Dual-phase trading — shorting the drop, then switching to long

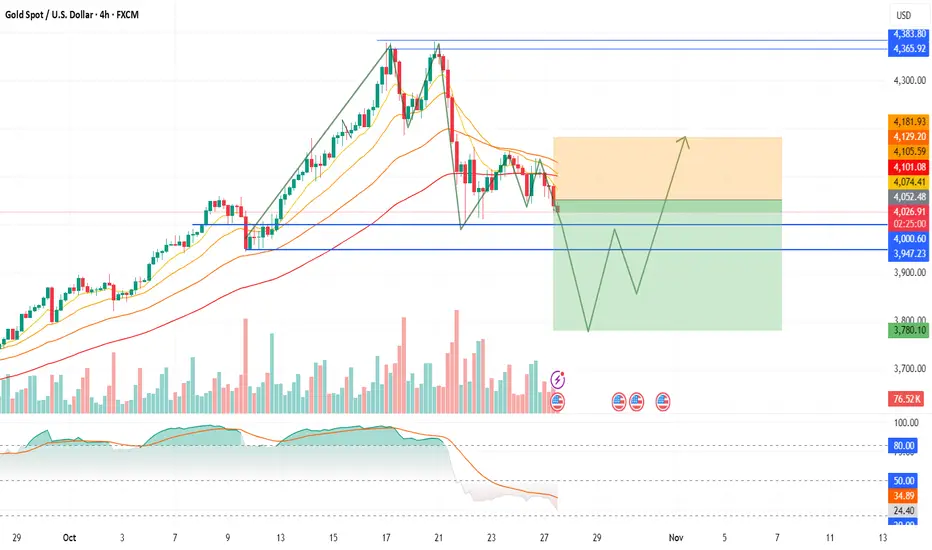

Gold is currently trading near $4,040, and my short-term outlook is bearish, followed by a strong bullish reversal in the coming sessions.

I expect prices to decline first toward the $3,800–$3,750 zone, which aligns with key support and previous demand levels. This correction phase would complete a healthy market reset before a potential major rally begins.

Once price stabilizes around $3,800, I anticipate a sharp reversal and breakout move toward $4,200+, possibly extending higher if momentum builds.

📊 My Plan:

Bias: Bearish first → then Bullish

Short-Term Target: $3,800–$3,750

Reversal Zone: Accumulate longs near $3,800

Upside Target: $4,200+

Invalidation: Below $3,740 (on 4H closing)

This setup favors patience and dual-phase trading — shorting the drop, then switching to long for the rebound.

I expect prices to decline first toward the $3,800–$3,750 zone, which aligns with key support and previous demand levels. This correction phase would complete a healthy market reset before a potential major rally begins.

Once price stabilizes around $3,800, I anticipate a sharp reversal and breakout move toward $4,200+, possibly extending higher if momentum builds.

📊 My Plan:

Bias: Bearish first → then Bullish

Short-Term Target: $3,800–$3,750

Reversal Zone: Accumulate longs near $3,800

Upside Target: $4,200+

Invalidation: Below $3,740 (on 4H closing)

This setup favors patience and dual-phase trading — shorting the drop, then switching to long for the rebound.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.