Chart Interpretation (Index Futures / Equity Index)

TECHNICAL ANALYSIS

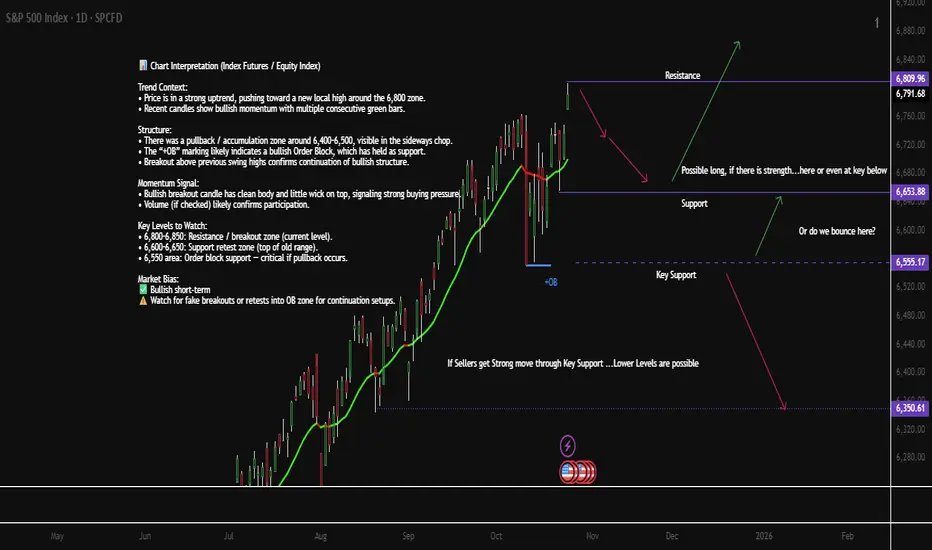

Trend Context:

• Price is in a strong uptrend, pushing toward a new local high around the 6,800 zone.

• Recent candles show bullish momentum with multiple consecutive green bars.

Structure:

• There was a pullback / accumulation zone around 6,400–6,500, visible in the sideways chop.

• The “+OB” marking likely indicates a bullish Order Block, which has held as support.

• Breakout above previous swing highs confirms continuation of bullish structure.

Momentum Signal:

• Bullish breakout candle has clean body and little wick on top, signaling strong buying pressure.

• Volume (if checked) likely confirms participation.

Key Levels to Watch:

• 6,800–6,850: Resistance / breakout zone (current level).

• 6,600–6,650: Support retest zone (top of old range).

• 6,450 area: Order block support — critical if pullback occurs.

Market Bias: Bullish short-term

Watch for fake breakouts or retests into OB zone for continuation setups.

FUNDEMENTAL ANALYSIS

U.S. Market Key Events — Week of Oct 27–31

Mon Oct 27

• 4:00 AM — 🇪🇺 German IFO Business Climate (watch EUR tone early session)

Tue Oct 28

• 9:00 AM — 🇺🇸 Richmond Manufacturing Index

• Tentative — 🇺🇸 CB Consumer Confidence

Wed Oct 29

• 9:00 AM — 🇺🇸 Pending Home Sales m/m

• 1:00 PM — 🇺🇸 Federal Funds Rate Decision (FOMC)

• 1:30 PM — 🇺🇸 FOMC Press Conference (high impact)

Thu Oct 30

• Tentative — 🇺🇸 Advance GDP q/q

• Tentative — 🇺🇸 Advance GDP Price Index

U.S.–China Trade Talks (market sensitivity risk)

Fri Oct 31

• Tentative — 🇺🇸 Core PCE Price Index m/m

• Tentative — 🇺🇸 Employment Cost Index q/q

📝 Focus on FOMC (Wed), GDP & Trade Talks (Thu), Core PCE (Fri) — high impact sessions for S&P / Dow / USD.

TECHNICAL ANALYSIS

Trend Context:

• Price is in a strong uptrend, pushing toward a new local high around the 6,800 zone.

• Recent candles show bullish momentum with multiple consecutive green bars.

Structure:

• There was a pullback / accumulation zone around 6,400–6,500, visible in the sideways chop.

• The “+OB” marking likely indicates a bullish Order Block, which has held as support.

• Breakout above previous swing highs confirms continuation of bullish structure.

Momentum Signal:

• Bullish breakout candle has clean body and little wick on top, signaling strong buying pressure.

• Volume (if checked) likely confirms participation.

Key Levels to Watch:

• 6,800–6,850: Resistance / breakout zone (current level).

• 6,600–6,650: Support retest zone (top of old range).

• 6,450 area: Order block support — critical if pullback occurs.

Market Bias: Bullish short-term

Watch for fake breakouts or retests into OB zone for continuation setups.

FUNDEMENTAL ANALYSIS

U.S. Market Key Events — Week of Oct 27–31

Mon Oct 27

• 4:00 AM — 🇪🇺 German IFO Business Climate (watch EUR tone early session)

Tue Oct 28

• 9:00 AM — 🇺🇸 Richmond Manufacturing Index

• Tentative — 🇺🇸 CB Consumer Confidence

Wed Oct 29

• 9:00 AM — 🇺🇸 Pending Home Sales m/m

• 1:00 PM — 🇺🇸 Federal Funds Rate Decision (FOMC)

• 1:30 PM — 🇺🇸 FOMC Press Conference (high impact)

Thu Oct 30

• Tentative — 🇺🇸 Advance GDP q/q

• Tentative — 🇺🇸 Advance GDP Price Index

U.S.–China Trade Talks (market sensitivity risk)

Fri Oct 31

• Tentative — 🇺🇸 Core PCE Price Index m/m

• Tentative — 🇺🇸 Employment Cost Index q/q

📝 Focus on FOMC (Wed), GDP & Trade Talks (Thu), Core PCE (Fri) — high impact sessions for S&P / Dow / USD.

Operación activa

Free Signals Telegram t.me/+8lsEDuKCVPc4YzFhExención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.