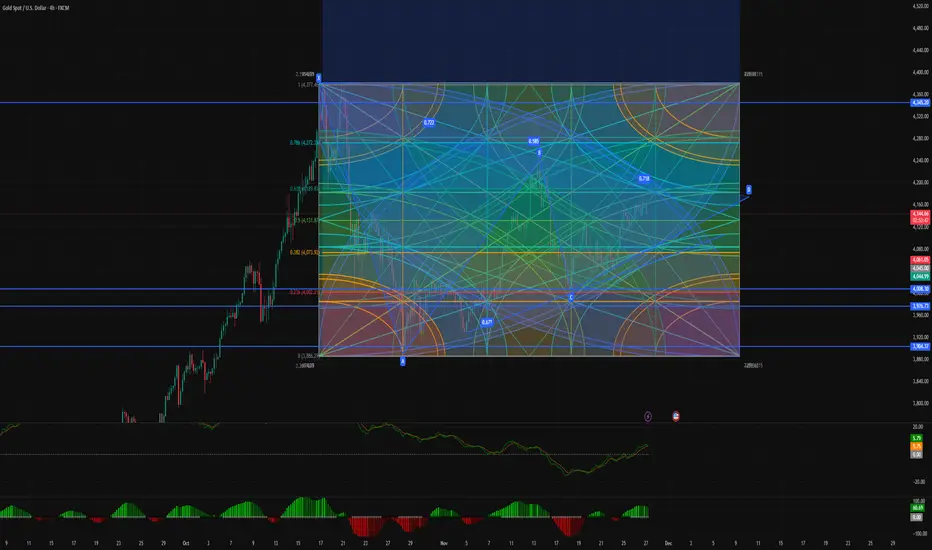

Gold is approaching one of the most important time pivot zones of the week.

Based on a combination of Gann analysis, Harmonic patterns (ABCD), Time Cycles, and momentum structure, the market is showing signs of a potential bullish reversal.

✅ Why a Bullish Move Is Likely

Several major signals are aligning:

1️⃣ Time Cycle Confluence – Strong Pivot at 9 PM UTC+2:00

Multiple time cycles, Gann angles, and the hexagonal time-star all converge around the same time window.

This type of confluence is rare — and usually marks the beginning of a new directional wave.

2️⃣ Corrective Structure Into Point D

The recent move into the D-point shows corrective behavior, not impulsive selling.

This indicates the market is preparing for a shift in direction.

3️⃣ Momentum Divergence

RSI and MACD are showing clear bullish divergence, confirming loss of bearish strength.

4️⃣ Accumulation Instead of Distribution

The last candles show:

Smaller bodies

Lower volume on the downside

Long wicks

This is typical accumulation behavior, not continuation selling.

🎯 Bullish Scenario (Primary Expectation)

If the time pivot triggers as expected, gold may start a new upward wave with potential targets:

4170

4215

4270

Extension target: 4340 if strong momentum develops.

A strong close above the micro-resistance confirms the bullish wave.

Based on a combination of Gann analysis, Harmonic patterns (ABCD), Time Cycles, and momentum structure, the market is showing signs of a potential bullish reversal.

✅ Why a Bullish Move Is Likely

Several major signals are aligning:

1️⃣ Time Cycle Confluence – Strong Pivot at 9 PM UTC+2:00

Multiple time cycles, Gann angles, and the hexagonal time-star all converge around the same time window.

This type of confluence is rare — and usually marks the beginning of a new directional wave.

2️⃣ Corrective Structure Into Point D

The recent move into the D-point shows corrective behavior, not impulsive selling.

This indicates the market is preparing for a shift in direction.

3️⃣ Momentum Divergence

RSI and MACD are showing clear bullish divergence, confirming loss of bearish strength.

4️⃣ Accumulation Instead of Distribution

The last candles show:

Smaller bodies

Lower volume on the downside

Long wicks

This is typical accumulation behavior, not continuation selling.

🎯 Bullish Scenario (Primary Expectation)

If the time pivot triggers as expected, gold may start a new upward wave with potential targets:

4170

4215

4270

Extension target: 4340 if strong momentum develops.

A strong close above the micro-resistance confirms the bullish wave.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.