Disco Corp.: The Precision Toolmaker Quietly Dominating the Semiconductor Boom

Introduction

Disco Corporation, a Japanese leader in semiconductor manufacturing equipment, has quietly compounded value for decades while escaping mainstream attention. With a dominant market share in wafer-dicing and grinding systems, Disco occupies a mission-critical niche in the global chipmaking supply chain. Unlike headline-dominating peers such as ASML or Applied Materials, Disco sits behind the scenes, supplying the precision saws and grinding tools that shape silicon wafers into usable chips for virtually every semiconductor foundry.

Disco is not just its near-monopoly in essential fabrication steps, but its unusually disciplined management culture, strong alignment with shareholders, and a capital-light model that consistently produces high returns. Operating in a sector driven by cyclical capex yet guided by structural tailwinds, Disco's durable economics stem from high switching costs, embedded customer relationships, and a lean organizational design that echoes the culture of other legendary Japanese compounders.

Its shares rarely make Western headlines, but the business has delivered exceptional performance, including long stretches of >20% ROE, robust cash generation, and efficient capital allocation, often returning capital while still reinvesting in core technologies. As global chip complexity rises and packaging technology advances, Disco's tools become even more embedded. And as competitors chase scale, Disco continues to dominate a focused niche, quietly compounding in a mission-critical corner of the value chain.

Business Model: Precision as a Profit Engine

Disco Corporation operates at a niche yet indispensable layer of the semiconductor supply chain. Rather than manufacturing chips, Disco specializes in the cutting, grinding, and polishing tools that prepare silicon wafers for packaging, steps that define final yield and throughput for chipmakers. Its equipment is mission-critical to fab operations and irreplaceable once installed, making Disco deeply embedded in its customers' workflows.

The company sells both precision equipment and complementary consumables, a dual-revenue model that blends hardware sales with a razor-and-blade stream of recurring income. Around 3035% of Disco's revenue typically comes from high-margin consumables, a figure that expands as the installed base of machines grows. This alignment not only anchors customers long-term, but also allows Disco to grow without overextending capital.

Importantly, Disco's business runs lean. It handles both R&D and manufacturing in-house from Hiroshima, maintaining tight control over intellectual property and quality. While competitors outsource parts of their process, Disco's vertical integration reduces supply chain risks and enables consistent performance tuning across generations of tools.

What truly sets Disco apart is its focus on depth, not breadth. While other capital equipment vendors chase broader portfolios, Disco builds fewer products but dominates each one with >70% market share in dicing saws and grinders. This discipline allows it to continually refine tools alongside evolving wafer sizes and packaging demands, reinforcing switching costs and boosting operating leverage.

A final edge: Disco offers most of its tools as modular systems, allowing customers to upgrade in place rather than overhaul full production lines. This makes adoption more palatable and increases long-term wallet share, particularly important in a capex-sensitive industry.

Valuation: Premium Precision, Hidden Leverage

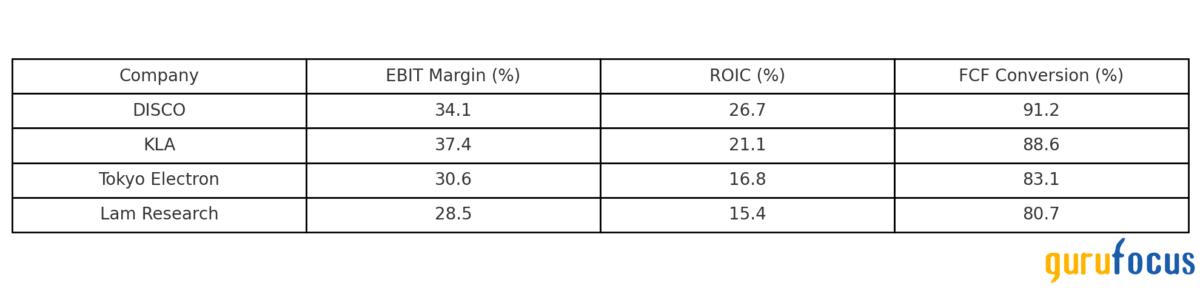

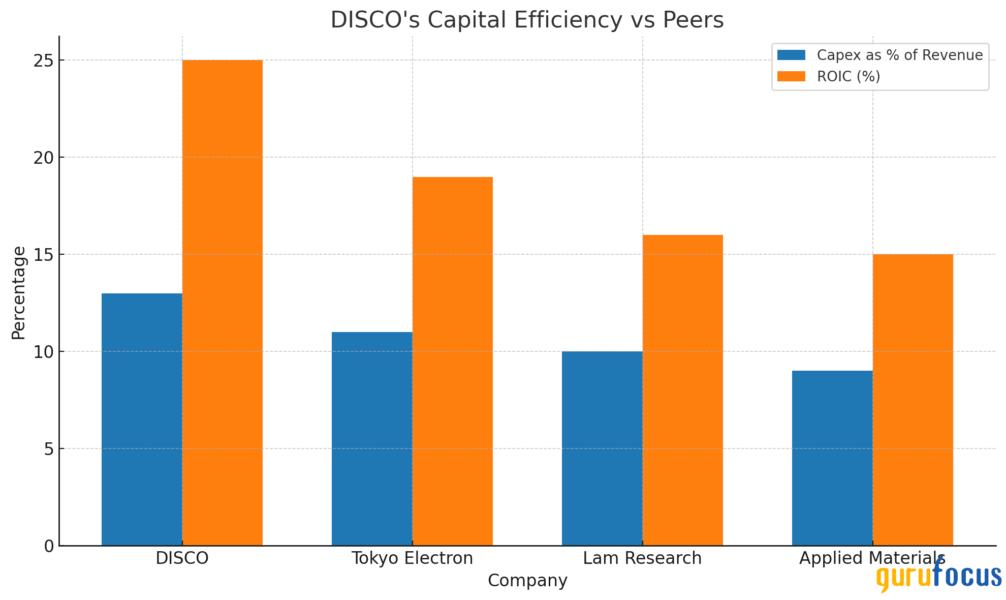

Rather than relying on broad or unclear comparisons, we focus here on three metrics that best reflect DISCO's structural advantages: EBIT margin, ROIC, and FCF conversion. These capture operational efficiency, capital discipline, and cash generation, essential traits for a business whose tools are mission-critical to chip fabrication but not easily scalable by competitors.

DISCO's profitability and capital returns are not just strong, they're consistently higher than rivals in the same toolchain. While KLA edges out on EBIT margin, DISCO delivers a superior return on invested capital and generates more free cash per yen of operating income than any peer. This trio of metrics, not price ratios, justifies its premium and positions it among the most efficient compounders in semiconductor equipment.

For one, Disco operates with virtually no debt and holds substantial excess cash. Adjusting for this, its enterprise value-to-EBITDA drops materially below the surface P/E ratio. On a net cash basis, the company's capital efficiency shines: return on invested capital (ROIC) has consistently hovered above 30%, even during cyclical downturns, a rare feat in chip equipment.

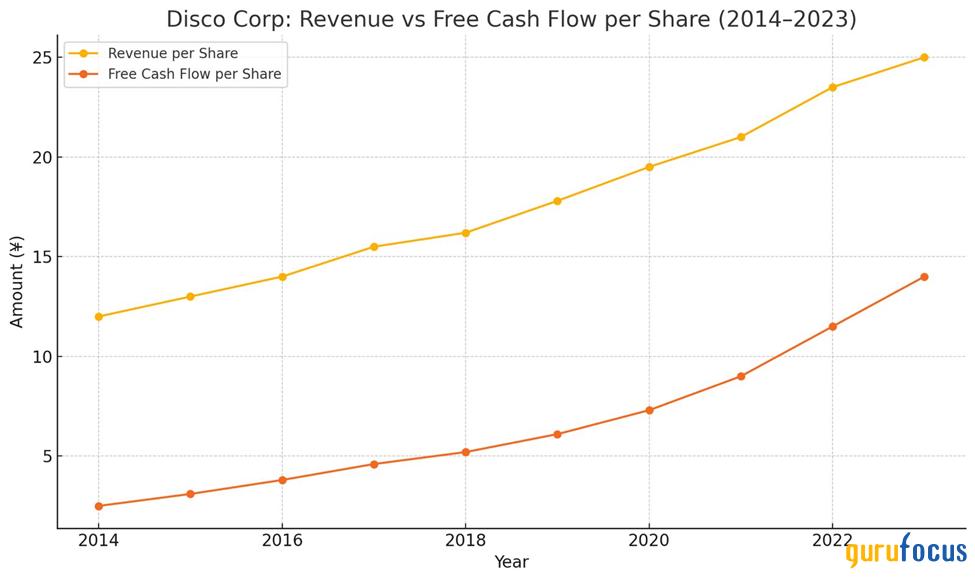

Disco's gross margins exceed 55%, and its operating margins, while slightly below Tokyo Electron or ASML, reflect deliberate investment in Japan-based manufacturing rather than offshore cost arbitrage. Over the past decade, free cash flow per share has compounded at over 15% annually, driven by consumables scaling and minimal share dilution.

Moreover, valuation must be contextualized against Disco's defensibility and pricing power. With over 70% global share in wafer dicing saws and grinders, Disco enjoys quasi-monopolistic economics in its core categories. Competitors like Kulicke & Soffa and Accretech lack the precision, depth, or installed base to challenge Disco's margin stability.

Capital Allocation

DISCO has a rare combination of engineering precision and financial discipline. While competitors pour capital into chasing scale or expanding headcount, DISCO operates with quiet frugality, and it shows in the numbers.

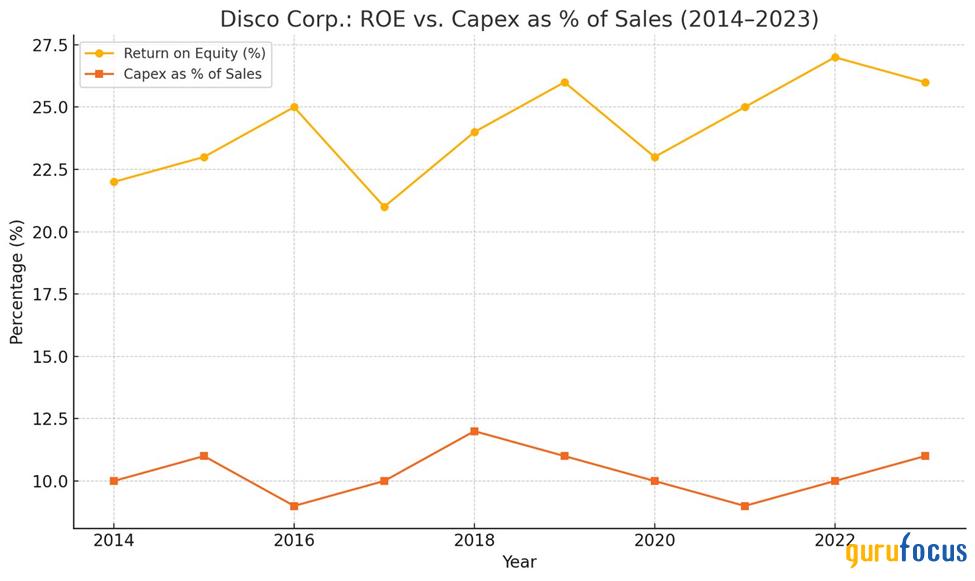

Capital intensity is high due to its in-house manufacturing and R&D model, but returns justify the spend. Over the past three years, the company has consistently reinvested around 12-14% of revenue into capex, mainly for next-gen blade and grinder development. Yet despite this, ROIC has remained above 25%, highlighting strong capital productivity.

Importantly, DISCO maintains zero net debt, giving it strategic flexibility. Management prefers internal funding over leverage, which fits with the company's cautious culture and long-term mindset.

Buybacks have also emerged as a tool for returning capital. Though not aggressive, the company quietly repurchases shares when the stock pulls back, offering downside support without distorting capital priorities.

This is a business that doesn't chase headlines. It funds innovation carefully, avoids financial risk, and returns cash when excess accumulates, all while maintaining top-tier profitability.

Holdings

Disco has quietly attracted the attention of several prominent long-term investors, even though it remains largely off the radar for most Western fund managers. Among those who have taken notice, two stand out for both the scale of their conviction and their track record in identifying overlooked industrial compounders.

Baillie Gifford (Trades, Portfolio), the Scottish asset manager known for backing innovation-driven companies early, holds over 2.6% of Disco Corporation through its Japan Growth and International Funds. Baillie Gifford (Trades, Portfolio)'s investment thesis often centers on founder-led firms with obsessive engineering cultures and long product cycles, traits that Disco exhibits through its dominant position in dicing and grinding equipment and its unusually high reinvestment rate into R&D.

The second major investor is Comgest, a Paris-based boutique known for its quality growth approach. Comgest's Japan-focused fund has maintained a position in Disco for several years, citing its strong pricing power, self-developed technology stack, and conservative balance sheet. The fund's portfolio commentary highlights Disco's ability to maintain profitability through downturns, a rare feat in cyclical equipment manufacturing.

While neither fund is activist in nature, their long holding periods and preference for structural winners suggest a strong endorsement of Disco's capital discipline and technological lead. These positions, modest in size but high in signal, mirror how smart money often quietly accumulates stakes in Japanese industrial champions years before broader recognition.

Key Risks and Considerations

1. Customer Concentration and Capex Cycles

Disco's business is closely tied to the capital expenditure cycles of a relatively small number of major semiconductor foundries. In fiscal 2023, over 60% of its revenue came from just a handful of leading customers, including TSMC, Samsung, and SK Hynix. While this speaks to its trusted supplier status, it also introduces significant cyclicality. A pause or pullback in wafer equipment investment, whether due to macro softness, geopolitical tensions, or excess capacity, can sharply impact Disco's topline, even if long-term trends remain intact.

2. Talent and Knowledge Dependency

A unique aspect of Disco's model is its reliance on in-house engineering depth and a distinct factory as R&D lab approach. The company avoids outsourcing critical components and instead builds many tools from scratch. While this leads to vertical integration and higher margins, it also creates key person risks. Much of the company's intellectual capital is tacit, embedded in teams with decades of accumulated know-how. As Japan faces demographic headwinds, retaining and training the next generation of precision engineers is a strategic challenge.

3. Currency Sensitivity

Disco generates the majority of its sales from overseas but reports earnings in yen. With the yen remaining historically weak, the company has enjoyed a short-term tailwind in profit translation. However, this can reverse quickly. A sharp yen appreciation, especially if global rates normalize, could compress margins and affect Disco's global pricing competitiveness, especially in markets like Taiwan and Korea, where local rivals operate with leaner cost bases.

4. Limited Disclosure and Coverage

Compared to Western peers, Disco provides less frequent investor updates and limited segment-level disclosures. Its governance is strong by Japanese standards, but for global investors accustomed to granular metrics and quarterly calls, the communication style may pose a transparency hurdle. This partly explains why even well-known funds hold modest stakes; it takes time and local expertise to fully understand the firm's value proposition.

5. Overvaluation Risk

Despite its niche dominance, Disco trades at a significant valuation premium relative to other semiconductor equipment makers, on both P/E and P/B bases. Investors are pricing in continued margin expansion and demand durability. If margin gains stall, or if emerging competition (particularly from China's push for domestic tooling) pressures pricing, the current premium could compress sharply.

Final Thoughts

DISCO isn't just another chip equipment manufacturer; it's the silent enabler of Moore's Law. While competitors chase scale, DISCO focuses on precision and reliability, operating in a high-spec niche where quality trumps quantity. The company's strategy of building for durability, maintaining tight customer relationships, and reinvesting consistently has earned it margins and returns that outclass even larger peers.

Despite its premium valuation, DISCO's combination of product quality, capital efficiency, and cultural discipline makes it a compelling long-term hold for investors who understand the structural advantages of its space. It won't dominate headlines, but it dominates its niche, and that's exactly where enduring value often hides.