OPEN-SOURCE SCRIPT

conditional_returns

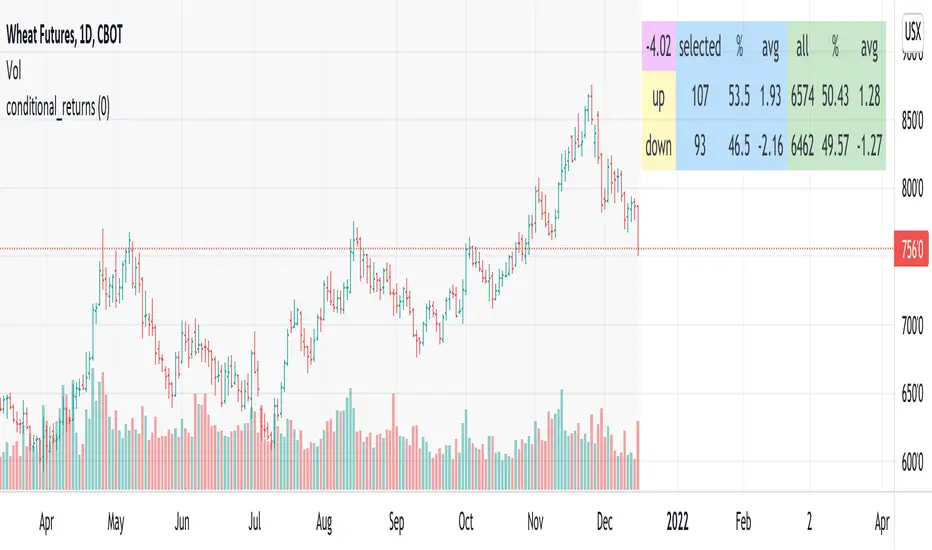

This script attempts to contextualize the instrument's latest return. It asks, "when a return of the same or greater magnitude occurred in the past, in the same direction, what was the following period's return?"

By default, the latest return is used. For example, on a daily chart, that would mean "today's" return. However, you can select any return you want using the "override" input.

The output table shows:

- The latest/override return, as a percentage. This is in the top left, fuchsia cell.

The first three, blue columns, show:

- The count of up and down (or positive and negative) next period returns. This shows you the sample size.

- The percentage of up/down next period returns.

- The average next-period return return, up and down, as percentages.

The next three, green columns show these same statistics, but for all returns--every period in the active date range is used. This data serves as a basis for comparison.

Note that you can select a custom date range with the "start" and "end" inputs. The corresponding area on the chart is shaded light grey, to show which data is used in the computations.

By default, the latest return is used. For example, on a daily chart, that would mean "today's" return. However, you can select any return you want using the "override" input.

The output table shows:

- The latest/override return, as a percentage. This is in the top left, fuchsia cell.

The first three, blue columns, show:

- The count of up and down (or positive and negative) next period returns. This shows you the sample size.

- The percentage of up/down next period returns.

- The average next-period return return, up and down, as percentages.

The next three, green columns show these same statistics, but for all returns--every period in the active date range is used. This data serves as a basis for comparison.

Note that you can select a custom date range with the "start" and "end" inputs. The corresponding area on the chart is shaded light grey, to show which data is used in the computations.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.