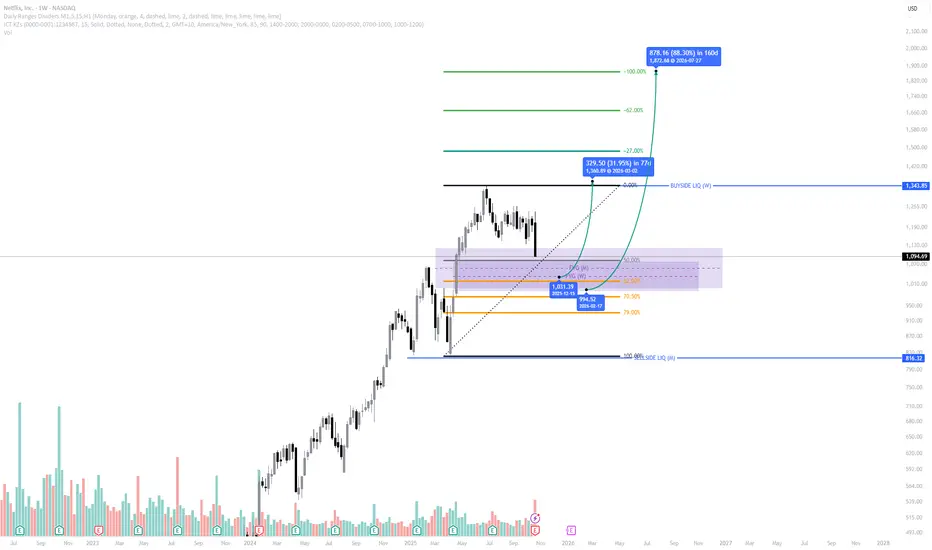

Netflix (NASDAQ: NFLX) is currently retracing into a high-probability multi-timeframe setup, aligning several ICT confluences that suggest a potential re-entry opportunity within a bullish continuation narrative.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and higher lows (HL). The recent decline represents a healthy retracement inside a developing higher-timeframe structure.

Fair Value Gap (FVG) Alignment:

The current pullback has driven price into an overlapping Monthly and Weekly FVG, an area of institutional interest where price has previously shown strong reactions.

This zone often serves as a re-accumulation region before expansion.

Optimal Trade Entry (OTE):

The FVG aligns directly within the 62%–79% Fibonacci retracement zone, known as the golden OTE zone.

This overlap of structural retracement and imbalance discount makes it a prime setup from a smart money perspective.

Liquidity & Target Zones:

- Discount Range: $944 – $1,033

- Primary Buyside Liquidity (BSL): $1,345

- Extended Target: $1,872 (100% expansion projection)

Each level aligns with liquidity pools and Fibonacci extension targets visible on higher timeframes.

Trade Bias:

Bullish, with focus on accumulation and confirmation within the OTE discount range.

A weekly bullish displacement or rejection candle within this zone would strengthen the case for long continuation plays.

Summary:

NFLX is presenting a multi-timeframe high-probability setup, where a clean retracement into an overlapping Monthly/Weekly FVG and OTE zone creates a strong case for re-entry.

If the discount zone holds, expect expansion toward buyside liquidity and potential continuation into 2026.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and higher lows (HL). The recent decline represents a healthy retracement inside a developing higher-timeframe structure.

Fair Value Gap (FVG) Alignment:

The current pullback has driven price into an overlapping Monthly and Weekly FVG, an area of institutional interest where price has previously shown strong reactions.

This zone often serves as a re-accumulation region before expansion.

Optimal Trade Entry (OTE):

The FVG aligns directly within the 62%–79% Fibonacci retracement zone, known as the golden OTE zone.

This overlap of structural retracement and imbalance discount makes it a prime setup from a smart money perspective.

Liquidity & Target Zones:

- Discount Range: $944 – $1,033

- Primary Buyside Liquidity (BSL): $1,345

- Extended Target: $1,872 (100% expansion projection)

Each level aligns with liquidity pools and Fibonacci extension targets visible on higher timeframes.

Trade Bias:

Bullish, with focus on accumulation and confirmation within the OTE discount range.

A weekly bullish displacement or rejection candle within this zone would strengthen the case for long continuation plays.

Summary:

NFLX is presenting a multi-timeframe high-probability setup, where a clean retracement into an overlapping Monthly/Weekly FVG and OTE zone creates a strong case for re-entry.

If the discount zone holds, expect expansion toward buyside liquidity and potential continuation into 2026.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.