OPEN-SOURCE SCRIPT

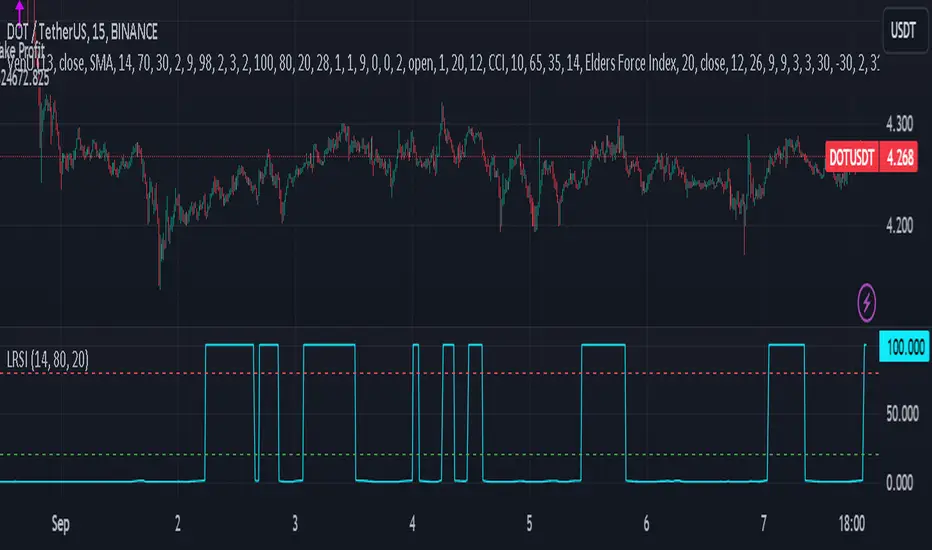

Laguerre RSI - non repainting

It seems that the traditional Laguerre* functions repaint due to the gamma parameter.

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.