Hello traders,

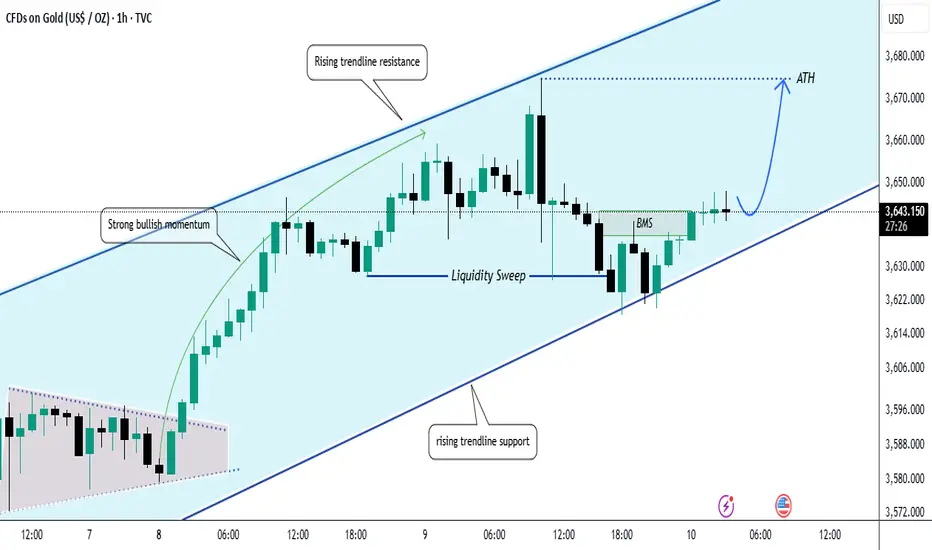

Gold recently dipped in a minor correction, retracing toward its rising trendline support, a level that has historically provided strong reactions. After a liquidity sweep below Monday’s low and a confirmed break in market structure, I see potential for another bullish leg developing from here.

My Trading Plan:

Why Fundamentals Support the Bulls:

Federal Reserve Outlook: Markets are pricing a 92% chance of a 25 bp rate cut in September, as weak job data and rising unemployment (4.3%) signal a slowing economy.

Inflation Risks: Even with slowing growth, “sticky” inflation, driven in part by tariffs, remains above the Fed’s target, keeping real yields pressured. This supports gold as an inflation hedge.

Political Pressure: Tensions around Fed independence, with political criticism of Chair Powell, are adding safe-haven demand.

Geopolitics: Escalations in the Middle East and Eastern Europe, plus central bank gold buying (especially from BRICS+), continue to underpin long-term bullish flows.

With both technical signals and macro forces aligned, gold’s case for another upside push looks solid.

What’s your take on this setup? Share your thoughts in the comments. If this idea adds value, please show your support with a boost.

Gold recently dipped in a minor correction, retracing toward its rising trendline support, a level that has historically provided strong reactions. After a liquidity sweep below Monday’s low and a confirmed break in market structure, I see potential for another bullish leg developing from here.

My Trading Plan:

- With a break in market structure already in play, I’ll be looking for longs in the 3640–3646 zone.

- First target: previous day’s high at 3635.67.

- On the bigger picture, I still expect Gold to test new record highs, so extending beyond yesterday’s high looks reasonable.

- Invalidation: a clean 1H candle close below 3620.

Why Fundamentals Support the Bulls:

Federal Reserve Outlook: Markets are pricing a 92% chance of a 25 bp rate cut in September, as weak job data and rising unemployment (4.3%) signal a slowing economy.

Inflation Risks: Even with slowing growth, “sticky” inflation, driven in part by tariffs, remains above the Fed’s target, keeping real yields pressured. This supports gold as an inflation hedge.

Political Pressure: Tensions around Fed independence, with political criticism of Chair Powell, are adding safe-haven demand.

Geopolitics: Escalations in the Middle East and Eastern Europe, plus central bank gold buying (especially from BRICS+), continue to underpin long-term bullish flows.

With both technical signals and macro forces aligned, gold’s case for another upside push looks solid.

What’s your take on this setup? Share your thoughts in the comments. If this idea adds value, please show your support with a boost.

🔥Free Telegram channel + Free Gold Signals👇

t.me/+a5tBJGKkGoNmZDY0

🔥Learn my trading strategy (Free). Click the Link👇

bit.ly/PXSTradingStrategy

t.me/+a5tBJGKkGoNmZDY0

🔥Learn my trading strategy (Free). Click the Link👇

bit.ly/PXSTradingStrategy

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

🔥Free Telegram channel + Free Gold Signals👇

t.me/+a5tBJGKkGoNmZDY0

🔥Learn my trading strategy (Free). Click the Link👇

bit.ly/PXSTradingStrategy

t.me/+a5tBJGKkGoNmZDY0

🔥Learn my trading strategy (Free). Click the Link👇

bit.ly/PXSTradingStrategy

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.