Has Nvidia Lost Sight of the Core Consumer?

NVIDIA Has Forgotten the Consumer

At the start of 2025, there was a lot of optimistic chatter about what Nvidia's stock might do during this year's Central Electronics Showcase. Thinking back to this timeline it almost seemed as if every headline, every social media post, and the majority of online commentary surrounding Nvidia's CES press conference focused on Nvidia forwarding their growth in AI markets ranging from: AI PCs built for developers to more efficiently run LLMs, AI powered Robotics platforms, and their partnerships with various players within the Autonomous Automobile industry such as Toyota and Tesla.

Very little attention was given to the Next-gen consumer focused RTX-50 series graphics cards during the showcase. I found this to be disappointing because this was at an annual event meant to showcase Consumer Electronics, yet Nvidia consumers essentially took a backseat to all of these more Enterprise focused AI products/concepts.

In the past, NVIDIA events were all about Productivity, Games, GPUs, and Raw graphics horsepower aimed at consumer interests like pushing frames per second higher, powering better visuals, improving encoding performance, power efficiency, and exciting the consumer base by which Nvidia's $4 trillion foundation was built upon.

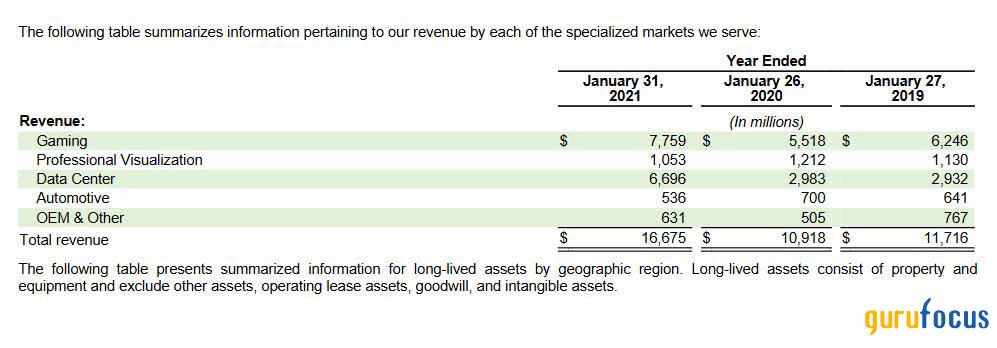

But today, It's all about AI and enterprise contracts. The headlines out of their most recent CES keynote weren't about consumer-grade GPUs or gaming, they were about new datacenter products and AI reasoning models with names like Nemotron and Llama in focus rather than the standard consumer power focused terms like CUDA and RTX. The everyday consumer will have minimal to no practical use for these AI reasoning models displayed by NVDA yet this was the focus of the showcase and really put things into perspective for me that NVDA seems to be abandoning its core consumer base in favor of satisfying its newly found AI enterprise markets. It was not so long ago that gaming was NVDA's top revenue source as detailed here in their 2021 Annual 10k filing;

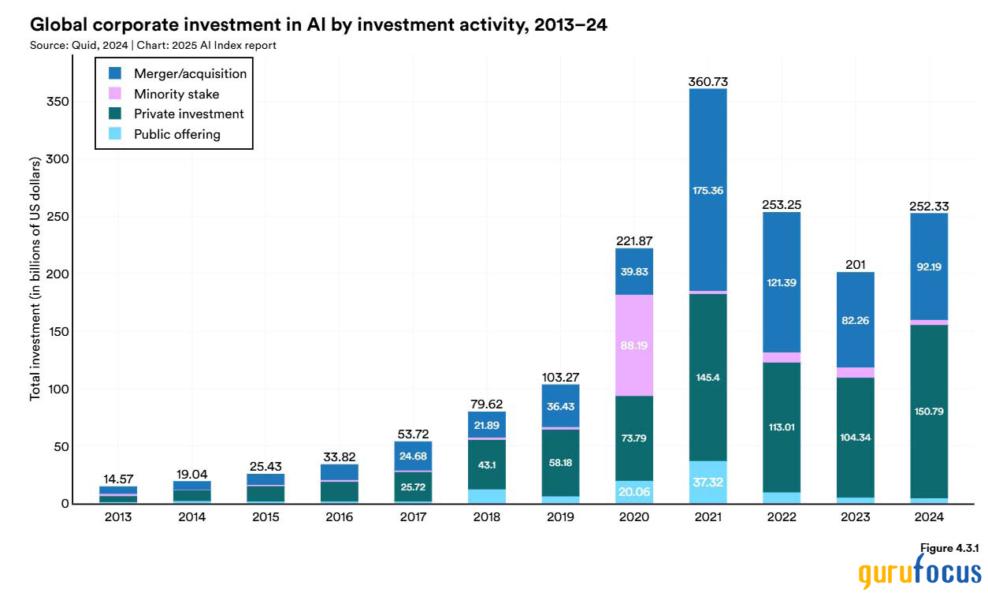

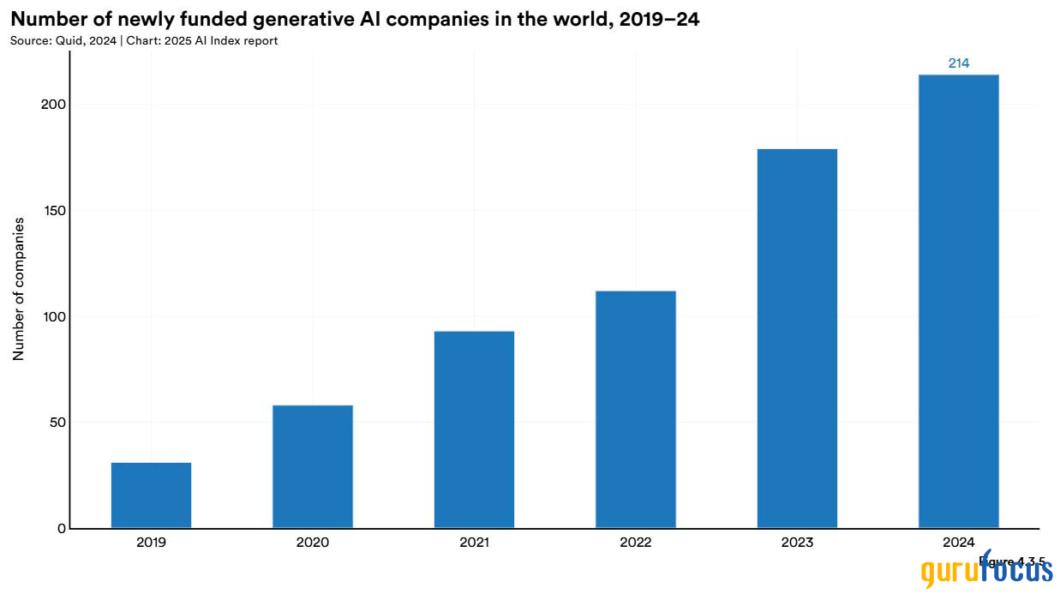

As seen in the above, datacenters made up a significantly smaller portion of NVDA's revenue prior to 2021 and the focus was on their core consumer grade gaming segment. However, with the popularization of generative AI tools like DALL-E and Chat-GPT by OpenAI in 2021 which sparked a race among the top tech companies to invest in and create the best generative models as a result we saw a more than 3x surge in AI investment market-wide between 2019 and 2021 which has since come to a plateau following a huge spike in 2021, after many of these companies including Microsoft and Google announced that they would be slowing down on their AI related spending and/or exploring in-house solutions to save on CapEx.

Source: Quid & Stanford University: 2025 AI Index

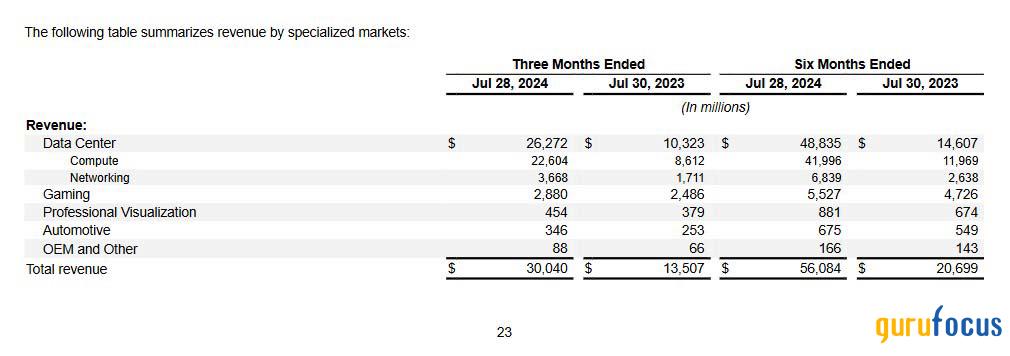

This AI investment surge has been congruent with the recent trend in NVDA's datacenter segment overtaking their gaming segment by an exponentially wide margin as seen a more recent 10k filing:

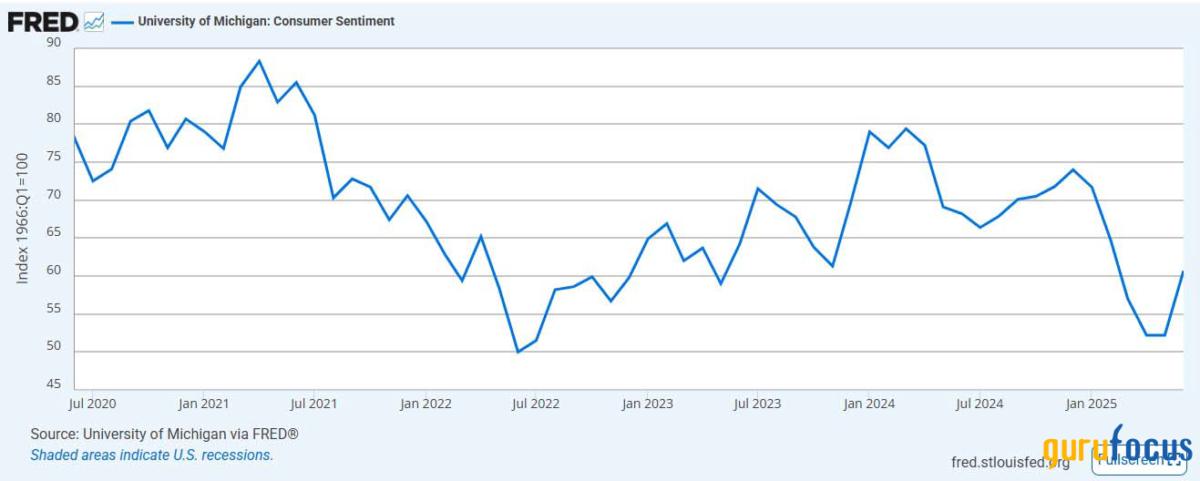

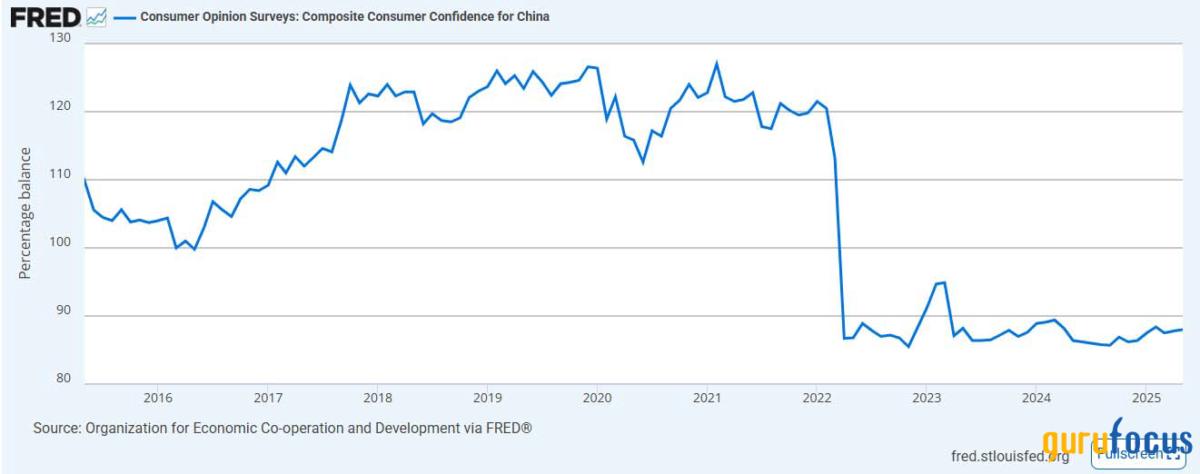

It is worth noting however that the corporate investments into AI only began to plateau in 2021-present, during this time we saw the top companies in the industry collectively aim to reduce their AI CapEx spend was also in alignment with the start of a sharp continuous decline in US Consumer Sentiment as released by the University of Michigan:

Furthermore, this decline in consumer sentiment has not only been observed in the US but China as well as China Consumer Sentiment has nose-dived to and even further extent during the same period;

Source: Organization for Economic Co-operation and Development via FRED

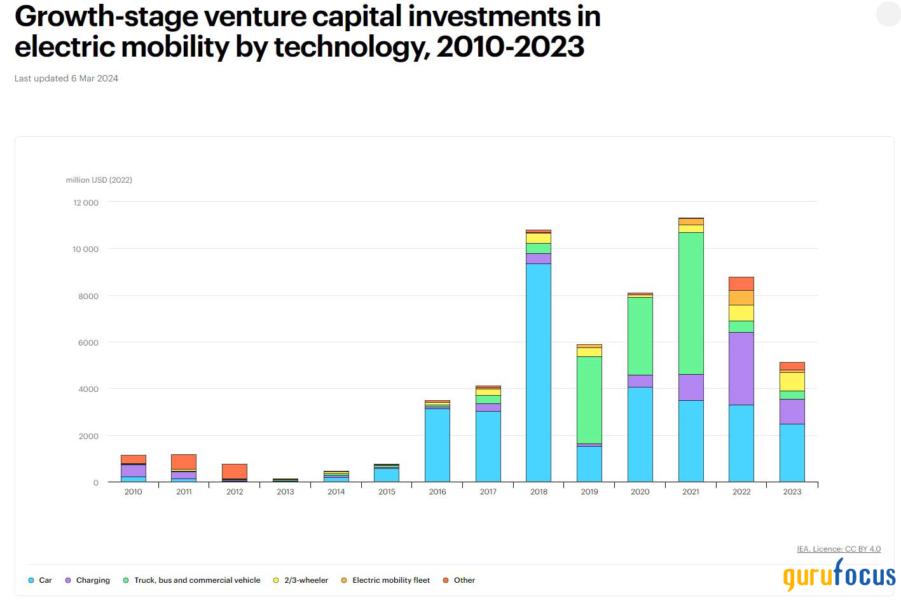

This sudden decline in the consumer sentiment has led to the pulling of investment capital not just in AI as detailed earlier, but also in adjacent industries like EVs;

Source: IEA

I have referenced the chart above in a previous article, which delves into my concerns revolving around a recent slowdown in TSLA Cash Flows. If TSLA keeps going on the path that it currently is, their Non-adjusted Free Cash Flows will once again turn negative. Given that TSLA is one of NVDA's top B2B customers, I see this as a worrying trend as this has all aligned with the drop in consumer sentiment starting in 2021.

Even as big tech investment into AI pulls back and the consumer sentiment declines, we can still see an exponential growth in the amount of newly funded Generative AI companies popping up on the frontend.

Source: Quid & Stanford University: 2025 AI Index

These newfound startups could find themselves entering into what was a booming industry, now entering a cooldown period, if that's the case these companies will be unlikely to find success in chasing the Gen-AI trend now as the CapEx liquidity once provided to this industry by big tech players dries up.

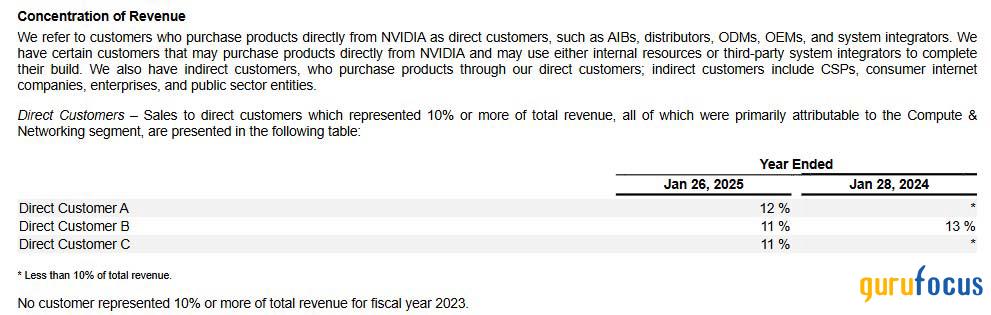

Concerningly, when evaluating NVDA's 2025 annual 10k filing it can be seen that 34% of this newfound revenue came from only three of their direct enterprise customers;

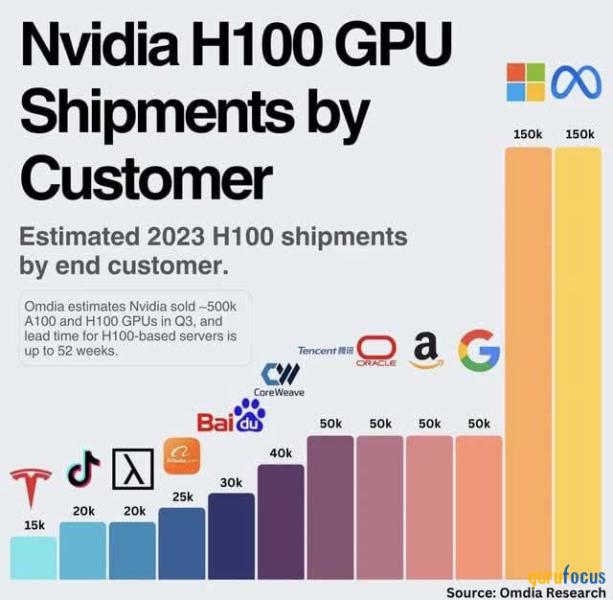

Though Nvidia did not name their customers directly, it can be inferred through Omida Research's Q32023 report of H100 Shipments that NVDA's top customers were Microsoft, Meta, Google, and Amazon with notable business from TSLA, Oracle, Tiktok, and CoreWeave.

Given that many of these customers are the same companies that have begun to cut back on external AI CapEx spending, likely in alignment with the fall of the consumer, it is very likely that NVDA sees an exceptionally greater direct hit in not only their profit margins but also their total revenue as these companies seek internal solutions and competition from potentially more balanced companies such as Intel enters the fray.

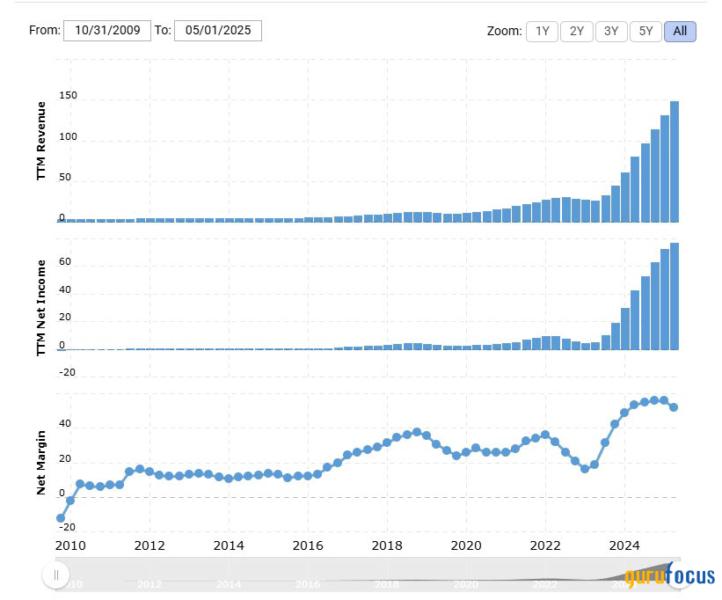

The goal of many of these companies are to balance capex spend with their revenues and right now they are focusing on creating the best product for their core consumer base to fall back on, as these companies reduce spending, develop in-house solutions, or find better and most likely cheaper competitors to NVDA, we will see more and more of NVDA's overly focused B2B model dwindle. In times like these it would be great for NVDA to not only have a functioning B2B base but to also maintain its base consumer as a foundation to fall back on in hard times just some of NVDA's most successful corporate customers do, but in the effort to chase a growing AI trend NVDA has lost sight of that foundation and is leaving itself open to a massive pull of liquidity. The time may soon be coming when a company such as NVDA would want to have a strong consumer base to fall back on because as of now when reading into NVDA's QoQ Net Margins, a peak can already be observed, rounding down since the start of 2024 with a declines being experienced the in Q2, 2025.

Source: MicroTrends.net

The last time we experienced any such decline in margins like this was at the start of 2022 which proceeded a 62% drop from $28.95 a share to $10.81 near the 89-month EMA all within the same year. If things were to go similarly this time around we could experience a similar 60-70% decline to around $50 per share aligning with the 89-month EMA in white.

Source: TradingView

NVDA currently trades at a 57x multiple with a $3.15 EPS, I'd suspect that NVDA has the capacity to correct down to around a 15-20x multiple If it experienced a severe repricing due to its AI endeavors being priced out by the market and there's even the risk of EPS going down due to falling margins. If EPS drops significantly to $1.15, setting it back a year a 20x multiple of that would align with NVDA trading down to $23 a share in the coming months.

Intel: Back to the consumer

Intel, is taking the opposite approach of Nvidia.

At CES 2025, Intel rolled out its Core Ultra 200 series processors. These cover everything from thin-and-light laptops to high-performance desktops. Unlike Nvidia's corporate-heavy pitch, Intel's message was simple: more power, less energy, and prices that make sense for consumers.

The Core Ultra 200HX and H series aims to bring serious improvements to creators and gamers, better multi-thread performance, integrated Arc graphics, and even built-in NPUs for AI acceleration. The 200U series targets mainstream laptops, while the 200S series brings efficient yet power a high 16-20+ core count 125-watt chips to desktops.

Intel is also targeting the mobile and notebook space directly, going up against Qualcomm and ARM and unlike Nvidia, Intel manufacture the majority of its chips in the United States. This puts them ad a great advantage when it comes to managing the ongoing tariffs and is likely to Nvidia heavy reliance on TSMC for production and Samsung for memory chips, which puts Nvidia in the crosshairs of these tariffs in which U.S based and sourced companies such as Intel and Micron could greatly benefit.

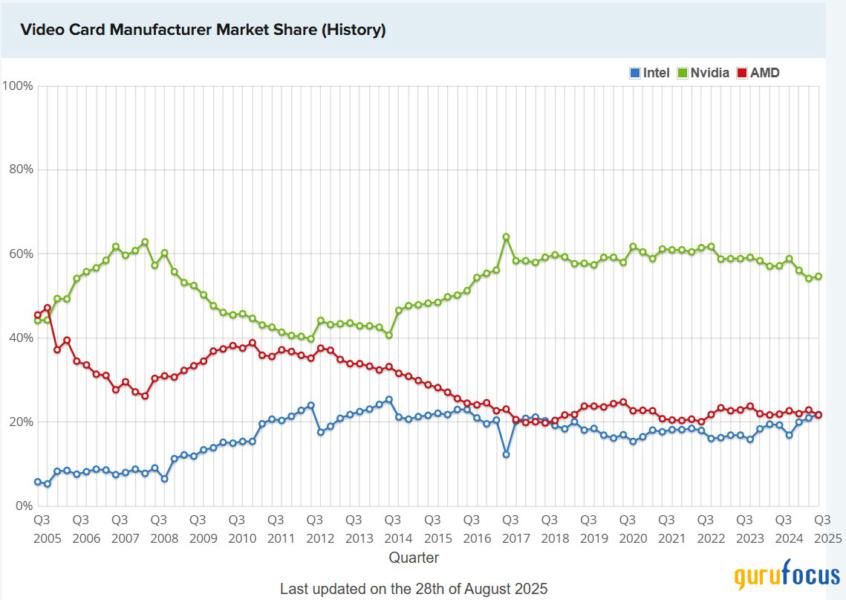

As NVDA has shifted its focus away from the consumer INTC has been aggressive in building its product lineup in the favor of the consumer and it really shows when looking at the chart of the historic video card market share:

Source: PassMark

The data here shows that NVDA's consumer video card market share dropped from 61.8% in 2022, to 54.2% in 2025, AMD remained stagnant, and during the same period, Intel's share rose from 16.1% to 21%.

Observing the chart, it would appear that NVDA's market share is on a downwards trajectory with more declines likely as competition, mainly the now pro-consumer focused Intel continues to gain ground within NVDA's lost, yet core industry as Intel's product lineup right now puts the core consumer base first and remains easily accessible. Unlike NVDA, INTC is not talking about abstract AI models with gimmicky names that sound like they were ripped out of some sci-fi film; they're instead talking about battery life, power efficiency, security features, and real improvements that everyday people will notice when they buy their next laptop or desktop.

A familiar trap?

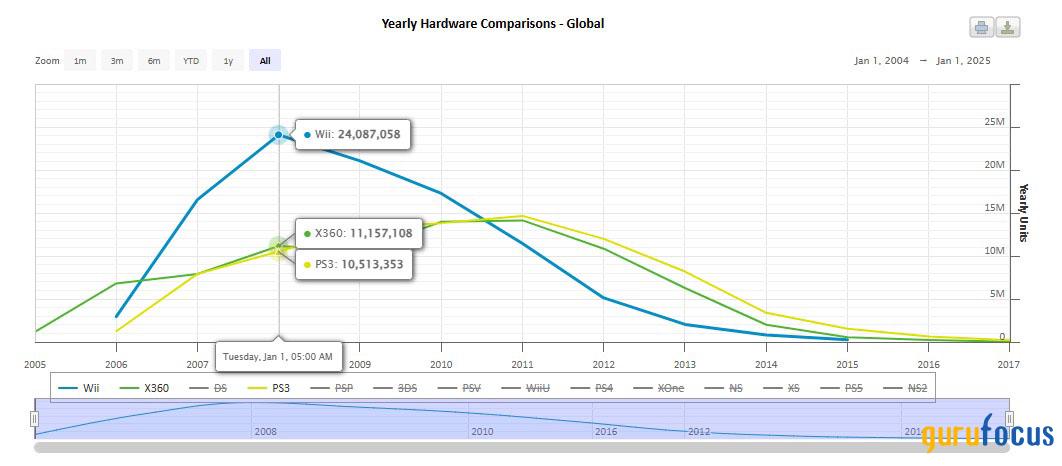

In many ways, this is reminiscent to when Microsoft fumbled with the new generations of Xbox with the Kinect. Microsoft had a winning product in the Xbox 360 but got distracted by the gimmicks introduced with the Kinect, focusing on getting rid of the traditional controller in favor of motion controls, becoming an all in one media hub, and enforcing always online requirements for Xbox One with Kinect; a practice none of the consumers ever approved of yet Microsoft pushed it for years. It seems likely that Microsoft's obsession with motion controls came from their desire to chase after the success of the Nintendo Wii, which released in 2006, introduced motion controls to the masses, and ended up being the best-selling seventh generation console of that generation by far.

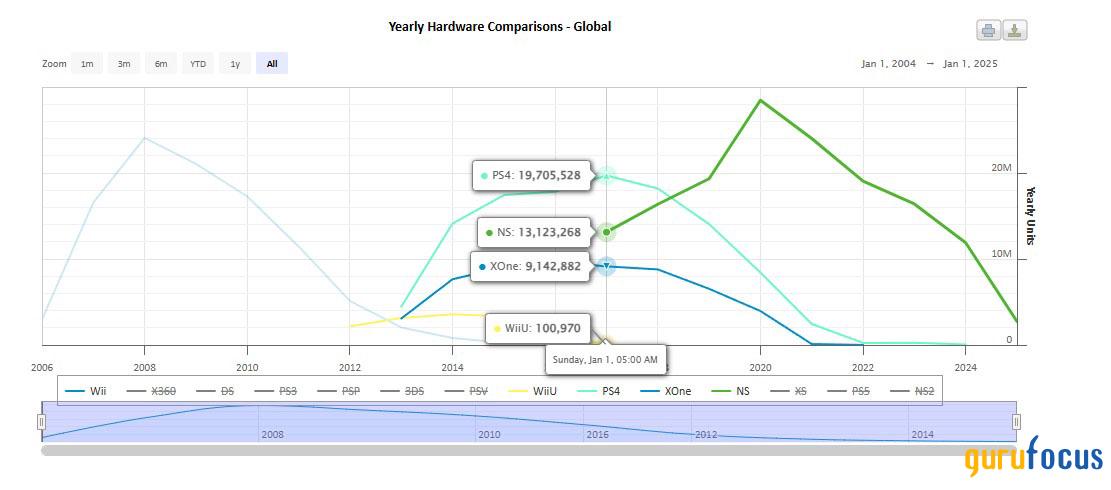

Source: VGChartz

But by the time the eighth generation rolled in, the novelty of motion controls had long played it course and that was made very apparent with the fall in the Nintendo Wii's yearly sales as well as to complete failure of the Wii U.

During the start of the eighth generation in 2013, we would see Sony, with its PS4 release, focus on games and gamer alike, showcasing pro-consumer features such as game sharing along with the ability to play games without the need of an internet connection; all backed by a strong lineup of game releases to boot. Sony did all of this and even took direct jabs at Microsoft, their competition, who was not then concerned with these pro-consumer moves at the time. Despite these open jabs from Sony, Microsoft would carry on with its anti-consumer practices in favor of the Kinect as it continued to push the all-in-one media hub features which was likely an attempt to compete with the then trending streaming markets, as well as pushing the motion controls which was a dying fad. As a result, a new trend would emerge of yearly PS4 sales consistently being double that of Xbox One sales;

Source: VGChartz

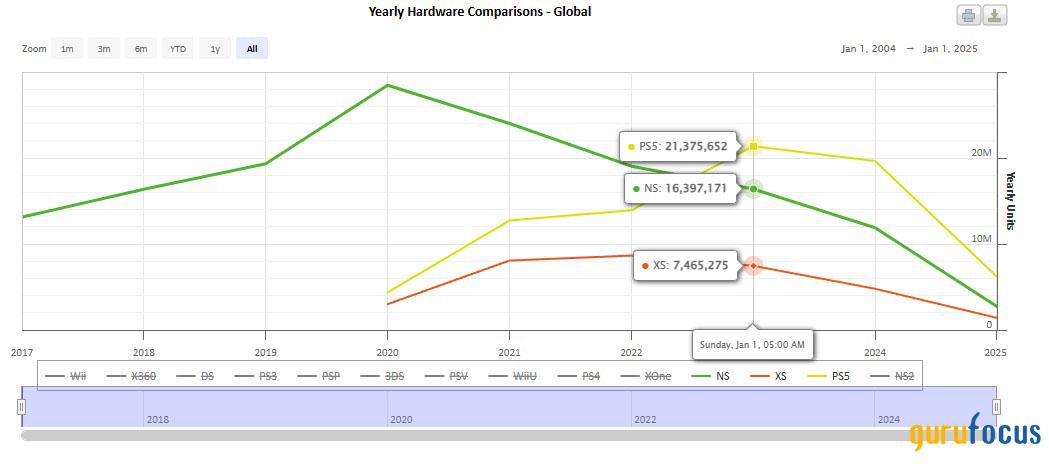

One year later the CEO of Microsoft would appoint Phil Spencer as the new head of Xbox who then would undo the anti-consumer practices set in motion by the previous head, Don Mattrick, starting with the unbundling of the kinect and a more consumer friendly approach to gamer by offering backwards compatibility, and reverting back to the brand's roots; Unfortunately it was too late as the previous leadership had already sullied the brand's relationship with its core customer base and many of those that might have considered coming back to Xbox were already comfortably on PlayStation and later on, thanks to a much improved marketing campaign, Nintendo Switch; the result of Xbox's previous years of not focusing on the core consumer and even antagonizing the consumer at times made it very tough to take back market share against Nintendo and Sony, which remained, focused on their core gaming audience throughout.

Even all these years later in the ninth generation of consoles, as Microsoft has spent the last 13 years reversing course on all of these anti-consumer practices, they remain significantly behind Nintendo and Sony generations later as the consumer base has already settled within their perspective ecosystems and winning them back has proven to be very hard for Microsoft to do with PS5 sales now being triple that of Xbox Series X/S.

Source: VGChartz

Nvidia risks falling into the same trap: chasing enterprise AI hype while forgetting about the consumer market that made it a household name in the first place and in time of economic slowdown Nvidia will need to lean back on this core base but by the time they do another competitor would have likely scooped up a significant portion of this core base and just like Microsoft with the Xbox, it could take years before Nvidia can rebuild all of that lost consumer trust.

Valuation Overview:

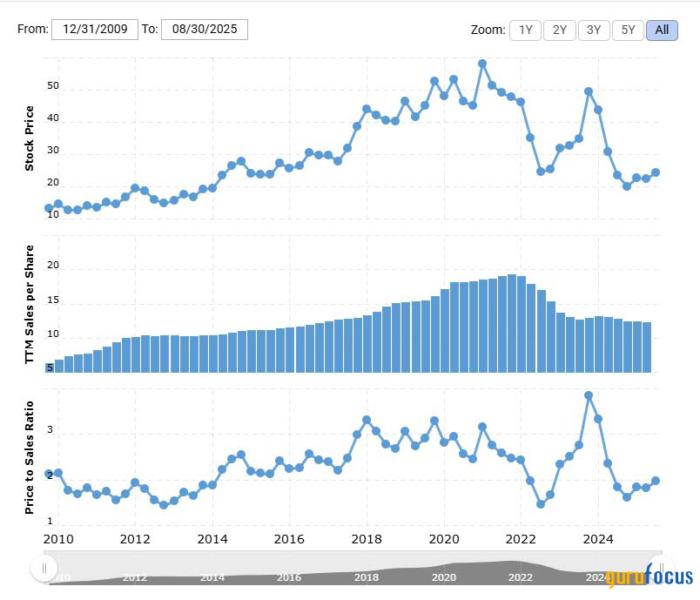

When taking in account NVDA's slowdown in profit margins mainly attributed to the slowdown in enterprise revenue paired with their loss in market share to INTC within the consumer base, it makes sense to consider INTC as the alternative investment to NVDA. Despite INTC's recent shaky history of EPS misses, it is worth considering the fact that the stock price trades at a very low price to sales multiple of 1.98x:

Source: MacroTrends

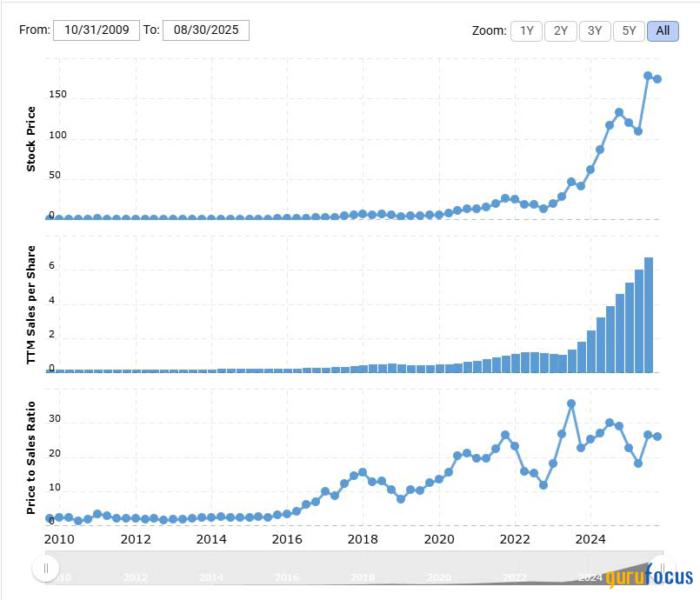

This low price to sales value contrasts with NVDA's which currently trades at a 25.95x multiple to its sales;

Source: MacroTrends

This in my opinion is a massive oversight in the market that shows speculative growth being priced into NVDA while ignoring the current actual contraction NVDA is currently facing, as a result, the comparison of these ratios tells us that sales growth is failing to keep up with the high speculative valuations of the current market.

Meanwhile the market has severely undervalued INTC, not taking into consideration the fact that it is currently gaining a significant core market share against NVDA and AMD alike in a trend that seems likely to continue.

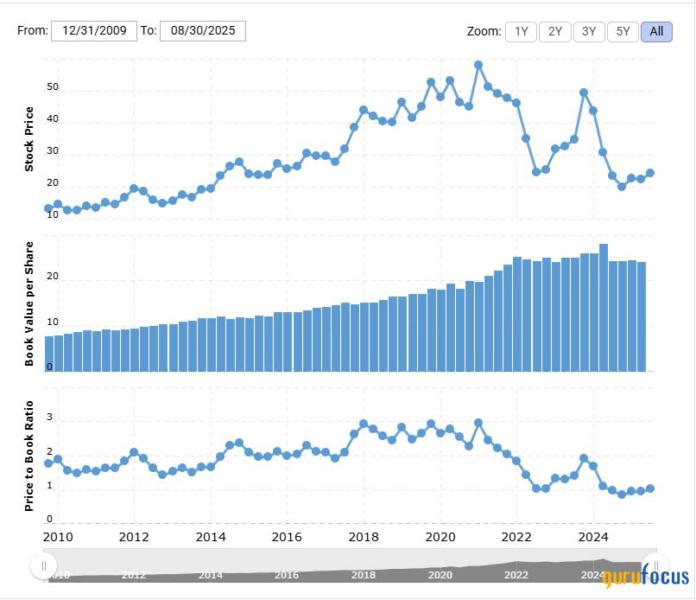

Looking into other valuation data we can also see that INTC trades at a 1.01x book value which ultimately confirms that despite INTC's recent growth, the stock market still hasn't priced in any growth at all within the company which means that the stock is currently at its fairest value right now.

Source: MacroTrends

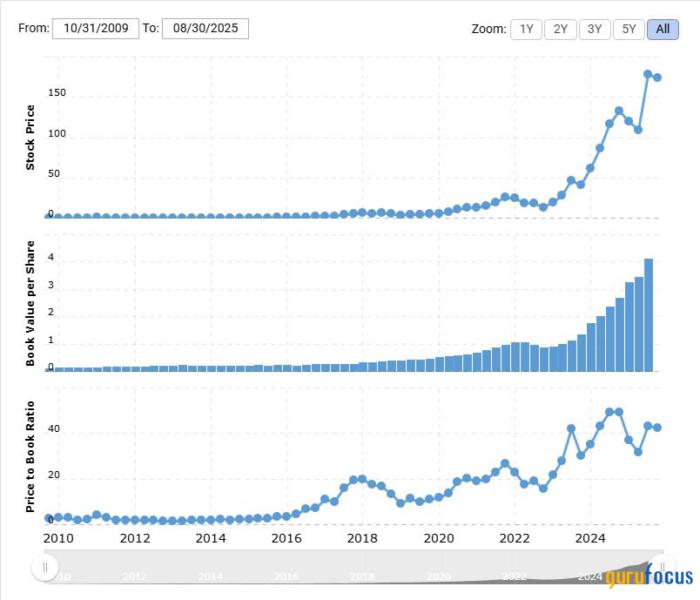

Meanwhile when looking at NVDA's price to book we can see that in spite of recent contractions, the market is still valuing NVDA's stock at a 42.33x multiple to its book value.

Source: MacroTrends

Taking in the totality of the data it would be in my opinion a valuable opportunity to capitalize on the arbitrage between NVDA and INTC's valuation and performance by investing long term into INTC rather it be shares or Long Call LEAPS (1 year or more of theta), while reducing share allocation or even buying some longer dated 300+ DTE OTM puts in NVDA or at least hedging current long positions in NVDA more aggressively with covered calls. As this arbitrage closes, I would anticipate NVDA's market cap valuation to contract while INTC's expands, narrowing the current spread between NVDA's $4.4T and INTC's $100B market cap valuations.