🔹 Intro / Overview

Managing a position after entry is just as important as identifying the entry itself.

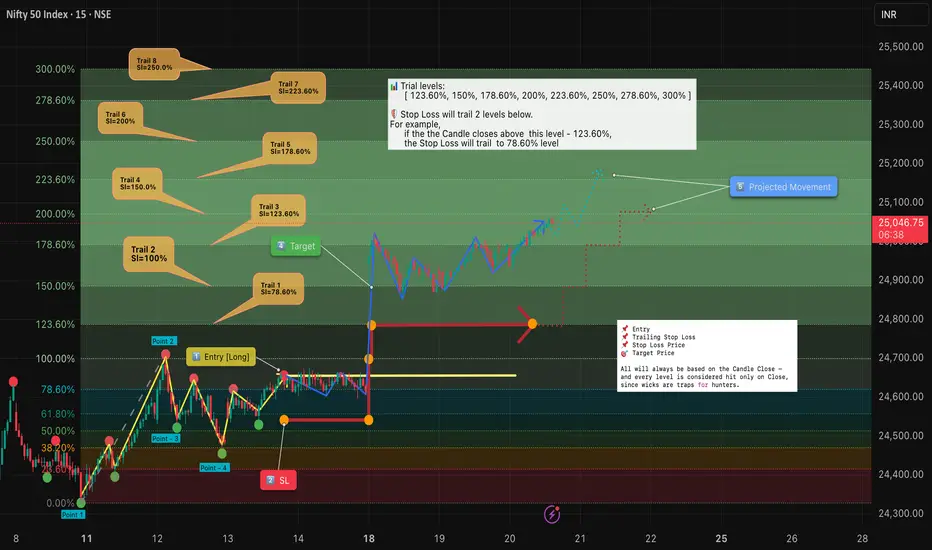

Here, we are specifically discussing trailing stops using Fibonacci retracements.

A well-structured trailing stop helps traders:

✅ Lock in profits

🛡️ Reduce risk

📊 Stay objective in the face of market noise

This idea shows how trailing stops can be applied in a structured way to complement Fibonacci retracements and trend management.

📖 Concept

📍 A trailing stop is a dynamic stop-loss that adjusts as price moves in your favor.

🔄 Instead of staying fixed, it “trails” price at a chosen distance — capturing more upside while capping downside.

🧩 Traders often trail stops using swing lows/highs, moving averages, or volatility measures like ATR.

📊 Chart Explanation (Step-by-Step)

1️⃣ Entry Criteria

✅ Successive closes above 78.6% confirm the long entry.

2️⃣ Stop Loss (SL)

📉 Placed at the previous swing low for structure-based protection.

⏩ SL adjustments move forward only with trailing rules — never backward.

3️⃣ Trailing Levels

👉 SL always trails two levels below the current trail level if the candle closes above it.

📈 Trail 1: 123.60% → SL moves to 78.60%

📈 Trail 2: 150.00% → SL moves to 100.00%

📈 Trail 3: 178.60% → SL moves to 123.60%

📈 Trail 4: 200.00% → SL moves to 150.00%

📈 Trail 5: 223.60% → SL moves to 178.60%

📈 Trail 6: 250.00% → SL moves to 200.00%

📈 Trail 7: 278.60% → SL moves to 223.60%

📈 Trail 8: 300.00% → SL moves to 250.00%

4️⃣ Target Points

🎯 At Target 1, book one lot to secure profits.

📊 Remaining positions can be trailed further with the next levels.

5️⃣ Projected Path

🔍 Dotted blue/red projections illustrate potential movement under this trailing system.

🔍 Observations

📌 Objective Entry: Requires successive closes above 78.6%, reducing false signals.

🎯 Partial Profit Booking: Taking one lot off at Target 1 ensures realized gains.

🔄 Two-Level Trailing: Locks in profits while leaving room for trend continuation.

📊 Rule-Based Framework: Clear Fibonacci-based progression keeps decisions mechanical and consistent.

✨ Why It Matters

✔ Prevents turning winning trades into losers.

✔ Builds confidence by removing emotions from exit decisions.

✔ Lets profits run while maintaining protection.

✅ Conclusion

Trailing stops are not about perfection — they’re about discipline.

By systematically adjusting stops as the market moves, traders:

🛡️ Protect capital

🚀 Let profits run

🤝 Remove emotions from decision-making

When combined with Fibonacci retracements, trailing stops provide a structured framework to manage trades effectively after entry.

⚠️ Disclaimer: For educational purposes only · Not SEBI registered · Not a buy/sell recommendation · No investment advice — purely a learning resource

Managing a position after entry is just as important as identifying the entry itself.

Here, we are specifically discussing trailing stops using Fibonacci retracements.

A well-structured trailing stop helps traders:

✅ Lock in profits

🛡️ Reduce risk

📊 Stay objective in the face of market noise

This idea shows how trailing stops can be applied in a structured way to complement Fibonacci retracements and trend management.

📖 Concept

📍 A trailing stop is a dynamic stop-loss that adjusts as price moves in your favor.

🔄 Instead of staying fixed, it “trails” price at a chosen distance — capturing more upside while capping downside.

🧩 Traders often trail stops using swing lows/highs, moving averages, or volatility measures like ATR.

📊 Chart Explanation (Step-by-Step)

1️⃣ Entry Criteria

✅ Successive closes above 78.6% confirm the long entry.

2️⃣ Stop Loss (SL)

📉 Placed at the previous swing low for structure-based protection.

⏩ SL adjustments move forward only with trailing rules — never backward.

3️⃣ Trailing Levels

👉 SL always trails two levels below the current trail level if the candle closes above it.

📈 Trail 1: 123.60% → SL moves to 78.60%

📈 Trail 2: 150.00% → SL moves to 100.00%

📈 Trail 3: 178.60% → SL moves to 123.60%

📈 Trail 4: 200.00% → SL moves to 150.00%

📈 Trail 5: 223.60% → SL moves to 178.60%

📈 Trail 6: 250.00% → SL moves to 200.00%

📈 Trail 7: 278.60% → SL moves to 223.60%

📈 Trail 8: 300.00% → SL moves to 250.00%

4️⃣ Target Points

🎯 At Target 1, book one lot to secure profits.

📊 Remaining positions can be trailed further with the next levels.

5️⃣ Projected Path

🔍 Dotted blue/red projections illustrate potential movement under this trailing system.

🔍 Observations

📌 Objective Entry: Requires successive closes above 78.6%, reducing false signals.

🎯 Partial Profit Booking: Taking one lot off at Target 1 ensures realized gains.

🔄 Two-Level Trailing: Locks in profits while leaving room for trend continuation.

📊 Rule-Based Framework: Clear Fibonacci-based progression keeps decisions mechanical and consistent.

✨ Why It Matters

✔ Prevents turning winning trades into losers.

✔ Builds confidence by removing emotions from exit decisions.

✔ Lets profits run while maintaining protection.

✅ Conclusion

Trailing stops are not about perfection — they’re about discipline.

By systematically adjusting stops as the market moves, traders:

🛡️ Protect capital

🚀 Let profits run

🤝 Remove emotions from decision-making

When combined with Fibonacci retracements, trailing stops provide a structured framework to manage trades effectively after entry.

⚠️ Disclaimer: For educational purposes only · Not SEBI registered · Not a buy/sell recommendation · No investment advice — purely a learning resource

Nota

Update (22 Aug): After price reached the 200% Fibonacci extension, the trend shifted to bearish on closing below the 150% level. This highlights how the Fibonacci levels have worked so far for projection and trailing-stop purposes.

We now wait for a proper bearish confirmation before applying bearish Fibonacci zones.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.