OPEN-SOURCE SCRIPT

Actualizado LordPepe Stochastic Signals

This is the Lord Pepe. Howdy. Basic buy/sell indicator to accumulate along a downtrend and release your stack during the uptrend and oversold levels of the stochastic. The buys should be used to stack, and sells indicate levels of profit taking, they do not signal a long term reversal, only < 25% of stack should be released on "OB" signals.

OB - overbought (sell)

OS - oversold (buy)

OB - overbought (sell)

OS - oversold (buy)

Notas de prensa

What's crackin', so this will be a revised version of the stochastic signals I recently posted. This update includes better options for buy/sell shapes and a new function you can use to identify potential uptrends. The correlation coefficient is taken from John F Ehlers and a link to the paper can be found at the bottom of this post. A trend is identified with the correlation factor when the line is showing +/- 0.5 - 20 bar history is found to work the best for any time-frame.

Signals for stochastic buy and sells should be used for accumulation and distribution of a trading position. They are not signals for long term reversals and they should be used in tandum with the time-frame they were given on.

Ex. Time Frame Trade Periods: 1hr (BUY) - 5hr hold (estimate) - 1hr (SELL)

Stochastic settings work best as (8, 3, 3) or (14, 3, 3).

To use correlation feature, remove the comments in the source code. Although, I would read the paper or look at how the signal is produced.

John F Ehlers (I cannot post links yet): Google John F Ehlers Correlation as a Trend Indicator

Notas de prensa

Just cleaned up some code I haven't figured out how to use and updooted the selling signal. The signals are quite easy but have, imo, proven to show strong sings of volume/reversal (buying/selling) zones. The settings for stochastic should not be changed as the (8, 3, 3) intervals are perfect and are used quite largely in banking. I'll be updating this more as to test strategies and give more clear alerts for automation.

Notas de prensa

Small update for fractional selling signal verse whole position. The whole position flag should just be used as a tool along with any other confirmations you have as its only indicating extremely overbought or oversold levels and these conditions may persist for another bar or two.

Use 4hr time frames from what I've seen works best. These signals can be used in the complete opposite way during downtrends, meaning you would short the sells and buy, obviously.

Notas de prensa

What up. I have added a volatility line and Lelec by inSilico. I hope you all enjoy, lmk if you have any recommendations. - Continue to use stoch (8, 3, 3) with 4hr time frame

- Use the line as a volatility indicator, usually the sell signal will occur before it breaks (ikr) but just to be sure if you're trading watch if it breaks, and reconfirms the line.

Notas de prensa

New features are just being able to adjust which time frame you want signals to print on the screen while having another time frame on. So,

- You can have 1hr time frame with 2hr signals

- Play around with it to see

I suggest using whatever timeframe to below the signal queues to see how they act as resistances

Notas de prensa

Bug fixNotas de prensa

Another oneNotas de prensa

UpdootNotas de prensa

You can change the Signal Type to give you more or less.Notas de prensa

Fixed some bugs, added Bollinger bands. - You can turn things off in the settings menu, these additional features are for people without PRO and who like to use more than tradingview allows

Notas de prensa

- You can now choose your own signals to produce for whatever asset

- Use stochastic, rsi, money flow indicator, and this one to search for your signals (try things out)

- Higher time frames work best but lower ones can be tuned with time.

- Heikin Ashi produces very good signals for PURPLE/ORANGE signals but loses Lelec (ill fix this)

Notas de prensa

Revamp to existing Stochastic Signals, I hope you all enjoy. Check out the code, I'll do more commenting so one's can learn how to implement or add new features themselves.New Features:

- New Settings Menu/Layout (better labeled)

- Binary Signals - produces long/short/long/short etc signals (stop-loss not ready yet)

- Stochastic Signals - produces a signal on LL crossover of stochastic(k, d) over 1000 and 500 bars ago, and does so with HH

- VWAP Moving Averages (experimental) - See if you can get anything out of it. Basically strong uptrends form when the price is over certain color moving averages. They move faster when the momentum of the VWAP is higher (slope is steeper).

How to use:

- Settings that are chosen are a lookback period of 10 bars and 10 signals of exhaustion, where exhaustion is set to count when close is > close[4] for bull bars ago and close < close[4] for bear. This means a reversal can be around the corner. If the market uses it as resistance, take trades at or near it and also for support. If the price breaks through, close your trade and wait.

- Use higher timeframes or experiment with "HH/LL over what Period?" parameters

- If you have binary set to true and price breaks s/r get out, I'll add a stop-loss feature soon, to alert you automatically

- Don't use too many indicators at once, there's a lot and I'll add more as time goes on

Notas de prensa

Recode...Notas de prensa

Readded the feature to color bars based on trend. On by default, to turn off check bottom of settings.Notas de prensa

Fixed another small bug****How to read bar colors:

Orange - Bearish exhaustion signal

Blue - Bullish exhaustion signal

Yellow - Volume spike

Green - Bullish trend, when price is over exhaustion levels

Red - Bearish trend, when price goes beneath exhaustion levels

Overall trend can be seed with shaded BLUE/RED adaptive moving averages (MESA)

Notas de prensa

Removed minor code bug*Notas de prensa

Added better tool tips to provide better instructions for these indicators. Added more options to turn things off and improved settings menu some more.

Turned off EMA bands by default, they can be turned on in settings.

Notas de prensa

Added another option to turn on just EMA Bands or EMA Dots.The Bands will plot EMA Moving Averages of length 20 for the high, low, and closes.

The dots will plot an EMA of the highest low over 10 bars - lowest high over 10 bars + close.

EMA((ta.highest(low, 10) - ta.lowest(high, 10)) + close), 10)

Notas de prensa

Removed some commented code.Notas de prensa

Features Added:Binary Signals - will produce alternating long/short signals

Changed Labels to Triangles

Notes:

You can turn off certain signals so if things are cluttered just reset the default settings to your choosing.

Notas de prensa

Just fixed some stuff and added some more settings for features.Notas de prensa

Fixed some typos on the menu.Notas de prensa

NEW FEATURE :DUnder testing

Most are off by default, check in settings. I don't want to overwhelm people who don't care.

Okay, so I added another exhaustion script for higher timeframes and a super position signal that will check both timeframes for signals.

I would use 2-6x the current timeframe for this as you're checking higher timeframes for sell signals while watching for lower timeframe ones.

Say you're on 1 hour timeframe and you have 4 hours set on the higher timeframe option. When you turn on Super Position you will get signals when BOTH the 1 hour and 4 hour exhaustion bars hit.

Lmk if you have questions.

Notas de prensa

Fixed higher timeframe signals. They now should show the signals for any timeframe you want.ToDo:

Fix the support and resistance lines

Notas de prensa

Fixed connection between higher time frame resistance line plots. Thx to user who brought it to my attention. :)Notas de prensa

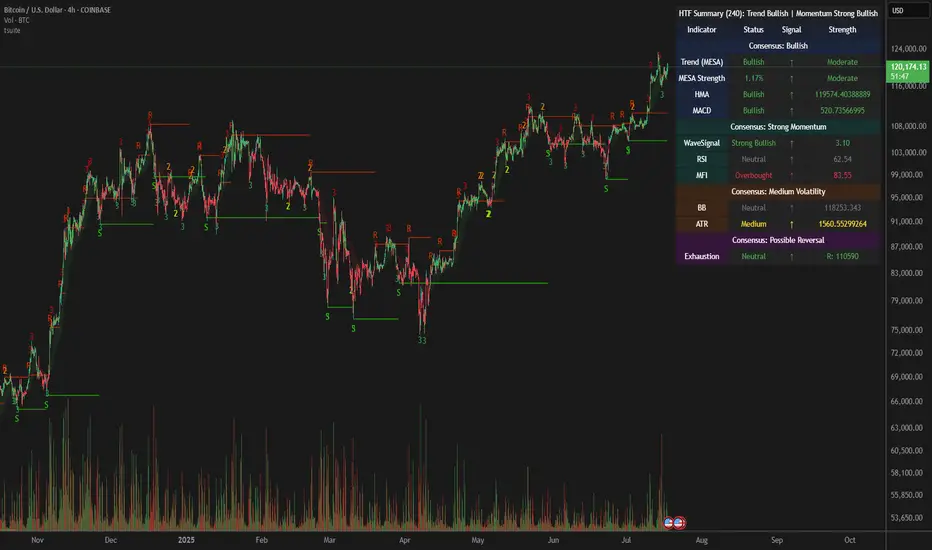

Renamed: Trade Suite (tsuite)- Recoded script

- Reformatted UI

- Added colored backgrounds for trends

- Added more alerts

- Added strategies for MESA (moving averages)

- Added retests of exhaustion levels (forming stronger S/R)

Notas de prensa

- Improved MESA Function

- Added background colors for over and undersold Wavetrend conditions.

Notas de prensa

- Added volume smoothing for the mesa function with toggles.

Notas de prensa

Excited to introduce a new feature to our Trade Suite indicator: Dynamic Thresholds for the WaveTrend component!New Features:

1. Dynamic Z-Score Thresholds: The indicator now uses adaptive thresholds for detecting oversold and overbought conditions, making it more responsive to changing market conditions.

2. Customizable Percentiles: Users can now adjust the percentiles used for calculating the dynamic thresholds.

3. Absorption Detection: Added a simple RSI divergence to detect potential absorption, which can signal imminent reversals.

How to use:

- The dynamic thresholds are automatically applied to the WaveTrend indicator.

- New input parameters have been added to the "Wavesignal" group:

- "Lookback Period": Controls the number of bars used for calculating percentiles (default: 100)

- "Nearest Rank Percentage": Used in percentile calculations (default: 90)

- "Lower Percentile": Sets the lower threshold for oversold conditions (default: 5)

- "Upper Percentile": Sets the upper threshold for overbought conditions (default: 95)

These new features enhance the WaveTrend indicator's ability to adapt to different market conditions and potentially provide more accurate signals. Experiment with the new parameters to find the optimal settings for your trading style and the assets you're trading.

Turn it on with "Wavetrend BG Signals". This will highlight oversold and overbought conditions where strong absorption is taking price, this can be used to pinpoint spots to add to or re-enter trends.

As always, we recommend thorough backtesting and forward testing before using any new features in live trading.

Notas de prensa

Fixed some minor bugsNotas de prensa

- Enhanced the display table.

Notas de prensa

Trade Suite v6 - The Ultimate All-in-One Analysis ToolWe're excited to announce the release of Version 6 of the Trade Suite! This update focuses on enhancing usability and clarity, featuring a completely overhauled Dashboard Table for a more intuitive at-a-glance analysis and more detailed code comments for those who want to dive deeper.

The Trade Suite is a comprehensive, multi-faceted indicator designed to give you a complete picture of the market from a single chart. It combines a sophisticated trend analysis engine, a volume-based momentum oscillator, and automatic support/resistance detection into one powerful package.

- [] MESA Engine: At its core, the suite uses John Ehlers' MESA (MAMA & FAMA) adaptive moving averages to provide incredibly responsive and low-lag trend analysis. The engine includes a visual trend cloud, bar coloring, and multi-timeframe overlays to keep you on the right side of the trend across different periods.

[] WaveSignal Oscillator: This isn't your average oscillator. WaveSignal integrates volume dynamics (Z-Score) with Wavetrend logic to identify high-probability overbought and oversold conditions. It generates tiered buy & sell signals (Levels 1, 2, and 3) to quantify the strength of a potential reversal.

[] Exhaustion S/R Zones: Automatically identify potential market tops and bottoms where price may be losing momentum. This module plots dynamic support and resistance levels directly on your chart, providing clear areas of interest for entries and exits.

[] All-in-One Dashboard: The newly upgraded information table is your central hub for market analysis. It synthesizes data from all the suite's components, plus standard indicators like RSI, MFI, MACD, and ATR. The dashboard provides a clear consensus on Trend, Momentum, Volatility, and potential Reversals, giving you a quick and actionable market summary.

How To Use

The power of the Trade Suite lies in combining its features to find high-conviction trade setups.

- Example Usecase (Trend Following): A trader might first use the MESA Engine to define the primary trend on a higher timeframe (e.g., 4-hour). Once an uptrend is confirmed (MAMA is above FAMA), they can switch to a lower timeframe (e.g., 15-minute) and look for a pullback. A high-quality entry signal would be a Level 2 or 3 buy signal from the WaveSignal oscillator occurring near a support level identified by the Exhaustion module. The Dashboard's "Bullish Consensus" would provide the final confirmation for the trade.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.