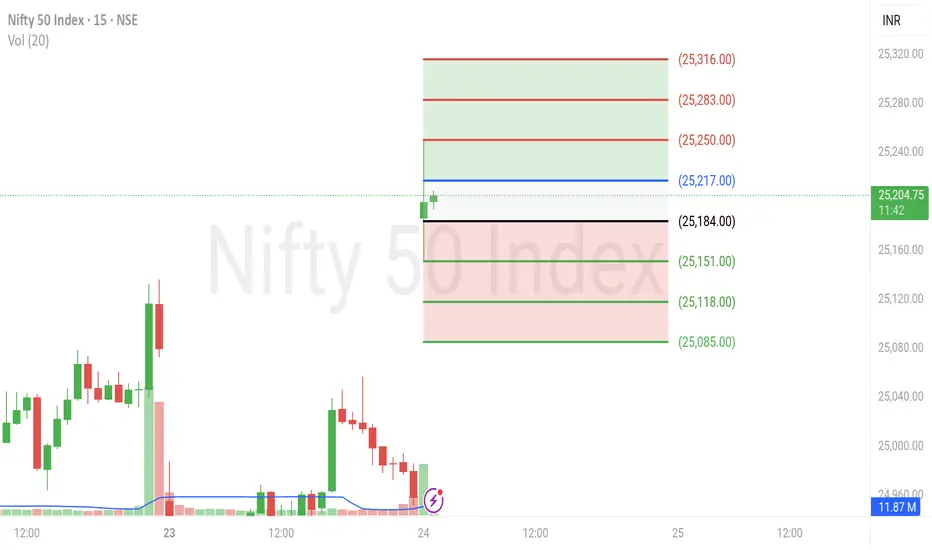

According to the price action observed at session start ,NIFTY is currently consolidating between the resistance at 25,217 and the support at 25,184 . The structure suggests price is coiling, and a decisive move beyond either level could trigger a directional breakout.

• Key Levels:

Resistance: 25,217

Support: 25,184

• Breakout Scenario:

If price breaks and sustains above 25,217 :

TP1 (1:1): 25,250

TP2 (1:2): 25,283

TP3 (1:3): 25,316

• Breakdown Scenario:

If price breaks and sustains below 25,184 :

TP1 (1:1): 25,151

TP2 (1:2): 25,118

TP3 (1:3): 25,085

"Stay neutral, stay ready. Let the chart pick the direction."

Information and analysis provided is for educational purposes only.

Operación activa

📊 NIFTY 50 – Intraday Summary | 24 June 2025[img]

Pre-Market Key Levels:

Resistance: 25,217

Support: 25,184

---

🔍 Price Action Insight:

At the session’s open, NIFTY exhibited a tight consolidation between the predefined resistance and support zones. This created an ideal setup for a breakout or breakdown scenario.

📈 Breakout Scenario:

Price broke above 25,217 multiple times during the session.

Achieved all three upside targets:

✅ TP1: 25,250

✅ TP2: 25,283

✅ TP3: 25,316

📉 Breakdown Scenario:

A clear breakdown occurred below 25,184, triggering a strong downside move.

All three downside targets were achieved:

✅ TP1: 25,151

✅ TP2: 25,118

✅ TP3: 25,085

---

📌 Session Close Observation:

Despite multiple bullish breakouts, NIFTY closed negatively.

The day showcased high intraday volatility, allowing opportunities in both directions.

---

🧠 Key Takeaway:

A textbook two-sided day for intraday traders—both breakout and breakdown targets were hit, offering several profitable trades. A strong reminder to remain unbiased and let price dictate the trade.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.