NIFTY TRADING PLAN – 06-Oct-2025

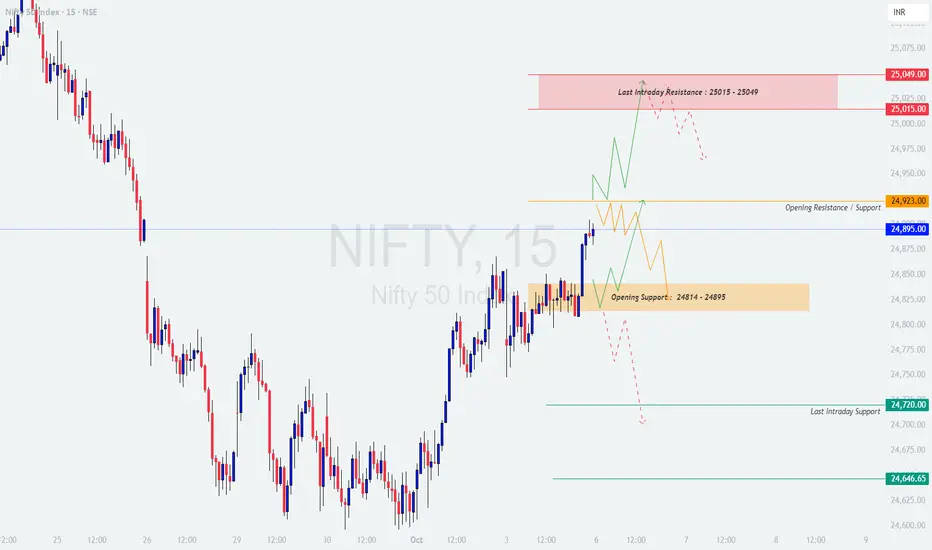

Nifty closed at 24,895, showing strong recovery momentum but still trading near crucial resistance and support levels. Tomorrow’s opening and follow-up price action will be key in determining short-term direction.

📌 Key Levels to Watch:

Opening Support Zone: 24,814 – 24,895

Opening Resistance / Support: 24,923

Last Intraday Resistance: 25,015 – 25,049

Last Intraday Support: 24,720 & 24,646

🚀 Scenario 1: Gap Up Opening (100+ points)

👉 Educational Note: Gap-ups near resistance zones often trap late buyers. Always wait for a retest before committing to a trade.

⚖️ Scenario 2: Flat Opening (within ±100 points)

👉 Educational Note: Flat openings usually create range-bound trades early in the session. Focus on range breakouts to avoid getting chopped in sideways action.

📉 Scenario 3: Gap Down Opening (100+ points)

👉 Educational Note: Gap-downs often trigger panic selling, but they can also present excellent reversal opportunities if support holds firmly.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

📊 Nifty is currently at a decision-making level. Breakout above resistance can extend bullish momentum, while breakdown below support may invite selling pressure. The best approach is to stay patient, follow confirmation signals, and manage risk with discipline.

⚠️ Disclaimer: This analysis is purely for educational purposes. I am not a SEBI-registered analyst. Please do your own research or consult with a financial advisor before making trading decisions.

Nifty closed at 24,895, showing strong recovery momentum but still trading near crucial resistance and support levels. Tomorrow’s opening and follow-up price action will be key in determining short-term direction.

📌 Key Levels to Watch:

Opening Support Zone: 24,814 – 24,895

Opening Resistance / Support: 24,923

Last Intraday Resistance: 25,015 – 25,049

Last Intraday Support: 24,720 & 24,646

🚀 Scenario 1: Gap Up Opening (100+ points)

- [] If Nifty opens above 25,000, it will be very close to Last Intraday Resistance (25,015 – 25,049).

[] Sustained price action above 25,049 could trigger further momentum towards 25,100 – 25,150 levels.

[] However, if rejection occurs around resistance, expect profit booking back towards 24,950 – 24,923.

[] Traders should avoid chasing the gap-up and instead look for either a breakout confirmation or rejection signals to enter.

👉 Educational Note: Gap-ups near resistance zones often trap late buyers. Always wait for a retest before committing to a trade.

⚖️ Scenario 2: Flat Opening (within ±100 points)

- [] A flat start near 24,850 – 24,900 will keep Nifty inside the Opening Support Zone (24,814 – 24,895) and just below 24,923 Resistance.

[] A breakout above 24,923 can fuel a rally towards 25,015 – 25,049, with further extension possible if momentum is strong.

[] On the downside, failure to hold above 24,814 may pull prices back to 24,720 or even 24,646.

[] Traders should adopt a wait-and-watch approach until the range between 24,814 – 24,923 is broken.

👉 Educational Note: Flat openings usually create range-bound trades early in the session. Focus on range breakouts to avoid getting chopped in sideways action.

📉 Scenario 3: Gap Down Opening (100+ points)

- [] If Nifty opens near or below 24,750 – 24,720, the Last Intraday Support (24,720) will be tested immediately.

[] A breakdown below 24,720 could extend weakness towards 24,646 – 24,600.

[] However, if support holds at 24,720 – 24,646, a sharp short-covering rally back towards 24,850 – 24,900 is possible.

[] Patience will be key – wait for confirmation whether support sustains or breaks before taking positions.

👉 Educational Note: Gap-downs often trigger panic selling, but they can also present excellent reversal opportunities if support holds firmly.

🛡️ Risk Management Tips for Options Traders

- [] ⏳ Avoid taking aggressive positions in the first 15–30 minutes; let volatility settle.

[] 🛑 Place stop losses based on 15-min or hourly candle closes, not just wicks.

[] 🎯 Use option spreads (Bull Call, Bear Put) to manage premium decay.

[] 📉 Always maintain at least a 1:2 Risk-Reward ratio.

[] 💰 Book partial profits at key levels to protect capital.

[] 🧘 Never risk more than 2–3% of capital on a single trade.

📌 Summary & Conclusion

- [] Bullish Bias: Above 24,923, targets 25,015 → 25,049 → 25,100+.

[] Neutral Zone: Between 24,814 – 24,923, expect consolidation. - Bearish Bias: Below 24,720, weakness towards 24,646 – 24,600.

📊 Nifty is currently at a decision-making level. Breakout above resistance can extend bullish momentum, while breakdown below support may invite selling pressure. The best approach is to stay patient, follow confirmation signals, and manage risk with discipline.

⚠️ Disclaimer: This analysis is purely for educational purposes. I am not a SEBI-registered analyst. Please do your own research or consult with a financial advisor before making trading decisions.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.