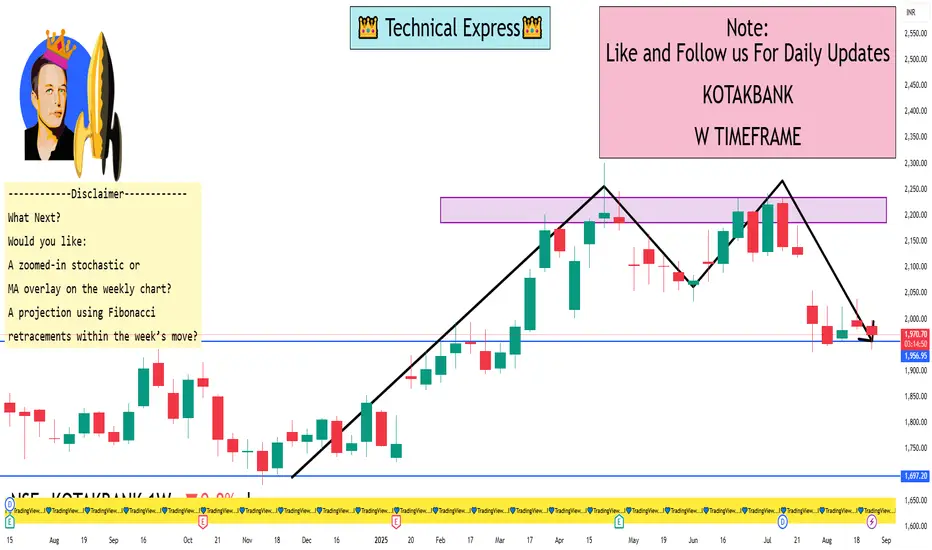

Weekly Technical Levels & Analysis

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.