OPEN-SOURCE SCRIPT

Actualizado Liquidations

First, thanks to the following Tradingview community members for providing open source indicators that I used to develop this indicator!

Liquidations by volume (spot/futures) - Thomas_Davison

Pivot and liquidation lines [LM] - lmatl

Let me know if either of you do not approve and I will remove the indicator.

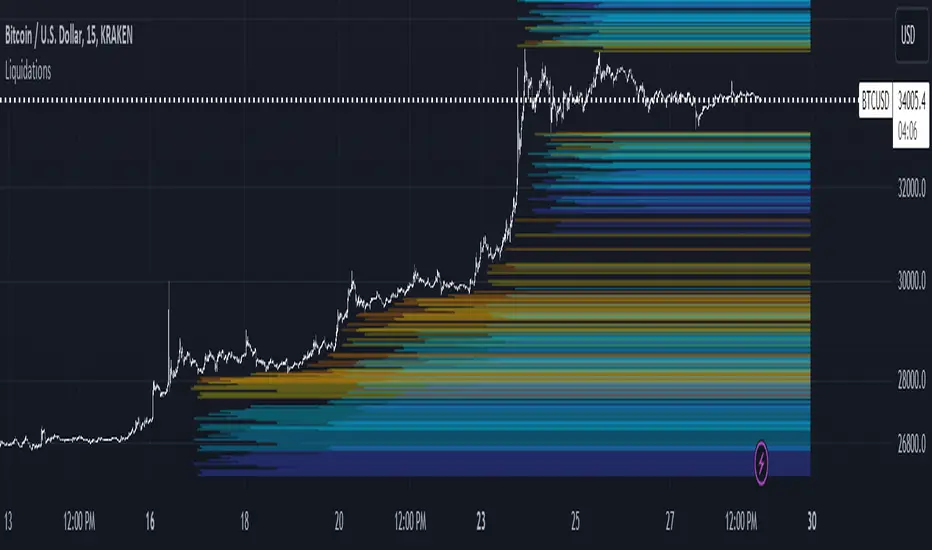

This indicator uses pivot points, volume and a liquidation percentage to determine potential liquidation levels. These are not exact but can give traders an idea of potential support or resistance levels.

Pivot points: Currently the pivot points are set to look left 5 bars and right 2 bars. This will determine the high and lows in the chart.

Volume: Assuming that high volume bars are where more leverage is used, this indicator uses the average volume over a 1000 bar period to determine to determine a baseline. I have arbitrarily set 100x lines to 20% above the average volume, 50x lines 10% above, 25x lines 5% above, 10x lines 2.5% above and 5x lines 1.25% above.

Liquidation: Finally, we are making a few assumptions on how liquidations are calculated. The following table includes the percentage a position can decline before being liquidated.

* * *

Short: Long:

100x 0.51% 0.49%

50x 1.55% 1.47%

25x 3.70% 3.38%

10x 5.11% 4.67%

5x 6.705% 6.115%

Let me know if there are any questions or if anyone has any improvements!

Liquidations by volume (spot/futures) - Thomas_Davison

Pivot and liquidation lines [LM] - lmatl

Let me know if either of you do not approve and I will remove the indicator.

This indicator uses pivot points, volume and a liquidation percentage to determine potential liquidation levels. These are not exact but can give traders an idea of potential support or resistance levels.

Pivot points: Currently the pivot points are set to look left 5 bars and right 2 bars. This will determine the high and lows in the chart.

Volume: Assuming that high volume bars are where more leverage is used, this indicator uses the average volume over a 1000 bar period to determine to determine a baseline. I have arbitrarily set 100x lines to 20% above the average volume, 50x lines 10% above, 25x lines 5% above, 10x lines 2.5% above and 5x lines 1.25% above.

Liquidation: Finally, we are making a few assumptions on how liquidations are calculated. The following table includes the percentage a position can decline before being liquidated.

* * *

Short: Long:

100x 0.51% 0.49%

50x 1.55% 1.47%

25x 3.70% 3.38%

10x 5.11% 4.67%

5x 6.705% 6.115%

Let me know if there are any questions or if anyone has any improvements!

Notas de prensa

minor optimization changesNotas de prensa

Added a user input for the lookback period. Minor adjustments to the liquidation levels.Notas de prensa

Updated leverage calculations and colorsNotas de prensa

Minor editNotas de prensa

changes are related to extending the lines and removing old liquidation lines.Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.