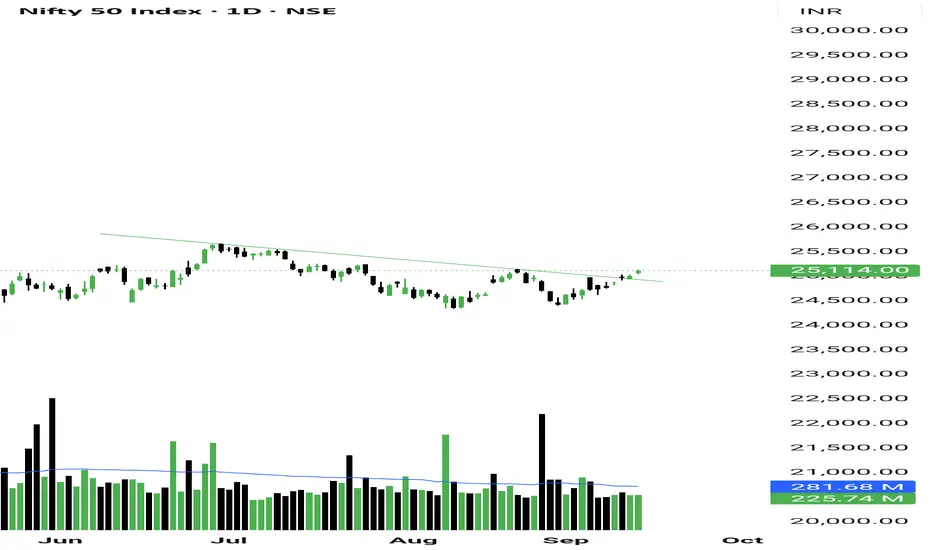

As we anticipated on Friday,  NIFTY broke the 25100 resistance and also gave a close above it.

NIFTY broke the 25100 resistance and also gave a close above it.

This clearly shows that strength has come back into the index and the market is getting ready for a sharp bull run in the coming days.

Let’s see what Nifty data indicates for Monday:

1. Nifty Pivot up – 25097

2. Retail index up

3. Momentum up

4. Volume – Negative (-9.5 million)

5. Market breadth – Positive

6. Close above resistance

7. Trend up

8. Momentum up

So, 7 points are positive and only 1 is negative. But volume is a big indicator, so its negativity matters. On top of that, weekly volume also shows sellers’ volume is 18 million higher than buyers.

Therefore, the view for tomorrow = bullish with a pullback.

Meaning, if sellers’ volume reflects tomorrow, we will buy at support which is at 24980.

But if 25155 breaks, then a sharp move till 25250 can come because PP is at 0.07%.

Overall, tomorrow’s move will set the direction for the coming week.

For next week, the financial sector will remain in trend and by Tuesday the telecom sector is also likely to join the rally.

📊 Levels at a glance:

Nifty Pivot: 25097

Support: 24980

Resistance: 25155

Target: 25250+

Pivot Percentile: 0.07% (sharp move hint)

Bias: Bullish with pullback probability

Sectors on radar: CNXFINANCE , Telecom

CNXFINANCE , Telecom

That’s all for today. Take care and have a profitable tomorrow.

This clearly shows that strength has come back into the index and the market is getting ready for a sharp bull run in the coming days.

Let’s see what Nifty data indicates for Monday:

1. Nifty Pivot up – 25097

2. Retail index up

3. Momentum up

4. Volume – Negative (-9.5 million)

5. Market breadth – Positive

6. Close above resistance

7. Trend up

8. Momentum up

So, 7 points are positive and only 1 is negative. But volume is a big indicator, so its negativity matters. On top of that, weekly volume also shows sellers’ volume is 18 million higher than buyers.

Therefore, the view for tomorrow = bullish with a pullback.

Meaning, if sellers’ volume reflects tomorrow, we will buy at support which is at 24980.

But if 25155 breaks, then a sharp move till 25250 can come because PP is at 0.07%.

Overall, tomorrow’s move will set the direction for the coming week.

For next week, the financial sector will remain in trend and by Tuesday the telecom sector is also likely to join the rally.

📊 Levels at a glance:

Nifty Pivot: 25097

Support: 24980

Resistance: 25155

Target: 25250+

Pivot Percentile: 0.07% (sharp move hint)

Bias: Bullish with pullback probability

Sectors on radar:

That’s all for today. Take care and have a profitable tomorrow.

TrendX INC

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

TrendX INC

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.