TL;DR:

Bear HVN rejection, momentum rollover, C-leg targets 111 k–110 k.

Short bias intact while under 113.5 k.

⸻

🩻 Market Logic

This is a C-leg continuation play within a corrective structure, trading momentum + order-flow confluence:

• CVD down + CRVOL flat = liquidity fade.

• RSI breakdown = momentum confirmation.

• HVN rejection = structural trigger.

If 113.6 k gets reclaimed on strong volume → thesis invalidated; above that, next play is the L-BOR toward 116 k – 122 k.

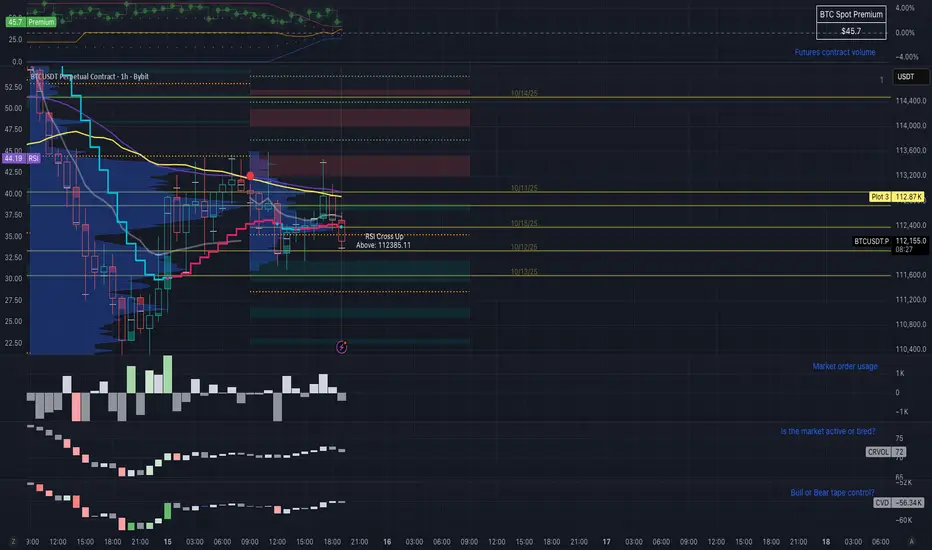

After the liquidation flush and retrace, BTC printed a textbook A–B–C corrective structure inside the larger wave-5 on hourly charts.

The B-wave retraced ~0.93 of the prior drop — deep enough to trap late longs but shallow enough to preserve bearish symmetry.

🧠 Technical Context

• 1H HVN: 113.1k zone acting as supply shelf.

• RSI (10m): rolled under 50 → momentum shift confirmed.

• CVD: still negative (~–55k) — buyers not reclaiming control.

• CRVOL: >1.1× → active but fading = exhaustion, not expansion.

• Fib projections (C-wave):

• 1.0 × target → 111.55k

• 1.618 × extension → 110.38k

⚙️ Execution Plan

• Short Entry: 112.9 k – 113.2 k (bear HVN underside)

• Stop: 113.6 k (above 1 h wick)

• Targets:

• TP1 = 111.55 k

• TP2 = 110.38 k

• TP3 = 109.8 k (full C-leg completion)

• Bias: Bearish until hourly close > 113.48 k

Bear HVN rejection, momentum rollover, C-leg targets 111 k–110 k.

Short bias intact while under 113.5 k.

⸻

🩻 Market Logic

This is a C-leg continuation play within a corrective structure, trading momentum + order-flow confluence:

• CVD down + CRVOL flat = liquidity fade.

• RSI breakdown = momentum confirmation.

• HVN rejection = structural trigger.

If 113.6 k gets reclaimed on strong volume → thesis invalidated; above that, next play is the L-BOR toward 116 k – 122 k.

After the liquidation flush and retrace, BTC printed a textbook A–B–C corrective structure inside the larger wave-5 on hourly charts.

The B-wave retraced ~0.93 of the prior drop — deep enough to trap late longs but shallow enough to preserve bearish symmetry.

🧠 Technical Context

• 1H HVN: 113.1k zone acting as supply shelf.

• RSI (10m): rolled under 50 → momentum shift confirmed.

• CVD: still negative (~–55k) — buyers not reclaiming control.

• CRVOL: >1.1× → active but fading = exhaustion, not expansion.

• Fib projections (C-wave):

• 1.0 × target → 111.55k

• 1.618 × extension → 110.38k

⚙️ Execution Plan

• Short Entry: 112.9 k – 113.2 k (bear HVN underside)

• Stop: 113.6 k (above 1 h wick)

• Targets:

• TP1 = 111.55 k

• TP2 = 110.38 k

• TP3 = 109.8 k (full C-leg completion)

• Bias: Bearish until hourly close > 113.48 k

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.