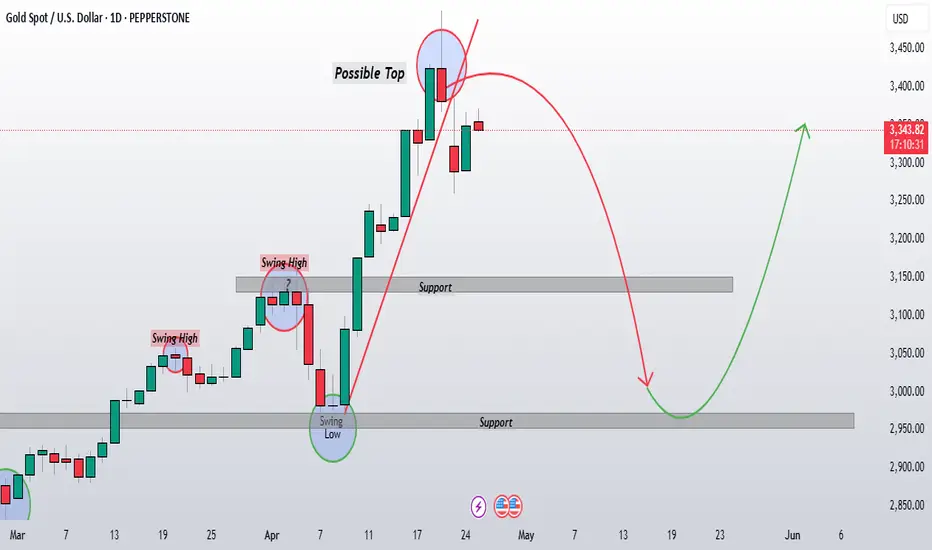

Gold Weekly Close Critical for Confirming correction Pattern

Yesterday's slight price recovery(Green Closing) appears to be a normal bounce after the sharp two-day decline. This aligns with typical market behavior where prices don't move in straight lines, even during strong drop or rise.

The current price action (3349) is still trading well below to golden fib zone(3380-3408) , which suggests that price is still under sellers control as of now.

The key will be whether price respects the first support level around 3150-65 or breaks through it, potentially accelerating toward my 3000 target.

As today is the weekly close, this will be particularly important for setting the tone for next week trading. If gold closes significantly below recent highs, it would strengthen the bearish /correction case for the short-term outlook that I have projected.

The current price action (3349) is still trading well below to golden fib zone(3380-3408) , which suggests that price is still under sellers control as of now.

The key will be whether price respects the first support level around 3150-65 or breaks through it, potentially accelerating toward my 3000 target.

As today is the weekly close, this will be particularly important for setting the tone for next week trading. If gold closes significantly below recent highs, it would strengthen the bearish /correction case for the short-term outlook that I have projected.

✅For Live Update on Gold Price and trade opportunities ; Join Free community

t.me/livepriceactiontrading

t.me/livepriceactiontrading

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

✅For Live Update on Gold Price and trade opportunities ; Join Free community

t.me/livepriceactiontrading

t.me/livepriceactiontrading

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.