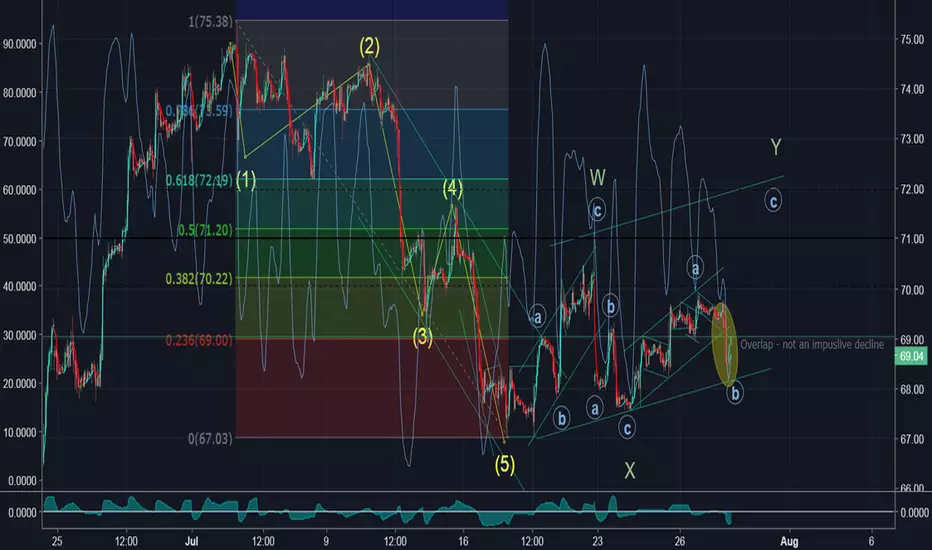

WTI -One leg up into more sophisticated corrective rise

There is a possible one more leg up in WTI. The last decline (elipce mark) is not an impulsive due to the overlap within it.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

Operación cerrada: objetivo alcanzado

Possible level for the end of the current corrective rise. RSX 1H is still forming the turn to the downside but not yet. This is also can be only the end of wave a in Y. That should be enough to get stop order into break even zone.

Operación cerrada manualmente

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.