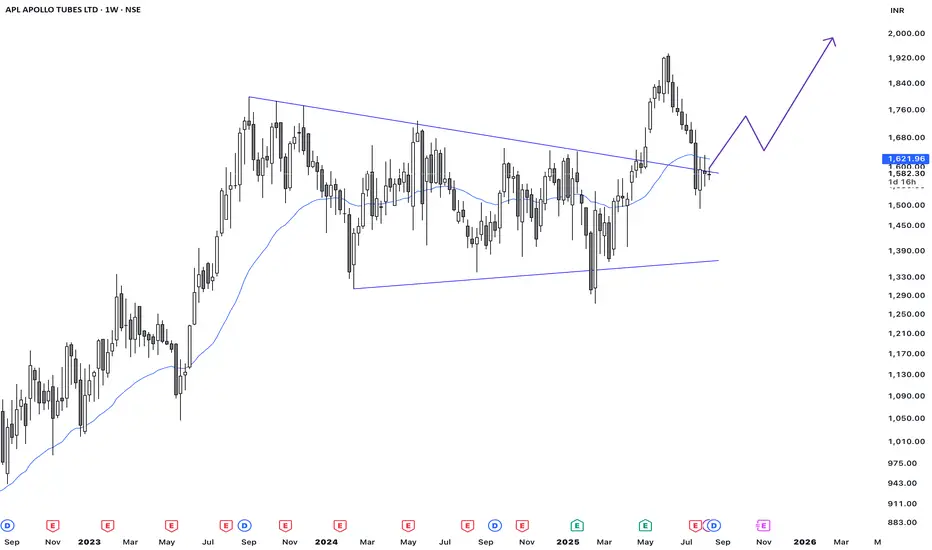

APL Apollo Tubes Ltd – Weekly Chart Update: Breakout from Multi-Period Consolidation

Technical Structure:

The chart clearly shows a long consolidation between early 2023 and mid‑2025, bounded by converging trend lines forming a symmetrical wedge/triangle.

Recently, price decisively broke above the upper trendline, accompanied by a volume spike, signaling a classic bullish breakout scenario. A subsequent retest of the breakout zone (~₹1,580–1,600) appears to be underway—buyers holding this zone could pave the way for a continued rally .

Potential Targets and Setup:

• Entry Zone: Weekly close above 34 week moving average

• SL on entry: 1485

• First target: 1900

• If momentum sustains, keep trailing SL

• Invalidation: SL is hit or any opposing bearish signal on chart

Fundamentals:

• The technical breakout aligns with healthy fundamentals—strong ROCE/ROE and sustained revenue growth.

• Though valuations are rich (P/E ~55x, P/B ~10x), the quality of earnings and performance metrics justify the multiple.

Technical Structure:

The chart clearly shows a long consolidation between early 2023 and mid‑2025, bounded by converging trend lines forming a symmetrical wedge/triangle.

Recently, price decisively broke above the upper trendline, accompanied by a volume spike, signaling a classic bullish breakout scenario. A subsequent retest of the breakout zone (~₹1,580–1,600) appears to be underway—buyers holding this zone could pave the way for a continued rally .

Potential Targets and Setup:

• Entry Zone: Weekly close above 34 week moving average

• SL on entry: 1485

• First target: 1900

• If momentum sustains, keep trailing SL

• Invalidation: SL is hit or any opposing bearish signal on chart

Fundamentals:

• The technical breakout aligns with healthy fundamentals—strong ROCE/ROE and sustained revenue growth.

• Though valuations are rich (P/E ~55x, P/B ~10x), the quality of earnings and performance metrics justify the multiple.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.

Exención de responsabilidad

La información y las publicaciones que ofrecemos, no implican ni constituyen un asesoramiento financiero, ni de inversión, trading o cualquier otro tipo de consejo o recomendación emitida o respaldada por TradingView. Puede obtener información adicional en las Condiciones de uso.