FedEx's Strategic Moves: A Deep Dive into Its Undervalued Potential

Most people don't give FedEx much thought until a box shows up at the door. It's been part of the background of the global economy for decades, quietly delivering millions of parcels without much fuss. But just because it feels familiar doesn't mean it's standing still.

In the last few years, FedEx has had to do some serious course-correcting. Soaring input costs, cooling demand, tough talks with labor, and rivals pushing harder than ever it hasn't been smooth sailing. Now, they're making a bold move: spinning off the freight division. It's not just a logistics shuffle it might change how Wall Street sees the whole company.

Let's be clear this isn't a stock that's going to 10x overnight. FedEx is a capital-intensive, slow-turning machine. But that doesn't mean it's dead money. The core business is stabilizing, margins are creeping higher, and the freight spin-off could be the kind of structural shake-up that gets investors to reassess what this company is really worth.

Right now, the stock's not making headlines. It's not flashy. But sometimes, that's when the opportunity shows up. If management sticks the landing and market conditions don't derail the plan, FedEx might just be setting the stage for a quieter but very real comeback.

Financial Metrics and Investment Considerations

FedEx's recent third-quarter results suggested that its transformation is quietly taking hold. Adjusted EPS rose to $4.51, up from $3.86 the prior year, while revenue increased 2% to $22.2 billion. The improvement in adjusted operating income, which reached $1.51 billion, was largely driven by FedEx's cost-cutting DRIVE program and stronger yields across segments. Margins also showed modest improvement, and the company reduced its capital expenditures for the fiscal year to $4.9 billion, underscoring a sharpened focus on operational efficiency.

Management revised its full-year adjusted EPS forecast to a range of $18.00 to $18.60, down from the prior $19.00 to $20.00. That downward guidance reflects cautious realism amid a sluggish U.S. industrial economy and macro uncertainty. Still, it hasn't stopped FedEx from moving forward. The company repurchased $500 million in stock during the quarter, signaling internal confidence and enhancing per-share value.

Looking ahead, investors should circle June 24, 2025 that's when FedEx is scheduled to release its fiscal Q4 earnings. With the freight spin-off looming and cost initiatives ramping up, that earnings call could provide the next major signal for how this transformation is progressing.

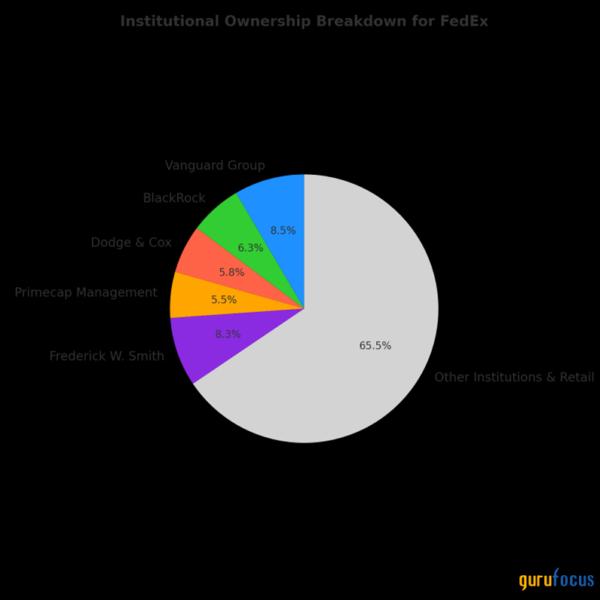

Who Owns FedEx?

It is a company trusted by some of the sharpest long term investors in the game when you look under the hood of FedEx's ownership structure. That stake is not noise, institutional ownership sits high at close to over 79 percent. It represents confidence in the company's fundamentals, its strategic direction and most importantly that it is capable of creating value in the medium term.

At the top of the shareholder list is Vanguard Group, holding about 8.43% of the company, followed closely by BlackRock with 6.25%.

But perhaps the most interesting stake is from Frederick W. Smith, FedEx's founder and executive chairman, who still holds over 8.3% of the company's shares. That kind of insider ownership sends a strong signal he's not just steering the ship, he's riding it through the rough waters. His continued involvement shows belief not only in the company's mission but in its ability to successfully execute its freight spin-off and transformation plan.

Together, this mix of institutional muscle and meaningful insider skin in the game builds a compelling picture. FedEx isn't some speculative play with a revolving-door investor base. It's a stock backed by institutions that do their homework and an insider who's been in it since day one. That level of commitment only adds to the sense that something bigger might be brewing here, especially as the company leans into becoming a leaner, more focused operator.

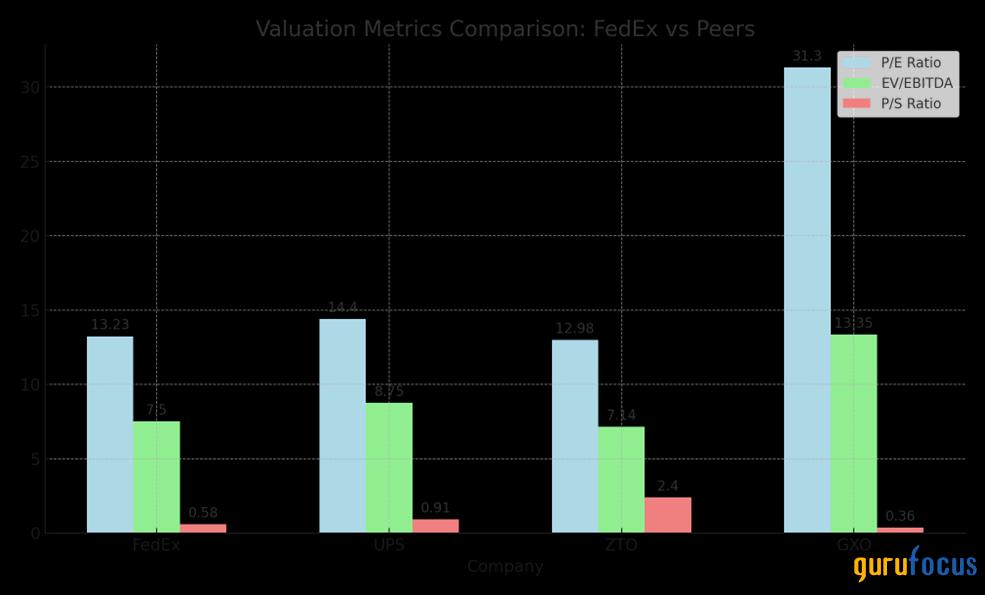

Assessing FedEx's Market Valuation

Valuation isn't just about numbers it's about the story the market believes. Right now, the market seems unsure about FedEx. Its shares are trading at a P/E of 13.23, with an EV/EBITDA of 7.5 and a P/S ratio of just 0.58. Those numbers suggest investors are looking at FedEx and seeing a mature, margin-squeezed shipper. But that view may already be outdated.

Let's put those figures in context. UPS, the closest peer, trades at a P/E of 14.4 and an EV/EBITDA of 8.75. It's a slightly richer valuation, and arguably deserved given UPS's steadier margins but FedEx is now aggressively closing that gap through its DRIVE cost transformation program, which has already begun delivering real savings.

Meanwhile, ZTO Express carries a similar P/E of 12.98 but enjoys a higher EV/EBITDA of 7.14 despite facing regional and regulatory risk in China. Then there's GXO Logistics, the sector's growth darling, trading at a sky-high P/E of 31.3 and an EV/EBITDA of 13.35 a valuation that prices in flawless execution and rapid expansion, with very little margin for error.

FedEx, by comparison, is still being priced like it's in trouble. But the fundamentals say otherwise. The company is generating solid earnings despite a soft macro backdrop, reining in capital expenditures, and boosting cash flow. It's also preparing a freight spin-off that could act as a major catalyst for valuation clarity and margin expansion.

And yet, it's priced at nearly half the EV/EBITDA multiple of GXO, and trades below UPS despite aggressive restructuring and improving margins. This gap reflects market hesitation not performance. And that hesitation is the opportunity. If FedEx continues to execute, the market will have to catch up to the reality of its progress.

Strategic Initiatives and Growth Prospects

To understand FedEx's valuation, you have to understand what the market thinks it's competing against and right now, that perception is shaped by three names: UPS, ZTO Express, and GXO Logistics. Each one highlights something FedEx hasn't quite solved and that's what keeps a lid on the stock.

UPS is the benchmark. Its strength isn't just scale it's integration. While FedEx still operates separate Ground and Express networks, UPS runs one seamless system. That translates to better asset utilization and tighter cost control. Add in the recent USPS air contract win, and UPS just gained more volume with less volatility. The market sees that efficiency, that predictability, and prices it accordingly. For FedEx, this raises the bar: until it proves its DRIVE program can close the operational gap, it's going to keep trading at a discount.

ZTO Express is different it's not a direct threat geographically, but it's a warning sign. It's running a lean, hyper-efficient network in China, and posting EBITDA margins that put most Western logistics firms to shame. Even if FedEx isn't chasing ZTO's turf, investors see what best-in-class margin execution looks like and FedEx doesn't look like that yet. That comparison adds to the skepticism, especially for a company promising a margin-driven transformation.

Then there's GXO Logistics. It doesn't move packages like FedEx it builds complex, high-margin supply chain solutions. Think automation, AI-driven fulfillment, data-rich inventory systems. The market loves that model, which is why GXO is trading at more than double FedEx's valuation multiples. And that creates a different kind of pressure. FedEx wants to evolve into a more tech-enabled logistics brand it even launched Dataworks to do exactly that but so far, the market hasn't seen enough to believe it. GXO sets the ceiling for where logistics innovation is going, and FedEx hasn't proven it can get there fast enough.

These competitors don't just take market share they shape investor expectations. UPS defines operational excellence. ZTO sets the efficiency standard. GXO owns the future-forward logistics narrative. FedEx, meanwhile, is trying to rewrite its identity and that's the hardest story to sell on Wall Street.

But that's also the angle. If FedEx can close the margin gap with UPS, deliver a clean freight spin-off, and show real traction on digital innovation, the market's entire view of the company shifts. That valuation discount? It becomes a rerating story. Because right now, FedEx isn't being priced for where it's heading it's being penalized for where it hasn't been yet.

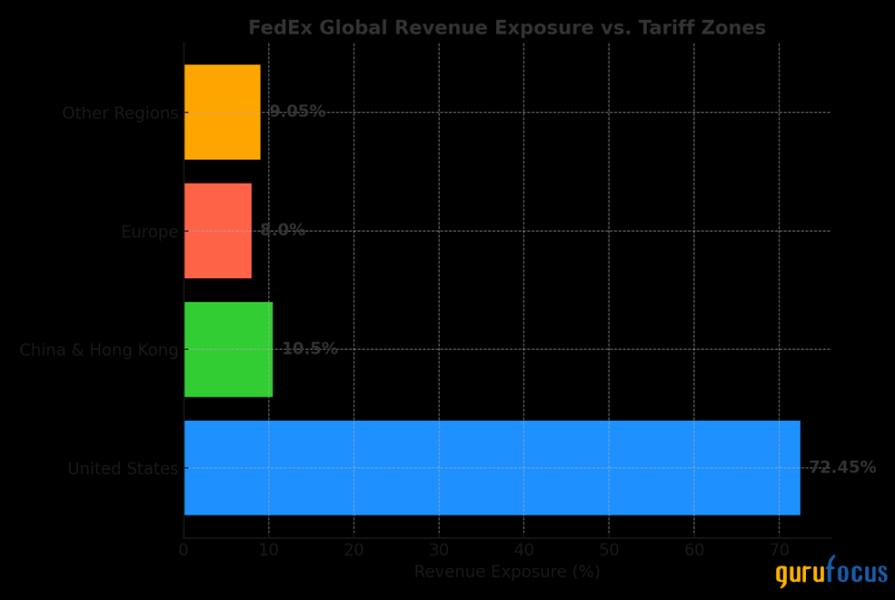

Risks and Challenges: The Roadblocks Between FedEx and a Rerating

FedEx is navigating several challenges that weigh heavily on investor sentiment. One of the most immediate developments is the recently brokered 90-day truce between the U.S. and China in their ongoing trade war. While tariffs on both sides have been significantly reduced U.S. duties on Chinese imports dropped from 145% to 30%, and China's retaliatory tariffs fell from 125% to 10% uncertainty remains.

There are still active tariffs, including a 20% fentanyl-linked penalty and targeted duties on electronics and pharmaceutical imports. These changes ease pressure on international logistics in the short term, but the volatility of trade policy continues to present a longer-term strategic risk.

Unionization efforts, particularly those involving the Teamsters, also pose a potential cost headwind. While FedEx has historically avoided unionized labor in most of its operations, continued negotiations and potential labor actions could increase wage expenses and reduce flexibility, especially as the company undergoes restructuring.

Another area of concern is the company's balance sheet. FedEx holds over $36 billion in long-term debt, with a debt-to-equity ratio of about 35%. While not alarming on its own, it does limit flexibility if macro conditions worsen or if the spin-off underperforms.

Beyond trade and labor, the spin-off of FedEx Freight is a pivotal move with potential upside, but also execution risk. A smooth separation could unlock shareholder value; a botched one could introduce new inefficiencies and hurt sentiment. Additionally, FedEx still needs to prove that the cost savings from DRIVE are not only real but also sustainable in a competitive environment.

Conclusion:

FedEx isn't a growth stock in disguise. It's a mature logistics heavyweight in the middle of a transformation and that's exactly where the opportunity lies. The market is treating it like a company that's stuck, weighed down by legacy costs, competitive pressure, and macro uncertainty. And yes, some of that caution is justified. Tariffs and the freight spin-off pose near-term risks, and innovation leadership is still up for debate.

But much of the market's skepticism is already reflected in the current valuation. What's not fully priced in is where FedEx could be heading. Cost-cutting is showing up in the margins. Capital discipline is improving. The freight spin-off, if executed well, could unlock meaningful value. And the valuation? Still trading below peers like UPS and far below high-fliers like GXO, despite making real progress on efficiency and focus.

This isn't about chasing hype. It's about spotting misalignment between perception and performance, between price and potential. FedEx is showing signs of becoming a leaner, sharper, more profitable version of itself. And for long-term investors, that setup a discounted stock with a real plan in motion doesn't come around often.

The risk is visible. But so is the upside. If FedEx sticks the landing, this could be one of the more overlooked value plays in logistics today.