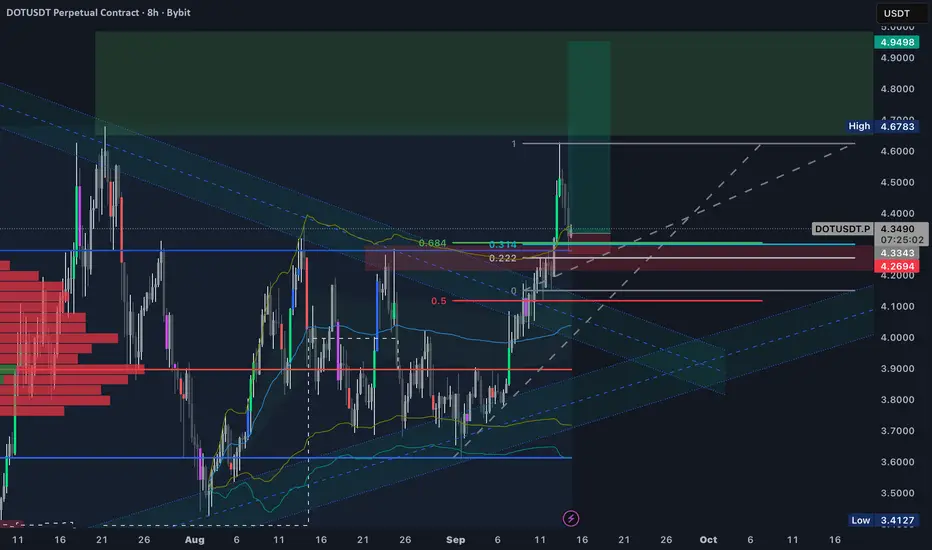

DOT is currently attacking a new high, but the question is whether this move is a true breakout or just a liquidity grab.

This time I’m looking for a quick long setup.

My main zone of interest is 4.25–4.31.

This area lines up with multiple previous highs, which I now consider potential new support. It also includes:

• the 0.314–0.222 retracement from the latest pump,

• the 0.684 level (inverse of 0.314 from the bottom),

• the highest anchored VWAP line.

On top of that, divergences on RSI (14) and MACD (12:26) suggest price could push higher.

We’ve already tested the triangle breakout, so I believe that phase of interest is over. From here, price may dip slightly lower, but it doesn’t have to. A ~3% move against the position is acceptable.

I’m already in the trade.

If DOT retests the 4.25–4.31 zone, I see it as a strong buying opportunity.

Target: At least a new local high around 4.70, where I’ll take my first partial profit.

This time I’m looking for a quick long setup.

My main zone of interest is 4.25–4.31.

This area lines up with multiple previous highs, which I now consider potential new support. It also includes:

• the 0.314–0.222 retracement from the latest pump,

• the 0.684 level (inverse of 0.314 from the bottom),

• the highest anchored VWAP line.

On top of that, divergences on RSI (14) and MACD (12:26) suggest price could push higher.

We’ve already tested the triangle breakout, so I believe that phase of interest is over. From here, price may dip slightly lower, but it doesn’t have to. A ~3% move against the position is acceptable.

I’m already in the trade.

If DOT retests the 4.25–4.31 zone, I see it as a strong buying opportunity.

Target: At least a new local high around 4.70, where I’ll take my first partial profit.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.