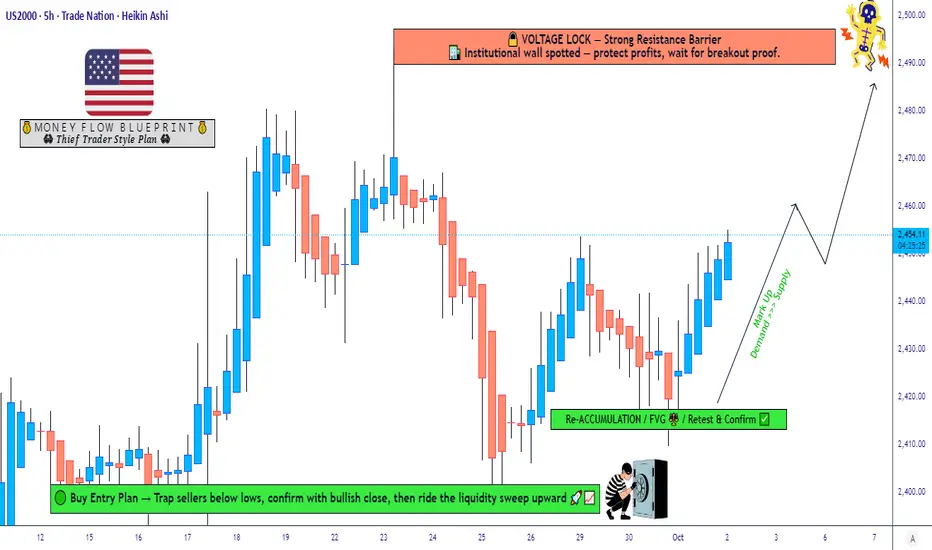

📊 US2000 Index – Market Wealth Strategy Map (Swing/Day Trade)

Ladies & Gentlemen (Thief OG’s) – here’s a fresh layering entry plan for US2000 with a bullish outlook. This is my playful "Thief Strategy" style — multiple entries, multiple chances, and yes… multiple exits too. 😎

🔑 Plan: Bullish Bias

💸 Entry (Layering Style):

Limit Buy Orders: 2430 / 2440 / 2450

You can expand layers further depending on your own risk appetite.

👉 This layered entry style (a.k.a. Thief Strategy) spreads out execution points to reduce risk of missing the move.

🛡️ Stop Loss (SL):

Thief SL parked at 2410

⚠️ Note: This is my risk level. Please set your SL according to your own money management.

🎯 Target (TP):

2490 → “Voltage Lock” Zone ⚡ (Strong resistance barrier + overbought levels + possible trap area).

⚠️ Note: Not financial advice. I’m sharing my target, but your TP is your choice — secure profits as you see fit.

📌 Correlation Watchlist / Related Pairs:

SPX500USD (S&P 500) → often leads the broader market sentiment.

SPX500USD (S&P 500) → often leads the broader market sentiment.

DJI (Dow Jones 30) → check rotation between large caps vs small caps.

DJI (Dow Jones 30) → check rotation between large caps vs small caps.

NDX (Nasdaq 100) → tech moves can spill over into Russell small caps.

NDX (Nasdaq 100) → tech moves can spill over into Russell small caps.

VIX (Volatility Index) → higher volatility can impact layered entries & SL triggers.

VIX (Volatility Index) → higher volatility can impact layered entries & SL triggers.

Correlation tip: When SPX and

SPX and  NDX are pumping together, US2000 often follows with strong momentum. But if

NDX are pumping together, US2000 often follows with strong momentum. But if  VIX spikes, layered buys can get trapped near support levels.

VIX spikes, layered buys can get trapped near support levels.

📖 Key Notes:

Layering helps spread entries across multiple levels to avoid emotional panic buys.

The "Voltage Lock" resistance at 2490 is my escape zone. Don’t marry the trade — date it, profit, and leave. 💍➡️💵

This is a strategy style I use — not a recommendation. Trade safe.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📌 Disclaimer: This is a Thief Style Trading Strategy — shared just for fun & educational purposes. Not financial advice.

#US2000 #Russell2000 #SP500 #NASDAQ100 #DowJones #ThiefStrategy #SwingTrade #DayTrading #IndexTrading #TechnicalAnalysis

Ladies & Gentlemen (Thief OG’s) – here’s a fresh layering entry plan for US2000 with a bullish outlook. This is my playful "Thief Strategy" style — multiple entries, multiple chances, and yes… multiple exits too. 😎

🔑 Plan: Bullish Bias

💸 Entry (Layering Style):

Limit Buy Orders: 2430 / 2440 / 2450

You can expand layers further depending on your own risk appetite.

👉 This layered entry style (a.k.a. Thief Strategy) spreads out execution points to reduce risk of missing the move.

🛡️ Stop Loss (SL):

Thief SL parked at 2410

⚠️ Note: This is my risk level. Please set your SL according to your own money management.

🎯 Target (TP):

2490 → “Voltage Lock” Zone ⚡ (Strong resistance barrier + overbought levels + possible trap area).

⚠️ Note: Not financial advice. I’m sharing my target, but your TP is your choice — secure profits as you see fit.

📌 Correlation Watchlist / Related Pairs:

Correlation tip: When

📖 Key Notes:

Layering helps spread entries across multiple levels to avoid emotional panic buys.

The "Voltage Lock" resistance at 2490 is my escape zone. Don’t marry the trade — date it, profit, and leave. 💍➡️💵

This is a strategy style I use — not a recommendation. Trade safe.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📌 Disclaimer: This is a Thief Style Trading Strategy — shared just for fun & educational purposes. Not financial advice.

#US2000 #Russell2000 #SP500 #NASDAQ100 #DowJones #ThiefStrategy #SwingTrade #DayTrading #IndexTrading #TechnicalAnalysis

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.