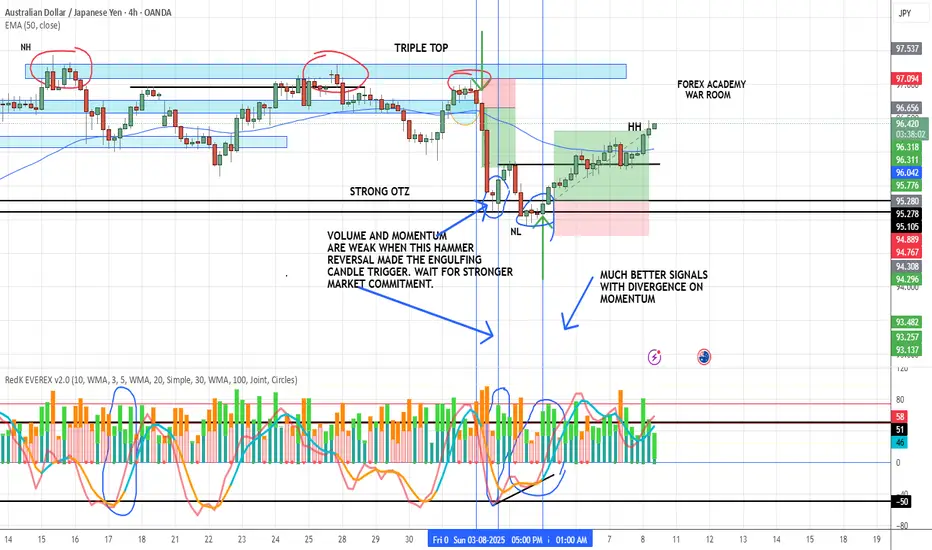

Here’s a perfect example of why following the rules matters.

The first setup was a strong hammer reversal right after an impulsive move to the downside (which we also traded). We got a clean engulfing candle and volume was decent…

But — both momentum lines must be hooking in our favor for confirmation. In this case, one was and one was not.

Daily chart was also in a downtrend but hitting support

So not bad, but not great

✅ Discipline says: Pass.

The very next day, we got a better setup:

All VMS rules met (Volume, Momentum, Structure)

Bonus: Momentum divergence in our favor

That’s the power of combining volume and momentum with structure — it filters out the “almost” trades and keeps us focused on the high-probability setups.

Disclaimer: This is for educational purposes only — not financial advice. Always do your own research, practice extensively, and use proper risk management before trading live.

The first setup was a strong hammer reversal right after an impulsive move to the downside (which we also traded). We got a clean engulfing candle and volume was decent…

But — both momentum lines must be hooking in our favor for confirmation. In this case, one was and one was not.

Daily chart was also in a downtrend but hitting support

So not bad, but not great

✅ Discipline says: Pass.

The very next day, we got a better setup:

All VMS rules met (Volume, Momentum, Structure)

Bonus: Momentum divergence in our favor

That’s the power of combining volume and momentum with structure — it filters out the “almost” trades and keeps us focused on the high-probability setups.

Disclaimer: This is for educational purposes only — not financial advice. Always do your own research, practice extensively, and use proper risk management before trading live.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.