Hello everyone,

If you’re struggling to combine Time (multi-timeframe analysis) and Structure (market framework) to build a solid foundation for predicting what’s likely to happen in the market, this post will reveal the secret many professionals use — with up to 80% win probability!

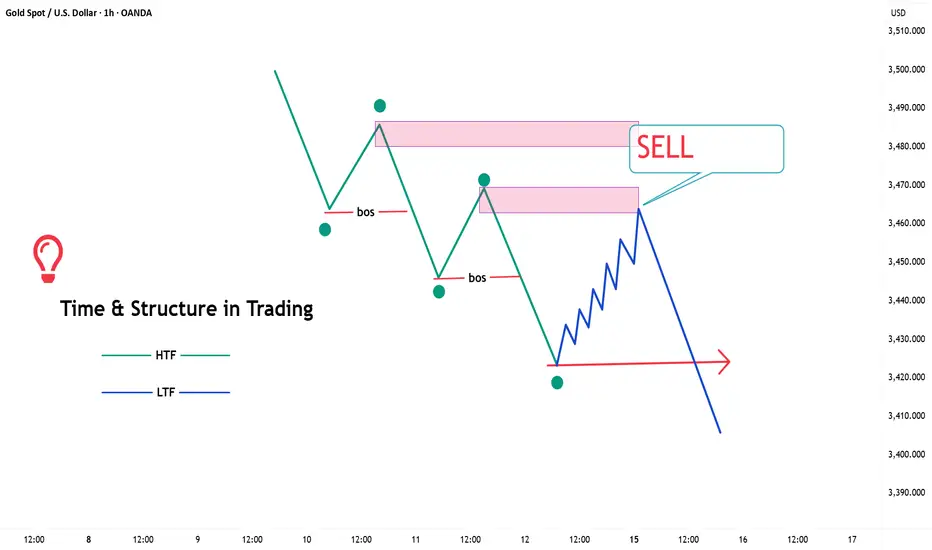

1. The Core Mindset – Time & Structure

Every timeframe speaks a different language:

- H4, D1 = the bigger picture (overall trend).

- M15, M5, M1 = the micro view (entry signals, internal flow).

The key is: never rely on one timeframe alone – always align them.

2. POI – Points of Interest

- Each timeframe has its own POI (Points of Interest).

- Example: When you find a POI on H4, don’t rush in.

Zoom into M15 or M5 to see what’s happening inside that zone.

3. Multi-Timeframe Alignment – The Smart Money Way

For example:

- H4: Price taps into a demand zone.

- M15: Structure shifts from bearish → bullish inside that demand zone.

This means H4 is preparing for a rally, and M15 confirms your BUY entry with higher precision.

When multiple timeframes align in the same direction, your probability skyrockets.

4. Why Always Respect the Bigger Picture?

- LTF (Lower Timeframe) = just noise or details.

- HTF (Higher Timeframe) = the real storyline.

If M15 shows a BUY but H4 is strongly bearish, you’re fighting the market.

But if M15 and H4 point the same way, you have a High Probability Setup.

5. Keys to High-Probability Trading

Identify the higher timeframe trend (H4, D1).

Mark strong POIs.

Drop to lower timeframes (M15, M5, M1) to watch for structure shifts.

Only trade when Time & Structure are aligned.

Always manage risk – place SL beyond OB/POI zones.

6. Final Takeaway

High-probability trades appear when multiple timeframes confirm the same direction.

Don’t trade on gut feeling — let Time + Structure guide you, just like Smart Money does.

If you’re struggling to combine Time (multi-timeframe analysis) and Structure (market framework) to build a solid foundation for predicting what’s likely to happen in the market, this post will reveal the secret many professionals use — with up to 80% win probability!

1. The Core Mindset – Time & Structure

Every timeframe speaks a different language:

- H4, D1 = the bigger picture (overall trend).

- M15, M5, M1 = the micro view (entry signals, internal flow).

The key is: never rely on one timeframe alone – always align them.

2. POI – Points of Interest

- Each timeframe has its own POI (Points of Interest).

- Example: When you find a POI on H4, don’t rush in.

Zoom into M15 or M5 to see what’s happening inside that zone.

3. Multi-Timeframe Alignment – The Smart Money Way

For example:

- H4: Price taps into a demand zone.

- M15: Structure shifts from bearish → bullish inside that demand zone.

This means H4 is preparing for a rally, and M15 confirms your BUY entry with higher precision.

When multiple timeframes align in the same direction, your probability skyrockets.

4. Why Always Respect the Bigger Picture?

- LTF (Lower Timeframe) = just noise or details.

- HTF (Higher Timeframe) = the real storyline.

If M15 shows a BUY but H4 is strongly bearish, you’re fighting the market.

But if M15 and H4 point the same way, you have a High Probability Setup.

5. Keys to High-Probability Trading

Identify the higher timeframe trend (H4, D1).

Mark strong POIs.

Drop to lower timeframes (M15, M5, M1) to watch for structure shifts.

Only trade when Time & Structure are aligned.

Always manage risk – place SL beyond OB/POI zones.

6. Final Takeaway

High-probability trades appear when multiple timeframes confirm the same direction.

Don’t trade on gut feeling — let Time + Structure guide you, just like Smart Money does.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.