OPEN-SOURCE SCRIPT

Dominant Cycle Adaptive MACD

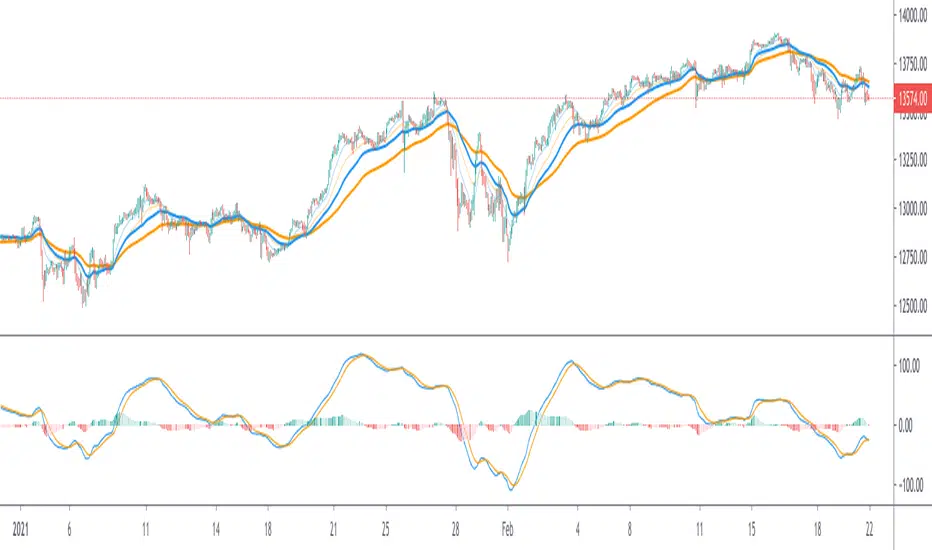

This Indicator is based on classic MACD but with an exceptional smoothing.

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.