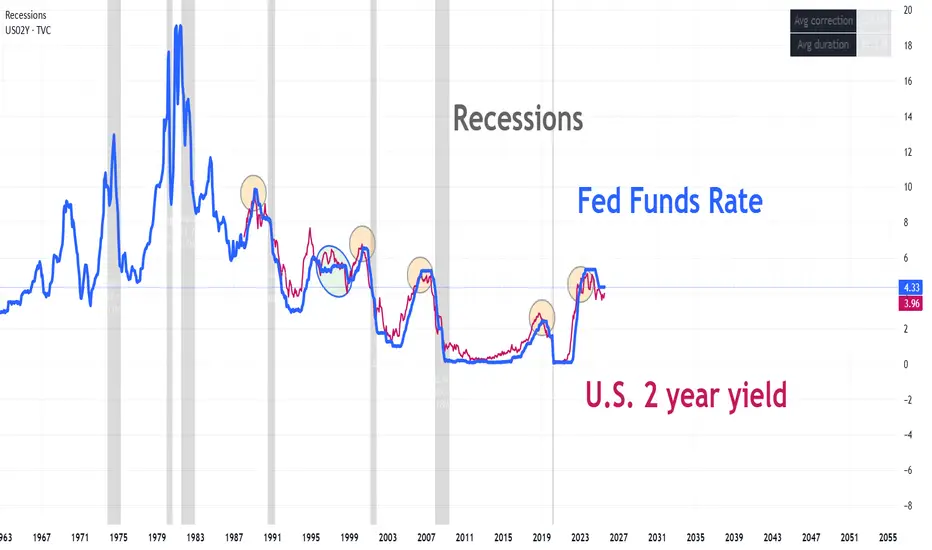

On August 4, we published a report analyzing the relationship between the 2-year yield and the Fed rate. At first glance, it looks like a technical oscillator, except in this case it represents market expectations for the 2-year rate. It embeds the expected real rate, expected inflation, and the term premium. Every time it gave a short signal, a recession followed shortly after. It generated one false signal and correctly anticipated the last four recessions. Two weeks after the report, Jackson Hole brought the pseudo-confirmation of the rate cut.

@intermarketflow

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

@intermarketflow

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.