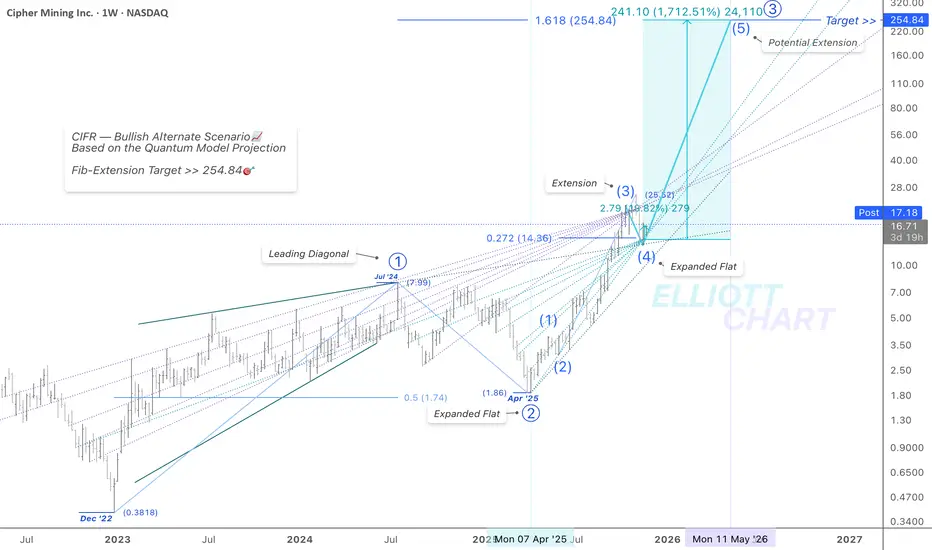

Bullish Alternative — Weekly

As highlighted in the prior analysis, $Cipher recorded a strong 19.8% intraday surge, rebounding right from the apex of the support-equivalence lines💫 where the market closed last week.

As outlined in the Nov. 19 update, Intermediate Wave (4) completed a decisive retracement into the $14.36 Fibonacci target, settling precisely at the structural apex. This reaction increases confidence that Wave (4) has likely bottomed.

From here, the model favours an extension into Intermediate Wave (5) within Primary Wave ⓷, projecting an impulsive advance toward $254🎯.

This target aligns with the confluence of divergent equivalence lines. It corresponds to the 1.618 Fibonacci extension derived from the Leading Diagonal of Primary Wave ⓵ — a configuration typically associated with structurally bullish continuation patterns.

Overall, the wave structure suggests the uptrend remains intact, with the next impulsive phase now potentially underway.

🔖 In my Quantum Models methodology, the equivalence lines function as structural elements, anchoring the model's internal geometry and framing the progression of alternate paths.

#MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #CIFR #DataCenters #BitcoinMining #HPC #CryptoMining #CipherMining #BTC #Bitcoin #BTCUSD

#HighPerformanceComputing

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.