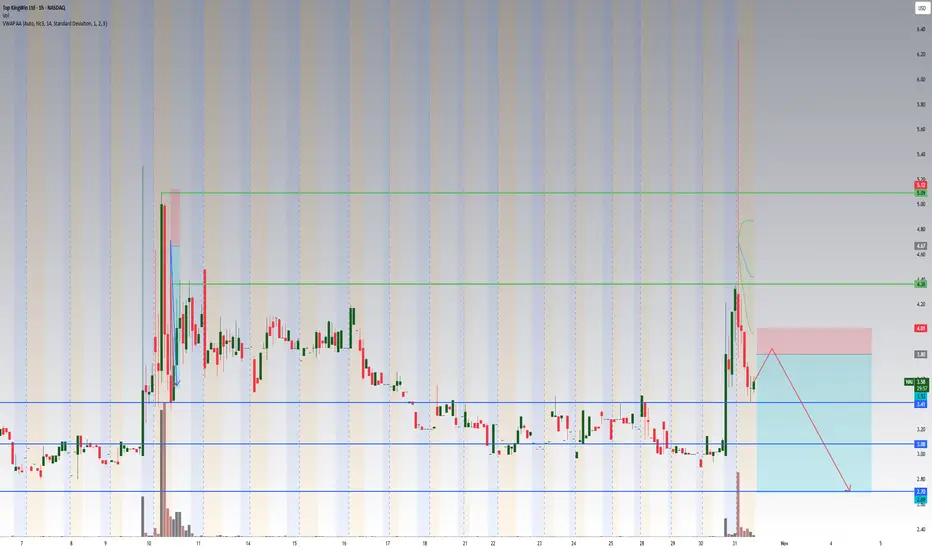

Ticker: WAI (Top KingWin Ltd)

Sector: Financial / China micro-cap

Float: ~1.8M

Pre-market Change: +17%

Pre-market Volume: ~3.9M

Rotation: ~2× float

Bias: Short after exhaustion

📊 Thesis

WAI is showing a low-float, low-volume gap with around 2× float rotation in pre-market trading.

These types of moves often start with a fast emotional push shortly after the open, followed by a sharp fade once liquidity dries up.

The float is small enough to attract momentum traders, but total dollar volume (~$14M) suggests limited sustainability unless volume expands aggressively at the open.

📈 Trading Plan

Zone Level Action

Resistance / Short zone 3.80–4.00 Watch for a failed breakout or topping wick

Confirmation add Below 3.50 (VWAP fail) Short continuation trigger

Stop-loss 4.20 Above morning breakout / high-of-day

Target 1 3.40 VWAP / early support

Target 2 3.00 Gap-fill zone

Target 3 2.80–2.60 Full unwind potential if volume dies out

⚙️ Trade Logic

Wait for first push into resistance (3.80–4.00).

Look for rejection wicks + heavy tape stall.

Confirm short only after VWAP rejection and break under 3.50.

Gradual scale-out through support levels — no need to overstay.

🧠 Key Notes

Avoid chasing pre-market moves; liquidity is limited.

Use smaller size and limit orders only due to low float.

Stay flexible — if VWAP is reclaimed and held for 15+ minutes, cut and reassess.

Summary:

WAI has decent pre-market attention but lacks the volume depth to sustain higher levels. A controlled short approach near $4.00, using VWAP confirmation, offers the best asymmetry for a morning fade.

Sector: Financial / China micro-cap

Float: ~1.8M

Pre-market Change: +17%

Pre-market Volume: ~3.9M

Rotation: ~2× float

Bias: Short after exhaustion

📊 Thesis

WAI is showing a low-float, low-volume gap with around 2× float rotation in pre-market trading.

These types of moves often start with a fast emotional push shortly after the open, followed by a sharp fade once liquidity dries up.

The float is small enough to attract momentum traders, but total dollar volume (~$14M) suggests limited sustainability unless volume expands aggressively at the open.

📈 Trading Plan

Zone Level Action

Resistance / Short zone 3.80–4.00 Watch for a failed breakout or topping wick

Confirmation add Below 3.50 (VWAP fail) Short continuation trigger

Stop-loss 4.20 Above morning breakout / high-of-day

Target 1 3.40 VWAP / early support

Target 2 3.00 Gap-fill zone

Target 3 2.80–2.60 Full unwind potential if volume dies out

⚙️ Trade Logic

Wait for first push into resistance (3.80–4.00).

Look for rejection wicks + heavy tape stall.

Confirm short only after VWAP rejection and break under 3.50.

Gradual scale-out through support levels — no need to overstay.

🧠 Key Notes

Avoid chasing pre-market moves; liquidity is limited.

Use smaller size and limit orders only due to low float.

Stay flexible — if VWAP is reclaimed and held for 15+ minutes, cut and reassess.

Summary:

WAI has decent pre-market attention but lacks the volume depth to sustain higher levels. A controlled short approach near $4.00, using VWAP confirmation, offers the best asymmetry for a morning fade.

Operación cerrada: objetivo alcanzado

Sharing clean, logical market analysis focused on liquidity, structure and volume. No signals, no pressure — just education. If you want more insights, you’re welcome to join: t.me/CE3vdc5m72w4MjRk

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Sharing clean, logical market analysis focused on liquidity, structure and volume. No signals, no pressure — just education. If you want more insights, you’re welcome to join: t.me/CE3vdc5m72w4MjRk

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.