💼 NIFTY TRADING PLAN – 10-Oct-2025

📊 Chart Timeframe: 15-min

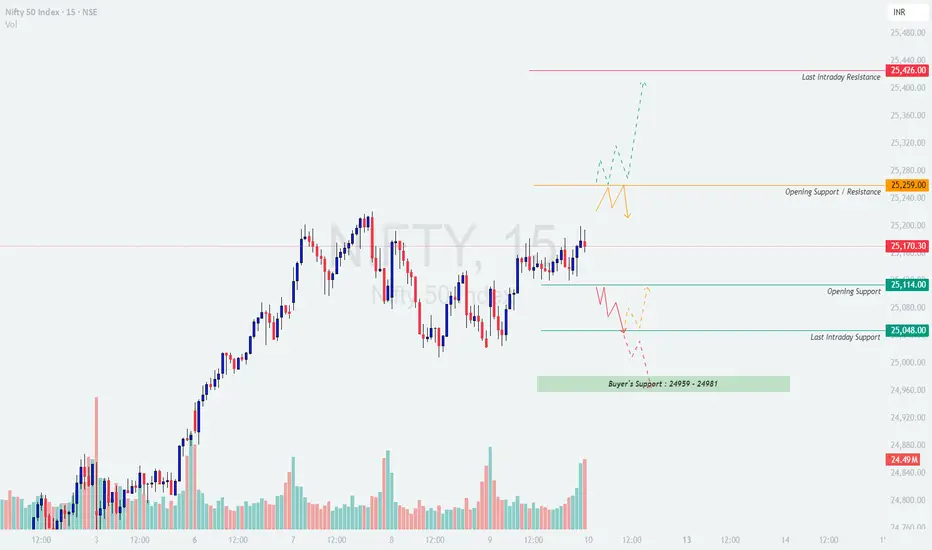

📍 Last Close: 25,170.30 | 🔻 Change: -7.40 pts (-0.03%)

📅 Analysis Based on Psychological & Technical Levels

🔍 Key Technical Zones

🟧 Opening Support / Resistance: 25,259

🟥 Last Intraday Resistance: 25,426

🟩 Opening Support: 25,114

🟢 Last Intraday Support: 25,048

💚 Buyer’s Support Zone: 24,959 – 24,981

🚀 Scenario 1 – Gap Up Opening (100+ pts above 25,270)

If Nifty opens near or above 25,270, it will directly approach the opening resistance zone.

🧠 Educational Insight:

Gap-up openings near resistance often create a “trap zone.” Patience is key — let the price test and confirm breakout strength before entering directional trades.

⚖️ Scenario 2 – Flat Opening (Around 25,150 ± 50 pts)

A flat start indicates market indecision and provides both long and short opportunities based on level reactions.

💡 Educational Note:

Flat openings favor disciplined traders who react to confirmation rather than prediction. Combining 15-min chart patterns with volume clues gives higher probability entries.

📉 Scenario 3 – Gap Down Opening (100+ pts below 25,060)

If Nifty opens around or below 25,060, it enters the support testing zone.

🧠 Educational Insight:

Gap-down openings can trigger emotional decisions — let the first 30 minutes unfold before entering trades. Reversal setups are only valid with clear rejection wicks or bullish engulfing candles near key supports.

🛡️ Risk Management Tips for Options Traders

📊 Summary & Conclusion

🎯 Focus Zone for 10-Oct-2025:

🟩 25,048 → 24,959 (Buyers’ Defensive Zone)

🟥 25,259 → 25,426 (Sellers’ Dominance Zone)

📢 Disclaimer:

I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Traders should perform their own due diligence or consult with a financial advisor before making trading decisions.

📊 Chart Timeframe: 15-min

📍 Last Close: 25,170.30 | 🔻 Change: -7.40 pts (-0.03%)

📅 Analysis Based on Psychological & Technical Levels

🔍 Key Technical Zones

🟧 Opening Support / Resistance: 25,259

🟥 Last Intraday Resistance: 25,426

🟩 Opening Support: 25,114

🟢 Last Intraday Support: 25,048

💚 Buyer’s Support Zone: 24,959 – 24,981

🚀 Scenario 1 – Gap Up Opening (100+ pts above 25,270)

If Nifty opens near or above 25,270, it will directly approach the opening resistance zone.

- []A sustained move above 25,259 with strong green candles could trigger momentum buying toward 25,426, which is the last intraday resistance.

[]Avoid chasing the first 15 minutes — wait for a minor pullback to 25,259–25,280 and look for support confirmation before going long.

[]If Nifty fails to sustain above 25,259, expect short-term profit booking that can drag prices toward 25,170 or even 25,114.

[]Fresh shorts should be avoided until there’s a confirmed reversal candle near 25,400–25,426, as this area may trigger volatility and fake breakouts.]

🧠 Educational Insight:

Gap-up openings near resistance often create a “trap zone.” Patience is key — let the price test and confirm breakout strength before entering directional trades.

⚖️ Scenario 2 – Flat Opening (Around 25,150 ± 50 pts)

A flat start indicates market indecision and provides both long and short opportunities based on level reactions.

- []If the index sustains above 25,170–25,200, buyers may attempt to push prices toward 25,259 → 25,426. Watch for volume expansion to confirm momentum.

[]If Nifty rejects 25,259, expect a dip toward 25,114–25,048, which will act as short-term intraday supports.

[]Buyers can look for reversal confirmation from 25,048–25,114 zone for potential bounce trades.

[]A decisive hourly close below 25,048 may shift intraday trend bearish toward 24,981–24,959 (Buyer’s Support Zone).]

💡 Educational Note:

Flat openings favor disciplined traders who react to confirmation rather than prediction. Combining 15-min chart patterns with volume clues gives higher probability entries.

📉 Scenario 3 – Gap Down Opening (100+ pts below 25,060)

If Nifty opens around or below 25,060, it enters the support testing zone.

- []Monitor early reactions near 25,048–25,020. A quick recovery from this area can lead to a short-covering rally back toward 25,114–25,170.

[]If the index sustains below 25,020, expect a gradual slide toward the Buyer’s Support Zone (24,959–24,981) — a critical area where bulls might attempt to defend.

[]Failure to hold 24,959 could invite further downside toward 24,880–24,840, so avoid catching a falling knife without confirmation.

[]Intraday traders should prefer trading only on sustained 15-min candle closes below key levels to avoid whipsaws.]

🧠 Educational Insight:

Gap-down openings can trigger emotional decisions — let the first 30 minutes unfold before entering trades. Reversal setups are only valid with clear rejection wicks or bullish engulfing candles near key supports.

🛡️ Risk Management Tips for Options Traders

- []Limit trade exposure to 2–3% of total capital per trade.

[]Always use a stop loss based on 15-min candle close to avoid fake breakouts.

[]Prefer ATM or slightly ITM options for better delta and reduced time decay.

[]Avoid holding losing positions after 2:45 PM, as premium decay accelerates.

[]When volatility rises, use spreads (Bull Call / Bear Put) to manage theta and vega risk.

[]Never average losing trades — protect capital before chasing profit. 💎

📊 Summary & Conclusion

- []Nifty remains in a neutral-to-bullish structure, as long as it sustains above 25,048.

[]Upside momentum may resume only above 25,259, targeting 25,426.

[]A breakdown below 25,048 could shift control to sellers, pulling prices toward 24,981–24,959.

[]Traders should watch 15-min closing confirmations and volume expansion before taking directional positions.]

🎯 Focus Zone for 10-Oct-2025:

🟩 25,048 → 24,959 (Buyers’ Defensive Zone)

🟥 25,259 → 25,426 (Sellers’ Dominance Zone)

📢 Disclaimer:

I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Traders should perform their own due diligence or consult with a financial advisor before making trading decisions.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.