NIFTY TRADING PLAN – 13-Oct-2025

📊 Chart Timeframe: 15-Minutes

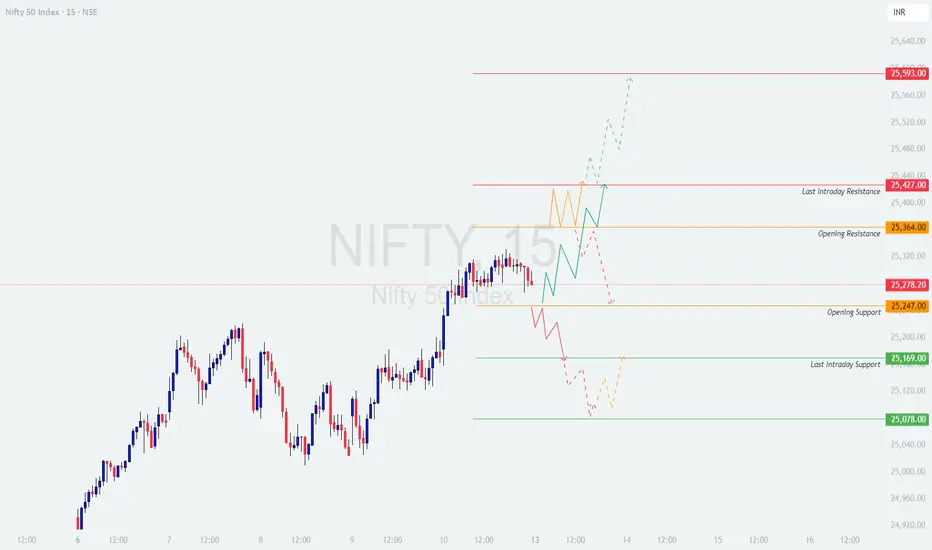

📍 Last Close: 25,278.20 | 🔽 -6.00 pts (-0.02%)

📅 Analysis Type: Psychological + Technical Levels-Based

🔍 Key Technical Levels to Watch

🟥 Last Intraday Resistance: 25,427

🟧 Opening Resistance: 25,364

🟠 Opening Support: 25,247

🟩 Last Intraday Support: 25,169

🟢 Major Support Zone: 25,078

🚀 Scenario 1 – Gap Up Opening (100+ pts above 25,380)

If Nifty opens above 25,380, it will enter a near-resistance zone between 25,364 – 25,427, making the early session crucial for direction confirmation.

💡 Educational Insight:

Gap-up openings near resistance zones often invite emotional buying. Wait for the market to confirm strength through structure — not just price. Watch volume and candle behavior closely before acting.

⚖️ Scenario 2 – Flat Opening (Around 25,250 ± 50 pts)

A flat opening around the previous close keeps Nifty within the decision zone between 25,247 – 25,364.

🧠 Educational Tip:

Flat openings give the best opportunity to follow structure-based breakouts. Don’t predict — let price action dictate direction. Wait for a clear breakout above 25,364 or breakdown below 25,169 for a decisive trade setup.

📉 Scenario 3 – Gap Down Opening (100+ pts below 25,180)

If Nifty opens below 25,180, sentiment will lean negative, but watch how it reacts near the 25,078 major support zone.

💬 Educational Note:

Gap-down openings near major support often create traps. Let confirmation come through a strong close — don’t rely solely on the first few minutes of panic or excitement.

🛡️ Risk Management Tips for Options Traders

📊 Summary & Conclusion

🎯 Focus Zones for 13-Oct-2025:

🟩 Buyers’ Zone: 25,169 → 25,078

🟥 Sellers’ Zone: 25,364 → 25,427

📢 Disclaimer:

I am not a SEBI-registered analyst. This analysis is meant purely for educational and informational purposes. Traders are advised to perform their own research or consult a certified financial advisor before making trading decisions.

📊 Chart Timeframe: 15-Minutes

📍 Last Close: 25,278.20 | 🔽 -6.00 pts (-0.02%)

📅 Analysis Type: Psychological + Technical Levels-Based

🔍 Key Technical Levels to Watch

🟥 Last Intraday Resistance: 25,427

🟧 Opening Resistance: 25,364

🟠 Opening Support: 25,247

🟩 Last Intraday Support: 25,169

🟢 Major Support Zone: 25,078

🚀 Scenario 1 – Gap Up Opening (100+ pts above 25,380)

If Nifty opens above 25,380, it will enter a near-resistance zone between 25,364 – 25,427, making the early session crucial for direction confirmation.

- []In case the index sustains above 25,427 for 15–30 minutes with supportive volume, it could trigger a momentum rally toward 25,520–25,593 levels.

[]Avoid aggressive long entries immediately at open — instead, wait for a controlled pullback or retest near 25,364–25,400, which can offer a low-risk long entry zone.

[]If rejection candles appear near 25,427, it may indicate short-term profit booking. In that case, downside retracement toward 25,247 can occur.

[]A sustained failure to hold above 25,364 post-gap-up could turn the session choppy, so trade with confirmation.]

💡 Educational Insight:

Gap-up openings near resistance zones often invite emotional buying. Wait for the market to confirm strength through structure — not just price. Watch volume and candle behavior closely before acting.

⚖️ Scenario 2 – Flat Opening (Around 25,250 ± 50 pts)

A flat opening around the previous close keeps Nifty within the decision zone between 25,247 – 25,364.

- []If Nifty sustains above 25,364, bulls may regain control with upside potential toward 25,427 and then 25,593.

[]Failure to hold above 25,247 can trigger mild profit booking, dragging prices toward 25,169 — the last intraday support.

[]A bounce from 25,169 can act as a low-risk buy setup with strict stop loss below 25,078.

[]If a 15-min candle closes below 25,078, it confirms short-term weakness; sellers can then aim for 25,000–24,950 zones.]

🧠 Educational Tip:

Flat openings give the best opportunity to follow structure-based breakouts. Don’t predict — let price action dictate direction. Wait for a clear breakout above 25,364 or breakdown below 25,169 for a decisive trade setup.

📉 Scenario 3 – Gap Down Opening (100+ pts below 25,180)

If Nifty opens below 25,180, sentiment will lean negative, but watch how it reacts near the 25,078 major support zone.

- []A bounce from 25,078 can offer a relief rally toward 25,169–25,247, especially if short covering kicks in.

[]However, a breakdown and 15-min close below 25,078 may extend weakness toward 24,950–24,900.

[]Avoid chasing shorts aggressively at open — instead, wait for a pullback toward resistance near 25,169–25,200 to re-enter with better risk-reward.

[]The key here is patience — let the initial volatility settle before entering positions.]

💬 Educational Note:

Gap-down openings near major support often create traps. Let confirmation come through a strong close — don’t rely solely on the first few minutes of panic or excitement.

🛡️ Risk Management Tips for Options Traders

- []Limit your risk to 2%–3% of total trading capital per trade.

[]Use 15-min or hourly candle close to confirm breakouts and stop losses.

[]Trade ATM or slightly ITM options to minimize time decay.

[]Avoid over-leveraging during high-volatility gap openings.

[]Consider using spreads (Bull Call / Bear Put) to hedge against rapid time decay.

[]Book partial profits once your trade achieves a 1:1 risk/reward to protect gains. - Avoid holding options beyond 2:45 PM, as theta decay intensifies in the final hour. ⏳]

📊 Summary & Conclusion

- []Nifty continues to hover in a tight consolidation range, with key resistance at 25,427 and support at 25,078.

[]A breakout above 25,427 can trigger fresh bullish momentum toward 25,593, while a breakdown below 25,078 may open the path for 24,950.

[]Patience, disciplined execution, and confirmation-based entries are essential — avoid emotional trading during gap openings.

[]Remember: The best trades are those backed by both structure and timing, not prediction.]

🎯 Focus Zones for 13-Oct-2025:

🟩 Buyers’ Zone: 25,169 → 25,078

🟥 Sellers’ Zone: 25,364 → 25,427

📢 Disclaimer:

I am not a SEBI-registered analyst. This analysis is meant purely for educational and informational purposes. Traders are advised to perform their own research or consult a certified financial advisor before making trading decisions.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.