OPEN-SOURCE SCRIPT

Brown's Exponential Smoothing Tool (BEST)

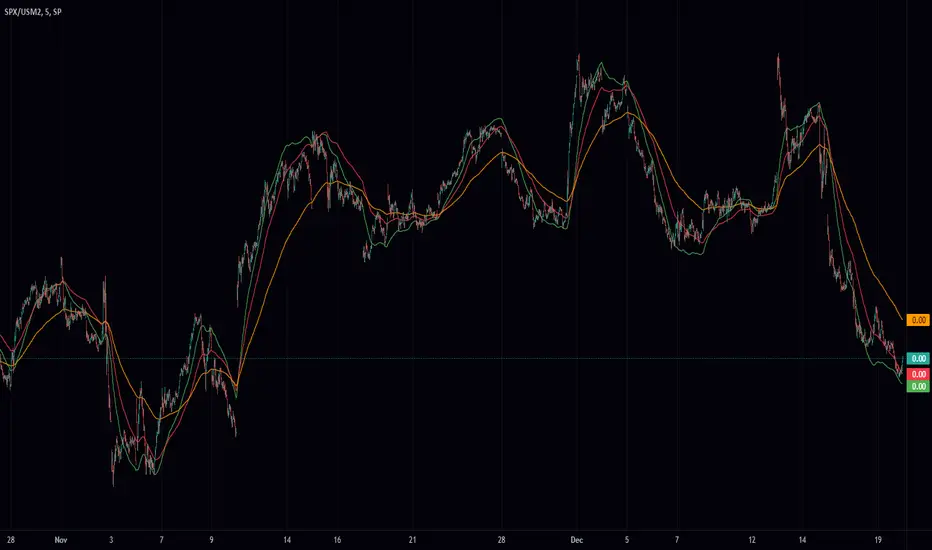

Brown's Exponential Smoothing Tool (BEST) is a script for technical analysis in financial markets. It is designed to smooth out price fluctuations and identify trends in a given time series data.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.