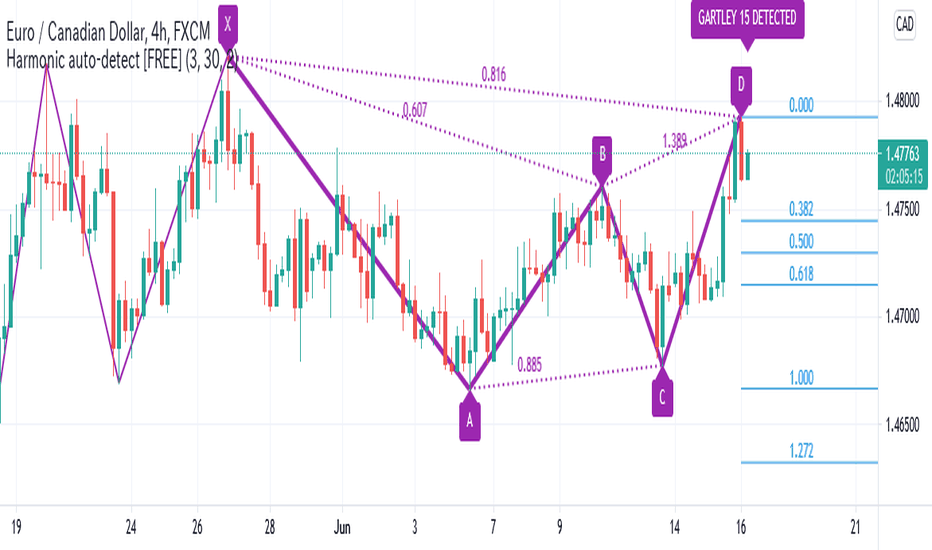

Harmonic auto-detect [FREE]Automatically detects and visually displays Harmonic patterns,

from small ZigZag to large ZigZag.

5 types of Harmonic patterns are supported.

Pattern5-0 / 3Drive / AB=CD / Gartley / Butterfly

小さいZigZagから大きいZigZagまですべてを監視し、ハーモニックパターンを自動的に検出します。

検出したパターンは視覚的に表示されます。

インジケーターは、5種類のハーモニックパターンに対応しています。

Pattern5-0 / 3Drive / AB=CD / Gartley / Butterfly

W-m-pattern

a strange coincidence and maybe a pattern?Hi everyone,

as soon as I know the reason for those numbers, I can't figure out if there is some kind of pattern (confirmation bias or stuff like that).

So I'm here asking for your help to try to find some kind of pattern between those numbers.

Please comment down below your ideas and I will try to code your ideas and update the indicator with new code.

I've separated odd and even numbers only for a better view.

Thank you

{INDYAN} GO WITH TREND V2This indicator has almost everything for intraday trading . There are two supertrends one with higher time frame and one at lower time frame, Due to which we can recognize reversal. If higher time frame supertrend is showing uptrend and minor is showing downtrend then better to avoid taking any trade in between. Both trend should be in same direction.

Tenkan and kijun is there to verify the trend authencity, check where the tenkan and kijun crossover is there or not at the time of reversal signal given by supertrends. It will boost trading chances.

Also VWAP is placed to know the current situation, If price is below VWAP go for sort if all other things match as above said.

HEMA LEMA is a EMA band and i found that it act as support and resistance, If price breaks channel with volume and sustain above/below for 2 candle close (TIMEFRAME AS SYMBOL).

Also placed FAST EMA to recognize the fast moving trend.

Pivot with CPR is there to trade on basis of CPR and Pivot.

For demand and supply traders, they can use blue and black candle for marking up zones. Blue is boring/base candle and Black is explosive candle.

I hope it will help my trader friends to recognize the trend and reversal.

Let me know if anything more we need to include or remove to make it better for everyone.

Happy Trading... Love INDYAN

#intraday

#hema-lema

#pivot

#cpr

#supertrend_reversal

#demandzone

#supplyzone

#tenkansen

#kijunsen

Tweezer Scanner v1Some code for detecting tweezer candles, which are reversal patterns. You'll need to tweak the settings to be either less strict (more detections) or more strict (less detections). I found that if you follow the documentation for tweezers exactly, you will get very few detections. It is possible that this candlestick has become overused, so the original pattern itself has been lost to the noise of the market.

Settings:

1. Tweezer Max Body Height (Pips) - How tall can the body of the tweezer be, in pips (increase this pips to increase detections)

2. Tweezer Body Similarity (>%) - How similar should the body heights be, higher percentage is more similar (reduce this % to increase detections)

3. Tweezer Tail Similarity (>%) - How similar should the tail heights be, higher percentage is more similar (reduce this % to increase detections)

4. Tweezer Tail Proportion (<%) - How short should the opposite tail heights be, lower percentage is shorter and more similar to the documentation (increase this % to increase detections)

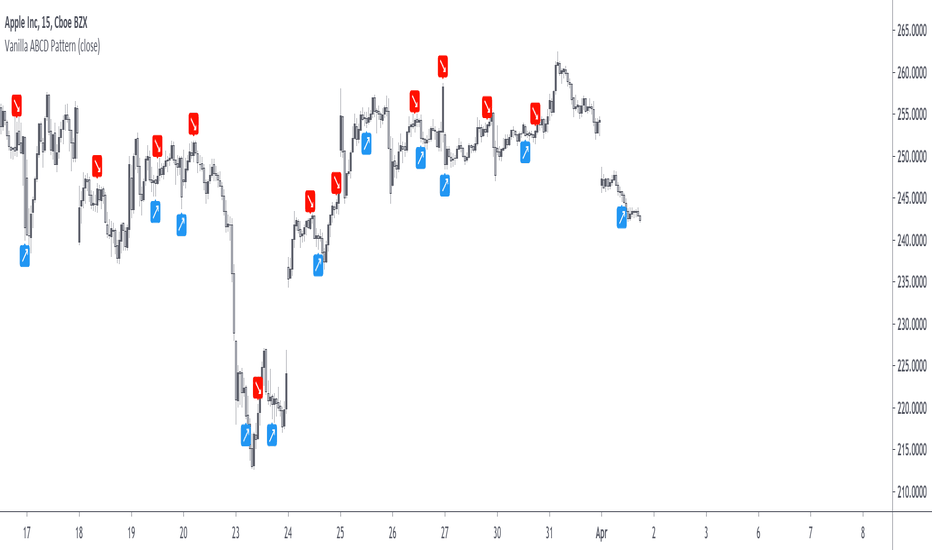

Vanilla ABCD PatternPatterns makes parts of the many predictive tools available to technical analysts, the most simples ones can be easily detected by using scripts. The proposed tool detect the simple (vanilla) form of the ABCD pattern, a pattern aiming to detect potential price swings. The script can use an additional confirmation condition that aim to filter potential false signals.

ABCD PATTERN

The ABCD pattern is not meant to be detected by analyzing individuals closing price observations but by analyzing longer term movements, this is done by using tools such as zig-zag. Like any pattern the ABCD one comes in different flavors, the simplest being based on the following structures:

Once price reach D we can expect a reversal. The classical pattern has the following conditions : BC = 0.618*AB and CD = 1.618*AB , as you can see this condition is based on 0.618 which is a ratio in the Fibonacci sequence. Other conditions are for AB to equal to CD or for CD to be 161.8% longer than AB. Why these conditions ? Cause Fibonacci of course .

The ABCD pattern that the proposed tool aim to detect is not based on the zig-zag but only on individual price observations and don't make use of any of the previously described conditions, thus becoming more like a candle pattern.

When the label is blue it means that the tool has detected a bullish ABCD pattern, while a red label means that the tool has detected a bearish ABCD pattern.

We can't expect patterns based on the analysis of 1,2,3 or 4 closing price observations to predict the reversal of mid/long term movements, this can be seen on the above chart, but we can see some signals predicting short term movements.

Since the pattern is based on a noisy variation, using smoother input can result in less signals.

Above the tool on BTCUSD using closing price as input. Below the tool using ohlc4 as input:

TOOL OPTIONS

Being to early can be as devastating as being to late, therefore a confirmation point can be beneficial, the tool allow you to wait for confirmation thus having a potentially better timing. Below is a chart of AMD with no confirmation:

As we can see there are many signals with some of them occurring to early, we can fix this by checking the confirmation option:

The confirmation is simply based on the candle color, for example if a bearish ABCD pattern has been detected in the past and the closing price is greater than the opening price then the tool return a buy signal. The same apply with a bearish ABCD pattern.

The "last bar repaint" option is true by default, this in order to show the bar where the D point of the pattern has been detected, since the closing price of the last bar is constantly changing the signals on the last bar can be constantly appearing/disappearing, unchecking the option will fix this but will no longer the bar where the D point of the pattern has been detected.

SUMMARY

The pattern is simple and can sometimes be accurate when predicting the direction of future short terms movements. The tool was a request, as it seems i don't post many pattern detectors, well thats true, and the reason is that for me patterns are not super significant, and their detection can be extremely subjective, this is why simple patterns are certainly the only ones worth a look.

Don't expect me to post many pattern related indicators in the future ^^'

chanlun_penthe strong line call 'pen' in chanlun.it is build from the thin line,and the thin line is about kline trend. when you see the red line(strong or thin) ,that's mean down trend has been complete,at the same time,up trend has start.

缠论分笔.当你看到红色线段时,说明下跌的一笔已经完成(下跌趋势结束),同时是上涨的一笔开始(上涨趋势开始)

chanlun can Identify charpatterns,and not only that

Sequentially Filtered Moving AverageThe previously proposed sequential filter aimed to filter variations lower than a certain period, this allowed to remove noisy variations and retain only the closing price values that occurred after a consecutive up/down, however because of the noisy nature of the closing price large filtering was impossible, in order to tackle to this problem the same indicator using a simple moving average as input is proposed, this allow for smoother results.

We will see that the proposed indicator can provide an alternative moving average that could be used as slow moving average in crossover systems.

The Indicator

The length parameter as the same function as the one described in the sequential filter post, however here length also control the period of the moving average used input, in short larger values of length will return a smoother but less reactive output.

In blue the moving average with length = 200, and in red the moving average with length = 50.

It is interesting to see how the moving average remain flat during ranging/flat market periods

Unfortunately like the sequential filter the sequentially filtered moving average (SFMA) is not affected by large short term variations such as gaps or short term volatile events. This is because of the nature of the sequential filter to ignore movements amplitude and only focus on the variation period.

Moving Average Crossover System

The SFMA is equal to a simple moving average of period length when a consecutive up/down sequence of size length has occurred, else the SFMA is equal to its precedent value, therefore we could expect less crosses between a fast moving average and the SFMA as slow moving average.

We can see on the figure above that the fast moving average of period 50 (in green) cross more with the slow moving average of period 200 (in red) than with the SFMA of period 200 (in blue).

Crosses can occur at the same time as with the classical slow moving average (in red) or a bit later.

Conclusion

A new moving average based on the recently proposed sequential filter has been proposed, it can be seen that under a moving average crossover system the proposed moving average seems to be more effective at producing less crosses without necessarily doing it with an excessive lag, in fact the moving average has either lag (length-1)/2 or lag length .

In the future it could be interesting to provide an hybrid alternative that take into account volatility as well as variations period.

Thanks for reading !

Sequential Filter - An Original Filtering ApproachRemoving irregular variations in the closing price remain a major task in technical analysis, indicators used to this end mostly include moving averages and other kind of low-pass filters. Understanding what kind of variations we want to remove is important, irregular (noisy) variations have mostly a short term period, fully removing them can be complicated if the filter is not properly selected, for example we might want to fully remove variations with a period of 2 bars and lower, if we select an arithmetic moving average the filter output might still contain such variations because of the ripples in the frequency response passband, all it would take is a variation of high amplitude for that variation to be clearly visible.

Although all it would take for better filtering is a filter with better performance in the frequency domain (gaussian, Butterworth, Bessel...) we can design innovative approaches that does not rely on the model of classical moving averages, today a new technical indicator is proposed, the technical indicator fully remove variations lower than the selected period.

The Indicator Approach

In order for the indicator output to change the closing price need to produce length consecutive up's/down's, length control the variation threshold of the indicator, variations lower than length are fully removed. Lets see a visual example :

Here length = 3, the closing price need to make 3 consecutive up's/down's, when the sequence happen the indicator output is equal to src , here the closing price, else the indicator is equal to its precedent value, hence removing other variations. The value of 3 is the value by default, this is because i have seen in the past that the average smallest variations period where in general of 3 bars.

Because the indicator focus only on the variation sign, it totally ignore the amplitude of the movement, this provide an effective way to filter short term retracement in a fluctuation as show'n below :

The candle option of the indicator allow the indicator to only focus on the body color of a candle, thus ignoring potential gaps, below is an example with the candle option off :

If we activate the "candle" option we end up with :

Note that the candle option is based on the closing and opening price, if you use the indicator on another indicator output make sure to have the candle option off.

Length and Indicator Color

The closing price is infected by noise, and will rarely make a large sequence of consecutive up's/down's, the indicator can therefore be useful to detect consecutive sequence of length period, here 6 is selected on BTCUSD :

A consecutive up's/down's of period 6 can be considered a relatively rare event.

It is important to note that the color of the indicator used by default has nothing to do with the consecutive sequence detected, that is the indicator turning red doesn't necessarily mean that a consecutive down's sequence has occurred, but only that this sequence has occurred at a lower value than the precedent detected sequence. This is show'n below :

In order to make the indicator color based on the detected sequence check the "Color Based On Detected Sequence" option.

Conclusion

An original approach on filtering price variations has been proposed, i believe the indicator code is elegant as well as relatively efficient, and since high values of length can't really be used the indicator execution speed will remain relatively fast.

Thanks for reading !

BEST ABCD Pattern ScreenerHello ladies and gentlemen traders

Continuing deeper and stronger with the screeners' educational series one more time.

This one is heavy crazy mega cool (pardon my french).

I - Concept

I present to you, ladies and gentlemen, the first screener for harmonic patterns.

Starting with an ACBD pattern screener this time!!

I used the calculations from Ricardo Santo's script

In short, he's using fractals (regular or Bill Williams ) for the pattern calculations. A masterpiece !!!

The screener will show in 1 consolidated chart the ABCD patterns for 5 selected assets. Could be stocks, forex, crypto, whatever you feel like making money with

II - Definitions

The ABCD pattern ( AB=CD ) is one of the classic chart patterns which is repeated over and over again.

The ABCD pattern shows perfect harmony between price and time.

More info here

The Williams Fractal is an indicator, developed by Bill Williams, that aims to detect reversal points (highs and lows) and marks them with arrows.

Up fractals and down fractals have specific shapes. The Williams Fractal indicator helps users determine in which direction price will develop

Source: www.tradingview.com

III - How did I set the screener

The visual signals are as follow:

- square: whenever there is an ABCD pattern detected

Then the colors are:

- green when a bullish pattern is detected

- red when a bearish pattern is detected

🔸 The script screenshot shows two red squares matching two ABCD bearish pattern from the above panel. As the chart is showing APPL, I highlighted where the screener mentioned the fruit stock ( APPLE, pun, bad joke, Dave out...)

🔸 I tried to make it as clear as I could with red arrows

Once again, we pushed together the limits of pine script beyond of what we thought was possible, beyond the realm of this world, reaching finally the dreamt pine script heaven (am I going too far? feel free to tell me)

Best regards,

Dave

Woodies CCI Trading System - Patterns - AlertsWoodies CCI Trading System - Patterns (Alert Mode) .

The Woodies CCI was initially designed for trading Stocks, Options and the Future Market.

However, different styles of traders can make use of it in various markets and any chart timeframes.

The Woodies CCI Trading System - Patterns takes a Strategy Builder like approach and can be easily configured to scan simultaneously for any available pattern.

The purpose of this tool is to compress everything down to 1 alert to warn of any opportunities, and it can also be automated .

To further improve the success rate , the patterns' performance can be studied with the help of the Strategy Tester .

The Strategy Tester Mode allows for instant backtesting on historical data.

It can assist in determining the right combination of patterns and exit rules , and it can help decide which patterns are better for which market.

This trading system contains all the particular features as described by Woodie, and more.

▪ Pattern Recognition (entry signals based on well-defined patterns)

- Trade patterns that are in agreement with the established trend

1. Zero-Line Reject (ZLR)

2. Trend Line Break (TLB) - with the trend

3. Horizontal Trend Line Break (HTLB) - with the trend

4. Tony Trade (TT)

5. GB100 (GB)

6. Reverse Divergence (RD)

- Trade patterns that are against the trend (these patterns indicate the possibility of a change in trend direction and are recommended for experienced traders)

1. Shamu Trade (ST)

2. The Famir Trade (FT)

3. Vegas Trade (VT)

4. Ghost Trade (GT)

5. Hook From Extreme (HFE)

6. Trend Line Break (TLB) - counter-trend

7. Horizontal Trend Line Break (HTLB) - counter-trend

▪ Exit rules

1. CCI Trend Line Breaks

2. CCI crossing back through the 100 lines

3. TCCI hooking or going flat, not moving, or no progress

4. CCI hook from extremes

5. Profit target hit

6. CCI forming a flat top formation

7. CCI crossing a Horizontal Trend Line

8. When the LSMA disagrees with the trade

9. CCI crossing the Zero-Line (ZL)

▪ WCCI Histogram coloring based on Woodie's trend definition

- Blue for Uptrend

- Red for Downtrend

- Gray for No Trend

- Yellow for trend establishment

▪ The LSMA is on the Zero-Line - it is the 25 period Least Squares Moving Average (it shows the ZL as a series of red and green segments)

- Red segments - the market price is below LSMA

- Green segments - the market price is above LSMA

▪ Chop Zone Indicator (CZI) - Positioned on the levels +100 and -100 (it shows market direction)

- Cyan shows up market

- Brown shows down market

- Multiple colors show market in a sideways mode

▪ Sidewinder Indicator (SI) - Positioned on the levels +200 and -200

- Red shows a flat or non-trending market

- Yellow shows a trending market

- Green shows a strong trending market

▪ The Woodies CCI (14) is indicated with the fuchsia color

▪ WCCI length auto-change to 20 on 1-hour chart intervals and higher

▪ The Turbo CCI (6) has a dark red color

▪ TWCCI auto-hide on 1-hour chart intervals and higher

▪ Early Alert Functionality available (eg 20 seconds before the signal is considered valid)

▪ Simplified Alerts

- An all in one alert

- Alerts for entry triggers

- Alerts for exit conditions

▪ Some Pattern Statistics are available on the chart in a panel

Simple Steps to set it up:

1 - Choose at least 1 pattern ( with-the-trend patterns are friendlier than the counter-trend ones)

2 - Choose at least 1 exit condition

3 - Set the alerts (1 for Entry and 1 for Exit, or 1 alert running for both Entry and Exit)

For Beginners:

For the new trader, the trend continuation patterns are easier to manage.

Newcomers should stick to trend-following patterns until they feel very confident!

Here are Three Entry Choices:

1 - Conservative -

Wait until the bar closes to enter - This is the easiest to execute.

2 - Conservative to Aggressive -

Woodie would like the beginner to enter the market if, with 20 seconds left in the bar, a valid CCI pattern presents itself.

3 - Very Aggressive -

Enter trade as soon as the bar indicates a signal during price bar formation. This is for experienced traders, as the signal conditions are final at the close of the bar and the intra-bar changes are not recorded.

Your implicit learned skills are put to the test here. Be fair to yourself and allow yourself time to grow and improve your skills.

You are strongly urged to follow the Option 2.

Money Management: Apply an Initial Protective Stop; Use Trade Exits; Study the past performance - Statistics (Strategy Tester Mode).

Related Tools:

Woodies-CCI Trading System - Patterns - Strategy Tester

Risk Management System (Stop Loss, Take Profit, Trailing Stop Loss, Trailing Take Profit) - it can be connected to the Woodies-CCI Trading System - Patterns - Alerts

Early/Delayed Signal Explained

GartleyPattern_ULTRA V1 [NXT2017] Autodrawing Harmonic PatternPrivate indicator.

HI BIG PLAYERS AROUND THE WORLD,

this script allows to draw automatically lines of Gartley Pattern. The Gartley Pattern is part of Harmonic Pattern.

Parallel to the automatic drawing, the indicator can give signals as soon as the typically Fibonacci extension immediately reached or has been reached. This allows the indicator GartleyPattern_ULTRA V1 to give early signals. In the default settings, the signals are displayed with a blue background on the chart.

NO REPAINT

As soon as the most points of the pattern are developed, the last point is a fix prediction without any repaints!

GartleyPattern_ULTRA V1 is offered for sale. More information can be found below in the signature.

In the settings it is possible to change the degree of details. This is sometimes necessary because TradingView limited only 55 lines per indicator in Pinescript Version 4.

Furthermore, you can set a range how much bars back you want go from current bar for the automatic drawings. As default is setting 2000 bars back.

In extreme cases it is possible to change the settings to "lite" that the Gartley Pattern represent waves only with 2 lines. This allows the indicator to detect far more Gartley Pattern on the same chart.

For more great indicators everyone is invited to follow me on TradingView.

Kind regards

NXT2017

More Examples:

[fikira] Harmonic Patterns (Gartley)When using "Harmonic Patterns", always look at the bigger picture, please do not depend solely on the "Pattern".

Use other indicators,... to confirm what you think is going on!

That said, it is quite useful!

Here we have "The Gartley", bullish and bearish.

The "Pattern" is created by checking 5 consecutive (pivot) points, starting with X, A, B, C, and ending with point D.

At point D all 5 points are compared, calculated and verified.

When confirmed, a "Label" will be plotted at point D, together with the "Entry", "Take Profit" and "Stop Loss" price.

The "Entry", "Take Profit" and "Stop Loss" lines will be plotted as well at point D.

Lastly, a "Drawing" automatically will be displayed which makes the "Pattern" visible.

Please do mind, the "Drawing" is calculated differently, the "Drawing" sometimes can be displayed incorrectly

when prices are too close to each other (for example low Satoshi price changes).

THE "ENTRY" , "TAKE PROFIT", "STOP LOSS" PRICES AND LINES ARE NOT AFFECTED AT ALL BY THIS, THEY WILL SHOW CORRECTLY!

- 1 "TP point" can be changed ("TP Level 0.618")

- "Labels", "Lines", "Drawings" can be disabled/enabled

- "Labels" can be made smaller or bigger ("Size Label")

- "Labels" can be placed further or closer to the bar ("Distance TP Label" > higher = closer, lower = further)

- "Lines" can be made thicker or thinner ("TP Linewidth")

- "Drawings" can be made thicker or thinner ("Drawings Linewidth")

- "Drawings" are created by comparing with 100 bars back in history (default), should it be (very rarely) a triangle is displayed flat on the left side,

possibly the first point(s) is/are further than 100 bars ago, in this case increase "Period Drawings" above 100.

- When a lot (really a lot!) of "Patterns" appear on the chart, the first ones will not be displayed anymore, first the "Drawings", then the "Lines"

The last (present) ones will always be displayed in total without a problem!

- If you want to see "Patterns" with less correct measurement, change "Error Marge" 0.9 - 1" and "Error Marge" 1 - 1.1"), this gives max. about 10% extra margin

Thank you very much!

[RS]ZigZag Percent Reversal - Helper - Draw Patterns - Part 3Helper script to draw patterns on chart.

[RS]ZigZag Percent Reversal - Helper - Draw Patterns - Part 2Helper script to display patterns on chart.

[RS]ZigZag Percent Reversal - Helper - Draw Patterns - Part 1Helper script to display patterns on chart.

Sneaky PatternSneaky pattern to grab some point on low TF with minimum risk

USE ON LOW TF: 1M TO 10M

the way to use is described on picture below.

The blue are is the order area

Once you order is hit (in this case long position) you can locate you stop-loss sticky (in this case I used the blue area = yellow area price spread to set stop-loss)

minimum risk V.1Was playing around and I've had this idea: most of day traders looking for catching price swings and sometimes they forgot about risk, so I was keeping focus not on price swings but on risk-momentum: the idea was to catch daily moments when the risk was minimum and this is the result.

There are some rules to use it correctly

1. Use it on lower timeframe (1M to 30M) best --> 1M to 5M

2. Do not open position on every signal !! keep focusing on the price

3. works better on Forex

upin and doin input: you can change it and you will see more signals but keep this inputs low as it is a filter I'm using for signals

I will update the indicator if I found new ideas

Enjoy!!

Candelsticks Pattern {LB}In questo script ho aggiunto i migliori candelstick pattern (che conosco) e che reputo diano indicazioni più chiare riguardo la tendenza quantomeno giornaliera. Consiglio quindi l'utilizzo di questo script su timeframe giornaliero in modo da avere un idea della direzione da seguire per poi passare a timeframe più bassi per entrare più nel dettaglio e favorire la propria strategia di ingresso.

Alcuni di questi pattern indicano la direzione da seguire, se Long o Short, altri invece indicano il tipo di pattern che, se rotto al rialzo indica una direzione long e viceversa, se rotto al ribasso indica direzione short, parliamo ad esempio del pattern 2Doji o del pinBar (vedi immagine sopra).

Infine resta da dire che non tutti i pattern inseriti in questo script verranno individuati su ogni grafico, ad esempio, su un grafico di un mercato azionario è più facile che ci siano dei pattern come il Bearish Engulfing in quanto il cosidetto pattern per verificarsi ha bisogno di aprirsi al di sopra del massimo della candela precedente e chiudersi al di sotto della candela precedente, quindi un apertura in gap, cosa che nel forex è difficile da trovare. Come questo come altri tipi di pattern come l'Outside di Larry Willliams, il BHL (Belt Hold Lines), morning star e via dicendo.

In totale questo script contiene 10 pattern. Condivido in open in modo che possiate farli vostri e migliorarli in base alle vostre esigenze come ho fatto io con alcuni di questi. Se vi è piaciuto questo script lasciate un bel like e se avete dei dubbi o volete contattarmi per del supporto sono pronto ad aiutare.

Saluti e buon trading a tutti.

[RS]ZigZag Percent Reversal - Forecast - patterns - labels description:

• Zig Zag indicator plots points on the chart whenever prices reverse

by a percentage greater than a pre-chosen variable.

• Forecasts area based on zigzag statistics.

• Displays labels with detected patterns.

• Displays slope information rate of price, time diferentials and angle(experimental)