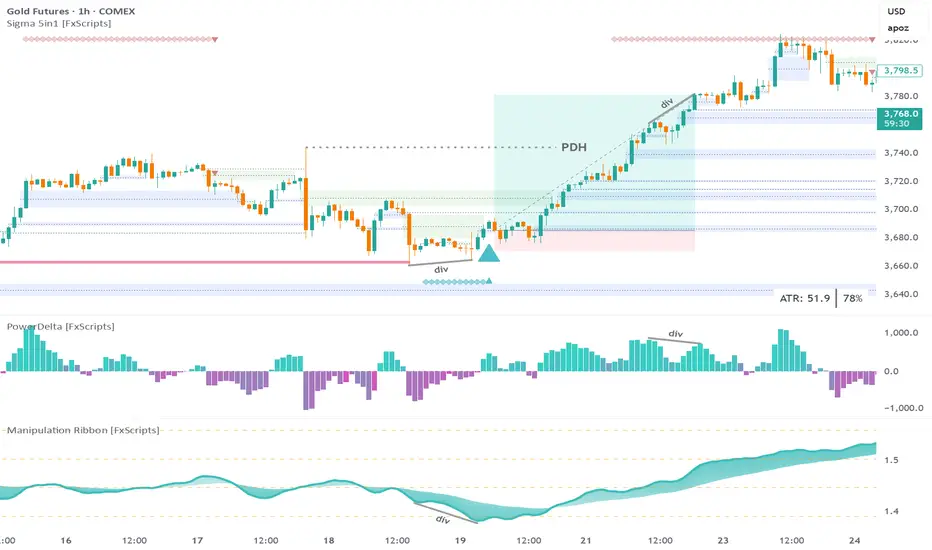

Step 1: wait for a sweep of daily liquidity

Note: the sweep must be confirmed for any of the other confluences to be valid

Step 2: wait for a bullish marker to be drawn by the Reversal Print indicator

Tip: set an alert if you don’t want to spend all day staring at the chart

Step 3: look for a divergence with either the PowerDelta Oscillator or, in this case, the Manipulation Ribbon

Info: the Manipulation Ribbon detects areas of price manipulation by Market Makers vs areas where it is trading in a natural, price-driven state

Step 4: the entry is a tap of the most recent confirmed FVG

FYI: all the drawings on the main chart are created by the Sigma 5-in-1 indicator

SL: low of first candle that forms the entry FVG

Tip: for a more conservative approach the recent swing low could also be used

TP: bearish divergence with the PowerDelta Oscillator

Note: gold was at an all-time high so anything beyond the Previous Day High (PDH) posed a risk however for a more conservative approach you could exit half your position at the PDH

Note: the sweep must be confirmed for any of the other confluences to be valid

Step 2: wait for a bullish marker to be drawn by the Reversal Print indicator

Tip: set an alert if you don’t want to spend all day staring at the chart

Step 3: look for a divergence with either the PowerDelta Oscillator or, in this case, the Manipulation Ribbon

Info: the Manipulation Ribbon detects areas of price manipulation by Market Makers vs areas where it is trading in a natural, price-driven state

Step 4: the entry is a tap of the most recent confirmed FVG

FYI: all the drawings on the main chart are created by the Sigma 5-in-1 indicator

SL: low of first candle that forms the entry FVG

Tip: for a more conservative approach the recent swing low could also be used

TP: bearish divergence with the PowerDelta Oscillator

Note: gold was at an all-time high so anything beyond the Previous Day High (PDH) posed a risk however for a more conservative approach you could exit half your position at the PDH

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Exención de responsabilidad

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.