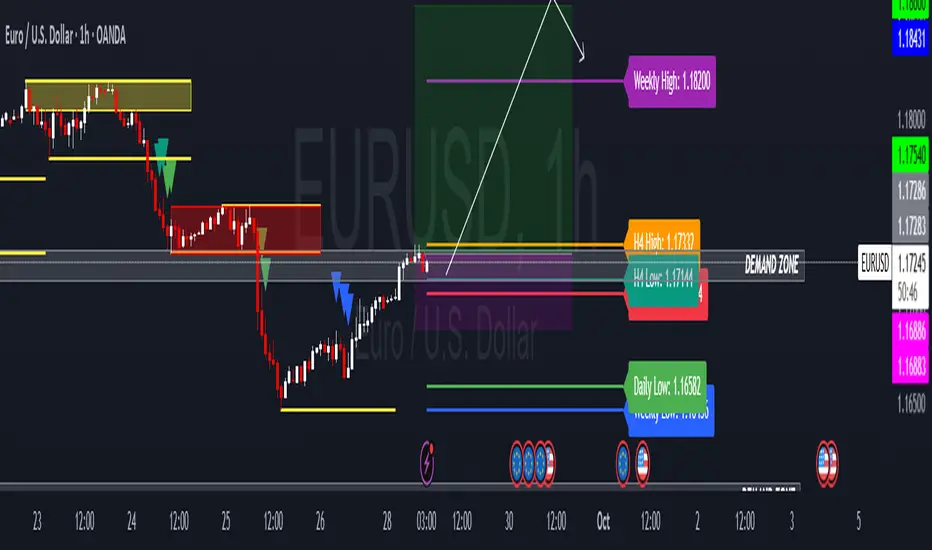

This indicator overlays Weekly, Daily, and H4 High/Low levels directly onto your chart, allowing traders to visualize key support and resistance zones from higher timeframes. It also includes high probability breakout signals that appear one candle after a confirmed breakout above or below these levels, filtered by volume and candle strength.

Use this tool to identify breakout opportunities with greater confidence and clarity.

█ FEATURES

• Plots Weekly, Daily, and H4 High and Low levels using request.security. • Customizable line colors, widths, and label sizes. • Toggle visibility for each timeframe independently. • Signals appear one candle after a confirmed breakout: • Bullish: Close above HTF High, strong candle, high volume. • Bearish: Close below HTF Low, strong candle, high volume. • Signal shapes match the color of the broken level for visual clarity.

█ HOW TO USE

1 — Enable the timeframes you want to track using the input toggles. 2 — Watch for triangle-shaped signals: • Upward triangle = Bullish breakout. • Downward triangle = Bearish breakout. 3 — Confirm the breakout: • Candle closes beyond the HTF level by at least 0.1%. • Candle body shows momentum (close > open for bullish, close < open for bearish). • Volume exceeds 20-period average. 4 — Enter trade on the candle after the signal. 5 — Use the HTF level as a reference for stop-loss placement. 6 — Combine with other indicators (e.g., RSI, EMA) for confluence.

█ LIMITATIONS

• Signals may lag by one candle due to confirmation logic. • Not optimized for low-volume assets or illiquid markets. • Best used in trending environments; avoid during consolidation. • Does not include automatic alerts (can be added manually).

█ BEST PRACTICES

• Use on H1 or higher timeframes for cleaner signals. • Avoid trading during news events or low volatility. • Backtest thoroughly before live trading. • Adjust breakout percentage and volume filter based on asset volatility. • Maintain a trading journal to track performance.

This indicator overlays Weekly, Daily, and H4 High/Low levels directly onto your chart, allowing traders to visualize key support and resistance zones from higher timeframes. It also includes high probability breakout signals that appear one candle after a confirmed breakout above or below these levels, filtered by volume and candle strength.

Use this tool to identify breakout opportunities with greater confidence and clarity.

█ FEATURES

• Plots Weekly, Daily, and H4 High and Low levels using request.security. • Customizable line colors, widths, and label sizes. • Toggle visibility for each timeframe independently. • Signals appear one candle after a confirmed breakout: • Bullish: Close above HTF High, strong candle, high volume. • Bearish: Close below HTF Low, strong candle, high volume. • Signal shapes match the color of the broken level for visual clarity.

█ HOW TO USE

1 — Enable the timeframes you want to track using the input toggles. 2 — Watch for triangle-shaped signals: • Upward triangle = Bullish breakout. • Downward triangle = Bearish breakout. 3 — Confirm the breakout: • Candle closes beyond the HTF level by at least 0.1%. • Candle body shows momentum (close > open for bullish, close < open for bearish). • Volume exceeds 20-period average. 4 — Enter trade on the candle after the signal. 5 — Use the HTF level as a reference for stop-loss placement. 6 — Combine with other indicators (e.g., RSI, EMA) for confluence.

█ LIMITATIONS

• Signals may lag by one candle due to confirmation logic. • Not optimized for low-volume assets or illiquid markets. • Best used in trending environments; avoid during consolidation. • Does not include automatic alerts (can be added manually).

█ BEST PRACTICES

• Use on H1 or higher timeframes for cleaner signals. • Avoid trading during news events or low volatility. • Backtest thoroughly before live trading. • Adjust breakout percentage and volume filter based on asset volatility. • Maintain a trading journal to track performance.

Notas de prensa

📄 DescriptionThis indicator overlays Highs and Lows from the previous Weekly, Daily, and H4 candles directly onto your chart, providing clear visual references for institutional support and resistance zones. It includes high probability breakout signals that trigger only during selected active trading sessions, helping traders align entries with market timing and volume.

🔧 Features

Plots previous Weekly, Daily, and H4 High/Low levels using request.security with lookahead=barmerge.lookahead_on

Customizable line colors, widths, and label sizes

Toggle visibility for each timeframe independently

Session filter for:

Sydney (6PM–2AM EST)

Tokyo (7PM–4AM EST)

London (3AM–11AM EST)

New York (8AM–5PM EST)

Signals appear one candle after a confirmed breakout:

Bullish: Close above HTF High, strong candle, high volume

Bearish: Close below HTF Low, strong candle, high volume

Signal shapes match the color of the broken level for visual clarity

📈 How to Use

Enable the timeframes and sessions you want to track

Watch for triangle-shaped signals:

🔺 Upward triangle = Bullish breakout

🔻 Downward triangle = Bearish breakout

Confirm breakout with:

Close beyond HTF level by at least 0.1%

Candle body shows momentum (close > open for bullish, close < open for bearish)

Volume exceeds 20-period average

Enter trade on the candle after the signal

Use HTF level as reference for stop-loss

Combine with other indicators (e.g., EMA, RSI) for confluence

⚠️ Limitations

Signals may lag by one candle due to confirmation logic

Not optimized for low-volume or illiquid assets

Best used in trending environments

Alerts not included (can be added manually)

✅ Best Practices

Use on H1 or higher timeframes

Avoid trading during low volatility or news events

Backtest thoroughly before live trading

Adjust breakout % and volume filter based on asset volatility

Maintain a trading journal to track performance

Notas de prensa

█ OVERVIEWThis indicator overlays Weekly, Daily, and H4 High/Low levels directly onto your chart, allowing traders to visualize key support and resistance zones from higher timeframes. It also includes high probability breakout signals that appear one candle after a confirmed breakout above or below these levels, filtered by volume and candle strength.

Use this tool to identify breakout opportunities with greater confidence and clarity.

█ FEATURES

• Plots Weekly, Daily, and H4 High and Low levels using request.security. • Customizable line colors, widths, and label sizes. • Toggle visibility for each timeframe independently. • Signals appear one candle after a confirmed breakout: • Bullish: Close above HTF High, strong candle, high volume. • Bearish: Close below HTF Low, strong candle, high volume. • Signal shapes match the color of the broken level for visual clarity.

█ HOW TO USE

1 — Enable the timeframes you want to track using the input toggles. 2 — Watch for triangle-shaped signals: • Upward triangle = Bullish breakout. • Downward triangle = Bearish breakout. 3 — Confirm the breakout: • Candle closes beyond the HTF level by at least 0.1%. • Candle body shows momentum (close > open for bullish, close < open for bearish). • Volume exceeds 20-period average. 4 — Enter trade on the candle after the signal. 5 — Use the HTF level as a reference for stop-loss placement. 6 — Combine with other indicators (e.g., RSI, EMA) for confluence.

█ LIMITATIONS

• Signals may lag by one candle due to confirmation logic. • Not optimized for low-volume assets or illiquid markets. • Best used in trending environments; avoid during consolidation. • Does not include automatic alerts (can be added manually).

█ BEST PRACTICES

• Use on H1 or higher timeframes for cleaner signals. • Avoid trading during news events or low volatility. • Backtest thoroughly before live trading. • Adjust breakout percentage and volume filter based on asset volatility. • Maintain a trading journal to track performance.

7 minutes ago

Release Notes

📄 Description

This indicator overlays Highs and Lows from the previous Weekly, Daily, and H4 candles directly onto your chart, providing clear visual references for institutional support and resistance zones. It includes high probability breakout signals that trigger only during selected active trading sessions, helping traders align entries with market timing and volume.

🔧 Features

Plots previous Weekly, Daily, and H4 High/Low levels using request.security with lookahead=barmerge.lookahead_on

Customizable line colors, widths, and label sizes

Toggle visibility for each timeframe independently

Session filter for:

Sydney (6PM–2AM EST)

Tokyo (7PM–4AM EST)

London (3AM–11AM EST)

New York (8AM–5PM EST)

Signals appear one candle after a confirmed breakout:

Bullish: Close above HTF High, strong candle, high volume

Bearish: Close below HTF Low, strong candle, high volume

Signal shapes match the color of the broken level for visual clarity

📈 How to Use

Enable the timeframes and sessions you want to track

Watch for triangle-shaped signals:

🔺 Upward triangle = Bullish breakout

🔻 Downward triangle = Bearish breakout

Confirm breakout with:

Close beyond HTF level by at least 0.1%

Candle body shows momentum (close > open for bullish, close < open for bearish)

Volume exceeds 20-period average

Enter trade on the candle after the signal

Use HTF level as reference for stop-loss

Combine with other indicators (e.g., EMA, RSI) for confluence

⚠️ Limitations

Signals may lag by one candle due to confirmation logic

Not optimized for low-volume or illiquid assets

Best used in trending environments

Alerts not included (can be added manually)

✅ Best Practices

Use on H1 or higher timeframes

Avoid trading during low volatility or news events

Backtest thoroughly before live trading

Adjust breakout % and volume filter based on asset volatility

Maintain a trading journal to track performance

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.