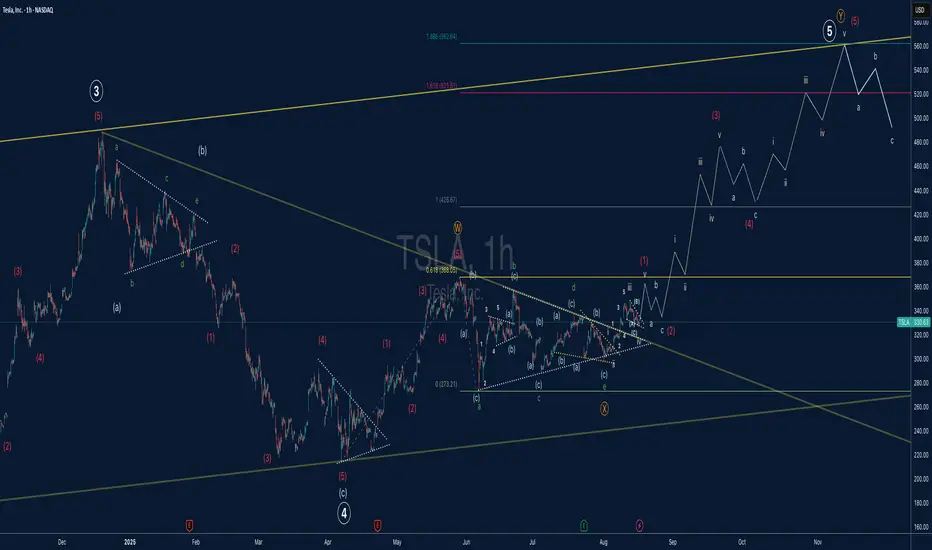

The Macro View:

The broader structure indicates that the peak in late 2024 marked the completion of a primary Wave ③. The subsequent decline into the April 2025 low was a standard a-b-c zigzag correction, successfully completing the large-degree Wave ④. This has set the stage for the next and final impulse wave of the entire sequence.

The Micro View & The Key Pattern:

The rally from the April 2025 low marks the beginning of our primary Wave ⑤. This wave will itself subdivide into five smaller waves. The key to this entire count is the complex Wave (2) of ⑤ that took place from June to August. This was not a simple pullback but a W-X-Y complex "double three" correction.

Wave W was the initial rally from the April low to the June high.

Wave X manifested as a classic contracting triangle, consolidating energy and building cause for the next major move.

Wave Y is the current breakout we are witnessing now, marking the end of the entire corrective phase and the resumption of the primary uptrend.

Future Projection:

With the W-X-Y correction now complete, TSLA appears to have begun its powerful Wave (3) of ⑤. This is typically the strongest and most extended part of an impulse.

Short-term: We expect the initial breakout to continue, finish forming Wave v of (1).

Mid-term: Initial price targets for the completion of the entire Wave ⑤ sequence point towards the $520 - $560 zone, which aligns with the 1.618 - 1.886 Fibonacci extension levels of the preceding impulse.

Invalidation: This bullish outlook remains valid as long as the price stays above the low of Wave (2) of ⑤, established at the end of the triangle around the $310 level. A break below this point would invalidate this specific count.

The broader structure indicates that the peak in late 2024 marked the completion of a primary Wave ③. The subsequent decline into the April 2025 low was a standard a-b-c zigzag correction, successfully completing the large-degree Wave ④. This has set the stage for the next and final impulse wave of the entire sequence.

The Micro View & The Key Pattern:

The rally from the April 2025 low marks the beginning of our primary Wave ⑤. This wave will itself subdivide into five smaller waves. The key to this entire count is the complex Wave (2) of ⑤ that took place from June to August. This was not a simple pullback but a W-X-Y complex "double three" correction.

Wave W was the initial rally from the April low to the June high.

Wave X manifested as a classic contracting triangle, consolidating energy and building cause for the next major move.

Wave Y is the current breakout we are witnessing now, marking the end of the entire corrective phase and the resumption of the primary uptrend.

Future Projection:

With the W-X-Y correction now complete, TSLA appears to have begun its powerful Wave (3) of ⑤. This is typically the strongest and most extended part of an impulse.

Short-term: We expect the initial breakout to continue, finish forming Wave v of (1).

Mid-term: Initial price targets for the completion of the entire Wave ⑤ sequence point towards the $520 - $560 zone, which aligns with the 1.618 - 1.886 Fibonacci extension levels of the preceding impulse.

Invalidation: This bullish outlook remains valid as long as the price stays above the low of Wave (2) of ⑤, established at the end of the triangle around the $310 level. A break below this point would invalidate this specific count.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.