🔹 NIFTY Trading Plan for 05-Nov-2025

(Based on psychological correction theory & intraday structural behavior)

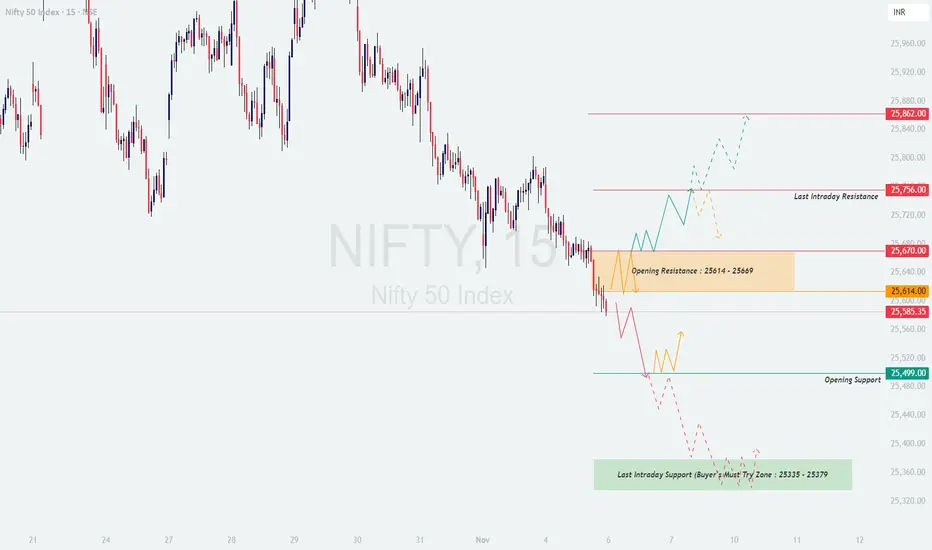

Chart Reference Levels:

🟧 Opening Resistance Zone: 25,614 – 25,669

🟥 Last Intraday Resistance: 25,756

🟩 Opening Support: 25,499

🟢 Last Intraday Support (Buyers’ Must-Try Zone): 25,335 – 25,379

❤️ Upside Extension: 25,862

🟢 Scenario 1: Gap-Up Opening (100+ points above previous close)

📘 Educational Note: Gap-up openings are often emotional reactions to overnight cues. Let the market confirm strength before chasing momentum. Look for stability above key resistance levels before taking directional calls.

🟠 Scenario 2: Flat Opening (±50 points around 25,585)

📘 Educational Note: Flat openings provide the cleanest opportunities for structured intraday setups. Patience during the first 30 minutes helps identify whether smart money is accumulating (bullish bias) or distributing (bearish bias).

🔴 Scenario 3: Gap-Down Opening (100+ points below previous close)

📘 Educational Note: Gap-downs often start with fear-driven selling. Smart traders wait for confirmation candles before entering, as the first impulse frequently fades when institutional players absorb liquidity at lower levels.

💡 Risk Management Tips for Options Traders

📊 Summary & Conclusion:

In summary, 05-Nov-2025 looks like a crucial reaction day — buyers must defend supports, while sellers may try to push the market lower. The best approach is to stay patient for the first half-hour, identify structure, and trade based on confirmation, not assumptions.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The analysis above is purely for educational and informational purposes. Traders are advised to do their own research or consult a certified financial advisor before making any trading decisions.

(Based on psychological correction theory & intraday structural behavior)

Chart Reference Levels:

🟧 Opening Resistance Zone: 25,614 – 25,669

🟥 Last Intraday Resistance: 25,756

🟩 Opening Support: 25,499

🟢 Last Intraday Support (Buyers’ Must-Try Zone): 25,335 – 25,379

❤️ Upside Extension: 25,862

🟢 Scenario 1: Gap-Up Opening (100+ points above previous close)

- [] If Nifty opens around or above 25,670, it will directly test the Opening Resistance Zone (25,614 – 25,669). Here, traders should observe how the market reacts — a rejection with long upper wicks or high volatility candles could indicate distribution.

[] For bullish continuation, Nifty must sustain above 25,669 with a decisive 15-min candle close. A breakout can invite fresh momentum, pushing the index toward 25,756 and possibly extending up to 25,862. - Failure to hold above 25,669 may trigger a quick pullback to 25,614 or even back to the Opening Support at 25,499, where intraday buyers might reattempt to defend.

📘 Educational Note: Gap-up openings are often emotional reactions to overnight cues. Let the market confirm strength before chasing momentum. Look for stability above key resistance levels before taking directional calls.

🟠 Scenario 2: Flat Opening (±50 points around 25,585)

- [] A flat open near the current zone (25,560–25,600) keeps Nifty in a balancing phase between bulls and bears. This range can act as a decision-making area for the day.

[] Sustained price action above 25,614 will likely attract buying interest, taking prices toward 25,669 – 25,756 levels. - On the downside, if Nifty slips below 25,499, selling pressure can intensify, dragging the index toward 25,379, which is the “Buyers’ Must-Try Zone.”

📘 Educational Note: Flat openings provide the cleanest opportunities for structured intraday setups. Patience during the first 30 minutes helps identify whether smart money is accumulating (bullish bias) or distributing (bearish bias).

🔴 Scenario 3: Gap-Down Opening (100+ points below previous close)

- [] A gap-down below 25,500 directly places the index near the Opening Support or Last Intraday Support zone (25,335 – 25,379).

[] Watch this area carefully — if buyers fail to defend, weakness can extend further. However, a strong reversal candle or volume divergence could trigger short-covering opportunities. - Recovery back above 25,499 would indicate that buyers are attempting to regain control. In that case, a bounce toward 25,614 may unfold, where traders can re-evaluate the next move.

📘 Educational Note: Gap-downs often start with fear-driven selling. Smart traders wait for confirmation candles before entering, as the first impulse frequently fades when institutional players absorb liquidity at lower levels.

💡 Risk Management Tips for Options Traders

- [] Define your maximum risk per trade (1–2% of capital) before entry.

[] Use hourly candle close-based stop losses to avoid false triggers from volatility spikes.

[] Avoid buying far OTM options post 11:00 AM; time decay accelerates rapidly.

[] If volatility (IV) is elevated, consider vertical spreads instead of naked calls or puts. - Always plan both entry and exit before executing — emotions should not decide your stop loss.

📊 Summary & Conclusion:

- [] Above 25,669 → Bullish momentum possible toward 25,756 – 25,862.

[] Between 25,499 – 25,614 → Neutral consolidation; intraday reactions will decide direction. - Below 25,499 → Weakness likely toward 25,379 and 25,335 zones.

In summary, 05-Nov-2025 looks like a crucial reaction day — buyers must defend supports, while sellers may try to push the market lower. The best approach is to stay patient for the first half-hour, identify structure, and trade based on confirmation, not assumptions.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The analysis above is purely for educational and informational purposes. Traders are advised to do their own research or consult a certified financial advisor before making any trading decisions.

Operación cerrada: objetivo alcanzado

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.