The Periodic Activity Tracker tool periodically tracks the cumulative buy and sell volume in a user-defined period and draws the corresponding matching bars and volume delta for each period.

Users can select a predefined aggregation period from the following options: Hourly, Daily, Weekly, and Monthly.

🔶 USAGE

This tool provides a simple and clear way of analyzing volumes for each aggregated period and is made up of the following elements:

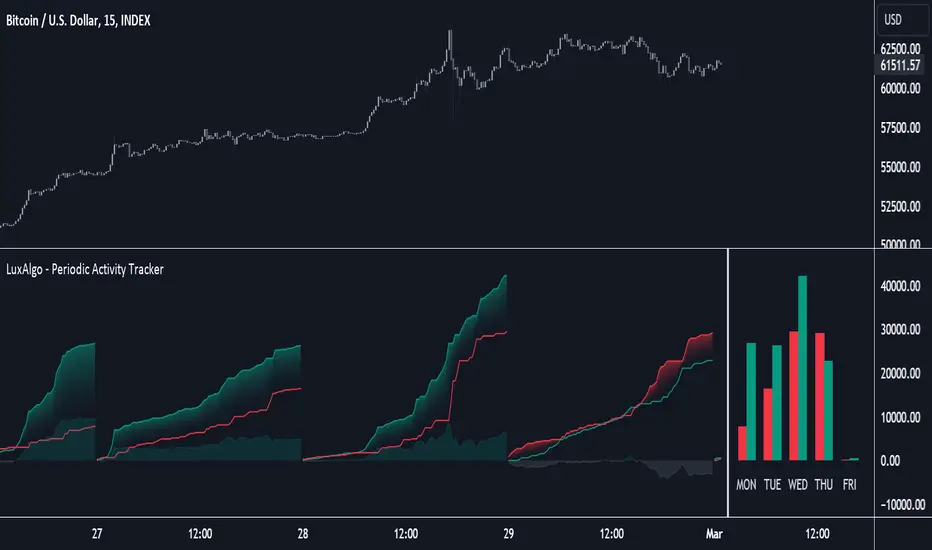

On the chart above we can see all the elements displayed, the volume level on the lines perfectly matches the volume level on the bars for each period.

In this case, the tool has the default settings so the anchor period is set to Daily and we can see how the period tag (each day of the week) is displayed below each pair of bars.

Users can disable the delta display and adjust the bar size.

🔹 Reading The Tool

In trading, assessing the strength of the bulls (buyers) and bears (sellers) is key to understanding the current trading environment. Which side, if any, has the upper hand? To answer this question, some traders look at volume in relation to price.

This tool provides you with a view of buy volume versus sell volume, allowing you to compare both sides of the market.

As with any volume tool, the key is to understand when the forces of the two groups are balanced or unbalanced.

As we can observe on the chart:

Traders need to understand that there is always an equal number of buyers and sellers in a liquid market, the quality here is how aggressive or passive they are. Who is 'attacking' and who is 'defending', who is using market orders to move prices, and who is using limit orders waiting to be filled?

This tool gives you the following information:

🔹 Anchor Period

By default, the tool is set to Hourly. However, users can select from a number of predefined time periods.

Depending on the user's selection, the bars are displayed as follows:

On the chart above we can see the four periods displayed, starting at the top left and moving clockwise we have hourly, daily, weekly, and monthly.

🔶 DETAILS

🔹 Chart TimeFrame

The chart timeframe has a direct impact on the visualization of the tool, and the user should select a chart timeframe that is compatible with the Anchor period in the tool's settings panel.

For the chart timeframe to be compatible it must be less than the Anchor period parameter. If the user selects an incompatible chart timeframe, a warning message will be displayed.

As a rule of thumb, the smaller the chart timeframe, the more data the tool will collect, returning indications for longer-term price variations.

These are the recommended chart timeframes for each period:

🔹 Warnings

This chart shows both types of warnings the user may receive

At the top, we can see the warning that is given when the 'Bar Width' parameter exceeds the allowed value.

At the bottom is the incompatible chart timeframe warning, which prompts the user to select a smaller chart timeframe or a larger "Anchor Period" parameter.

🔶 SETTINGS

🔹 Data Gathering

🔹 Style

Users can select a predefined aggregation period from the following options: Hourly, Daily, Weekly, and Monthly.

🔶 USAGE

This tool provides a simple and clear way of analyzing volumes for each aggregated period and is made up of the following elements:

- Buy and sell volumes by period as red and green lines with color gradient area

- Delta (difference) between buy & sell volume for each period

- Buy & sell volume bars for each period

- Separator between lines and bars, and period tags below each pair of bars for ease of reading

On the chart above we can see all the elements displayed, the volume level on the lines perfectly matches the volume level on the bars for each period.

In this case, the tool has the default settings so the anchor period is set to Daily and we can see how the period tag (each day of the week) is displayed below each pair of bars.

Users can disable the delta display and adjust the bar size.

🔹 Reading The Tool

In trading, assessing the strength of the bulls (buyers) and bears (sellers) is key to understanding the current trading environment. Which side, if any, has the upper hand? To answer this question, some traders look at volume in relation to price.

This tool provides you with a view of buy volume versus sell volume, allowing you to compare both sides of the market.

As with any volume tool, the key is to understand when the forces of the two groups are balanced or unbalanced.

As we can observe on the chart:

- NOV '23: Buy volume greater than sell volume, both moving up close together, flat delta. We can see that the price is in range.

- DEC '23: Buy volume bigger than Sell volume, both moving up but with a bigger difference, bigger delta than last month but still flat. We can see the price in the range above last month's range.

- JAN '24: Buy and sell volume tied together, no delta whatsoever. We can see the price in range but testing above and below last month's range.

- FEB '24: Buy volume explodes higher and sell volume cannot keep up, big growing delta. Price explodes higher above last month's range.

Traders need to understand that there is always an equal number of buyers and sellers in a liquid market, the quality here is how aggressive or passive they are. Who is 'attacking' and who is 'defending', who is using market orders to move prices, and who is using limit orders waiting to be filled?

This tool gives you the following information:

- Lines: if the top line is green, the buyers are attacking, if it is red, the sellers are attacking.

- Delta: represents the difference in their strength, if it is above 0 the buyers are stronger, if it is below 0 the sellers are stronger.

- Bars: help you to see the difference in strength between buyers and sellers for each period at a glance.

🔹 Anchor Period

By default, the tool is set to Hourly. However, users can select from a number of predefined time periods.

Depending on the user's selection, the bars are displayed as follows:

- Hourly : hours of the current day

- Daily : days of the current week

- Weekly : weeks of the current month

- Monthly : months of the current year

On the chart above we can see the four periods displayed, starting at the top left and moving clockwise we have hourly, daily, weekly, and monthly.

🔶 DETAILS

🔹 Chart TimeFrame

The chart timeframe has a direct impact on the visualization of the tool, and the user should select a chart timeframe that is compatible with the Anchor period in the tool's settings panel.

For the chart timeframe to be compatible it must be less than the Anchor period parameter. If the user selects an incompatible chart timeframe, a warning message will be displayed.

As a rule of thumb, the smaller the chart timeframe, the more data the tool will collect, returning indications for longer-term price variations.

These are the recommended chart timeframes for each period:

- Hourly : 5m charts or lower

- Daily : 1H charts or lower

- Weekly : 4H charts or lower

- Monthly : 1D charts or lower

🔹 Warnings

This chart shows both types of warnings the user may receive

At the top, we can see the warning that is given when the 'Bar Width' parameter exceeds the allowed value.

At the bottom is the incompatible chart timeframe warning, which prompts the user to select a smaller chart timeframe or a larger "Anchor Period" parameter.

🔶 SETTINGS

🔹 Data Gathering

- Anchor period: Time period representing each bar: hours of the day, days of the week, weeks of the month, and months of the year. The timeframe of the chart must be less than this parameter, otherwise a warning will be displayed.

🔹 Style

- Bars width: Size of each bar, there is a maximum limit so a warning will be displayed if it is reached.

- Volume color

- Delta: Enable/Disable Delta Area Display

Notas de prensa

- Fixed bars location drawn outside the permitted intervalScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Build your own edge with AI: luxalgo.com

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Build your own edge with AI: luxalgo.com

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.