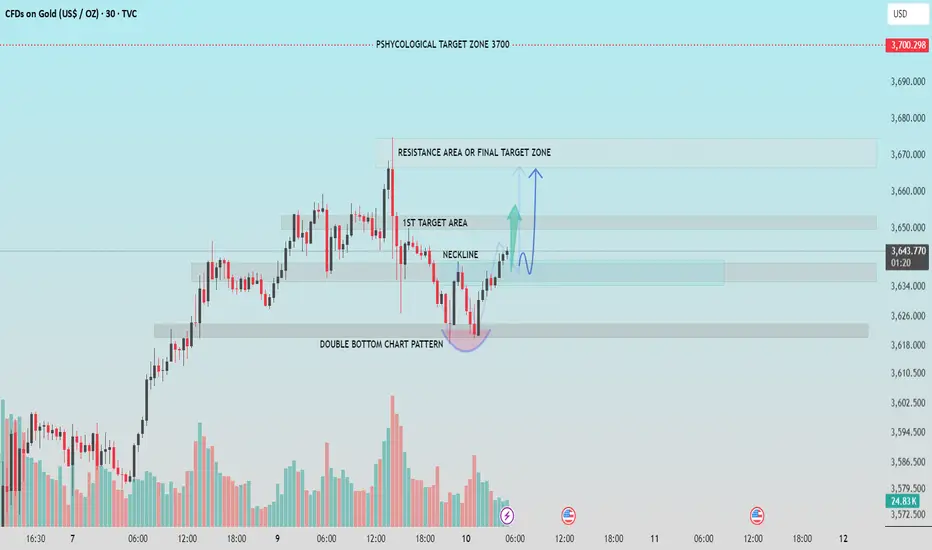

Gold (XAU/USD) Technical Analysis – 30-Minute Chart

The chart shows a clear Double Bottom chart pattern near the $3,618–$3,620 support zone, indicating potential bullish reversal. This is a classic bullish pattern, often signaling the end of a downtrend and beginning of an upward move.

▪️Neckline Breakout

The neckline of the double bottom has been successfully broken around the $3,638 level, confirming the pattern. Price has retested the neckline and is now attempting to move higher.

▪️Key Target Zones

1st Target Area: $3,648–$3,652

Price is approaching the first resistance zone, which may act as short-term resistance.

Final Target / Resistance Zone: $3,668–$3,675

A breakout above the first target may drive price toward the final resistance zone.

▪️Psychological Target Zone: $3,700

This remains a significant psychological level and long-term bullish target if momentum continues.

▪️Volume Analysis

Volume increased notably during the formation and breakout of the double bottom, adding strength to the bullish reversal signal.

▪️Outlook

As long as price holds above the neckline support (~$3,638), the bullish scenario remains valid with potential targets of $3,652 and $3,675. Failure to hold above the neckline may invalidate the pattern.

If this helpful for you, press the like button.

The chart shows a clear Double Bottom chart pattern near the $3,618–$3,620 support zone, indicating potential bullish reversal. This is a classic bullish pattern, often signaling the end of a downtrend and beginning of an upward move.

▪️Neckline Breakout

The neckline of the double bottom has been successfully broken around the $3,638 level, confirming the pattern. Price has retested the neckline and is now attempting to move higher.

▪️Key Target Zones

1st Target Area: $3,648–$3,652

Price is approaching the first resistance zone, which may act as short-term resistance.

Final Target / Resistance Zone: $3,668–$3,675

A breakout above the first target may drive price toward the final resistance zone.

▪️Psychological Target Zone: $3,700

This remains a significant psychological level and long-term bullish target if momentum continues.

▪️Volume Analysis

Volume increased notably during the formation and breakout of the double bottom, adding strength to the bullish reversal signal.

▪️Outlook

As long as price holds above the neckline support (~$3,638), the bullish scenario remains valid with potential targets of $3,652 and $3,675. Failure to hold above the neckline may invalidate the pattern.

If this helpful for you, press the like button.

Operación activa

from 3640, after breakout & retest of double bottom .Nota

1st target achieved,Nota

the one more layer was added from 3616, with sl 3610 & it's going 400 pips+ .Operación cerrada: objetivo alcanzado

💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.