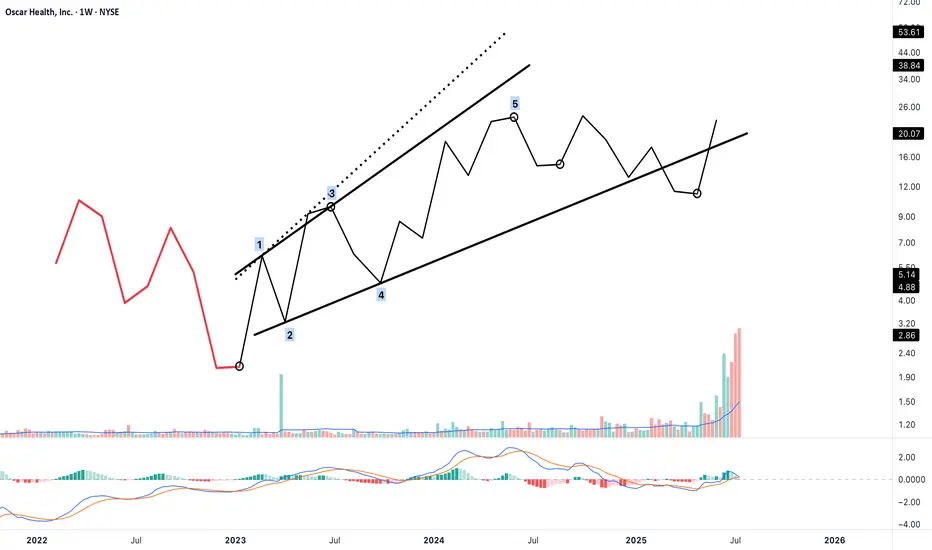

This chart presents a potential 5-wave terminal impulse structure — most likely a 5-extension terminal, where waves 1, 3, and 5 display impulsive character.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formation"

🔹 The wave is segmented using 12-bar intervals on a weekly chart.

🔹 Wave 3 and Wave 5 both meet the price extension and structural criteria of Neely’s Rule 4.

🔹 The final wave (5) reaches just above 141.4% of Wave 3, consistent with a 5-extension terminal.

🔹 Channel boundaries and post-terminal retracement suggest a completed structure.

According to NeoWave guidelines, the structure meets both:

Impulsive appearance, and

Overlap conditions required for a terminal.

The current focus shifts to analysing the post-terminal movement to determine whether it is part of a:

"2nd wave correction (if terminal was Wave 1)"

"or B wave retracement (if terminal was Wave A)"

🔍 Further bar-by-bar and structural analysis will be applied to this segment next, likely starting from m10 and beyond.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formation"

🔹 The wave is segmented using 12-bar intervals on a weekly chart.

🔹 Wave 3 and Wave 5 both meet the price extension and structural criteria of Neely’s Rule 4.

🔹 The final wave (5) reaches just above 141.4% of Wave 3, consistent with a 5-extension terminal.

🔹 Channel boundaries and post-terminal retracement suggest a completed structure.

According to NeoWave guidelines, the structure meets both:

Impulsive appearance, and

Overlap conditions required for a terminal.

The current focus shifts to analysing the post-terminal movement to determine whether it is part of a:

"2nd wave correction (if terminal was Wave 1)"

"or B wave retracement (if terminal was Wave A)"

🔍 Further bar-by-bar and structural analysis will be applied to this segment next, likely starting from m10 and beyond.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.