OPEN-SOURCE SCRIPT

Trend Stability Index (TSI)

Overview

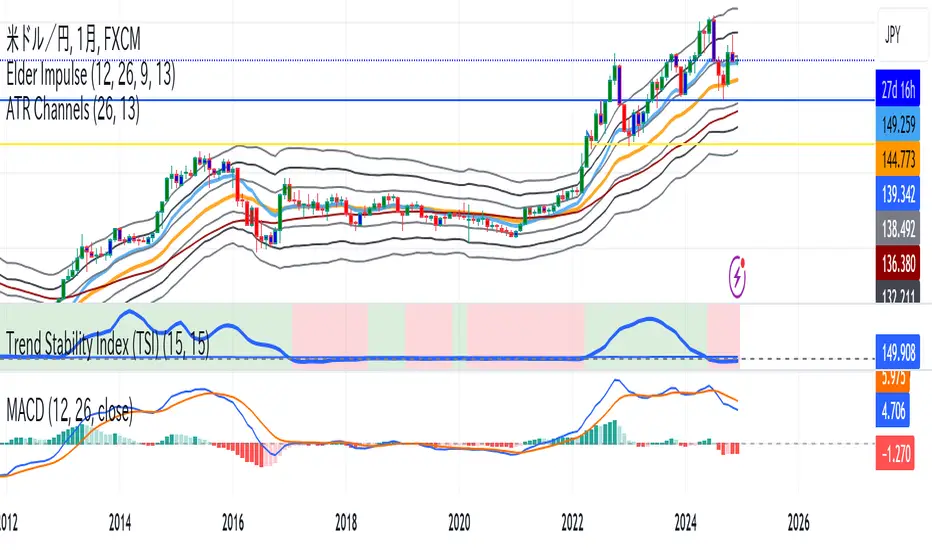

The Trend Stability Index (TSI) is a technical analysis tool designed to evaluate the stability of a market trend by analyzing both price movements and trading volume. By combining these two crucial elements, the TSI provides traders with insights into the strength and reliability of ongoing trends, assisting in making informed trading decisions.

Key Features

• Dual Analysis: Integrates price changes and volume fluctuations to assess trend stability.

• Customizable Periods: Allows users to set evaluation periods for both trend and volume based on their trading preferences.

• Visual Indicators: Displays the Trend Stability Index as a line chart, highlights neutral zones, and uses background colors to indicate trend stability or instability.

Configuration Settings

1. Trend Length (trendLength)

• Description: Determines the number of periods over which the price stability is evaluated.

• Default Value: 15

• Usage: A longer trend length smooths out short-term volatility, providing a clearer picture of the overarching trend.

2. Volume Length (volumeLength)

• Description: Sets the number of periods over which trading volume changes are assessed.

• Default Value: 15

• Usage: Adjusting the volume length helps in capturing significant volume movements that may influence trend strength.

Calculation Methodology

The Trend Stability Index is calculated through a series of steps that analyze both price and volume changes:

1. Price Change Rate (priceChange)

• Calculation: Utilizes the Rate of Change (ROC) function on the closing prices over the specified trendLength.

• Purpose: Measures the percentage change in price over the trend evaluation period, indicating the direction and momentum of the price movement.

2. Volume Change Rate (volumeChange)

• Calculation: Applies the Rate of Change (ROC) function to the trading volume over the specified volumeLength.

• Purpose: Assesses the percentage change in trading volume, providing insight into the conviction behind price movements.

3. Trend Stability (trendStability)

• Calculation: Multiplies priceChange by volumeChange.

• Purpose: Combines price and volume changes to gauge the overall stability of the trend. A higher positive value suggests a strong and stable trend, while negative values may indicate trend weakness or reversal.

4. Trend Stability Index (TSI)

• Calculation: Applies a Simple Moving Average (SMA) to the trendStability over the trendLength period.

• Purpose: Smooths the trend stability data to create a more consistent and interpretable index.

Trend/Ranging Determination

• Stable Trend (isStable)

• Condition: When the TSI value is greater than 0.

• Interpretation: Indicates that the current trend is stable and likely to continue in its direction.

• Unstable Trend / Range-bound Market

• Condition: When the TSI value is less than or equal to 0.

• Interpretation: Suggests that the trend may be weakening, reversing, or that the market is moving sideways without a clear direction.

Visualization

The TSI indicator employs several visual elements to convey information effectively:

1. TSI Line

• Representation: Plotted as a blue line.

• Purpose: Displays the Trend Stability Index values over time, allowing traders to observe trend stability dynamics.

2. Neutral Horizontal Line

• Representation: A gray horizontal line at the 0 level.

• Purpose: Serves as a reference point to distinguish between stable and unstable trends.

3. Background Color

• Stable Trend: Green background with 80% transparency when isStable is true.

• Unstable Trend: Red background with 80% transparency when isStable is false.

• Purpose: Provides an immediate visual cue about the current trend’s stability, enhancing the interpretability of the indicator.

Usage Guidelines

• Identifying Trend Strength: Utilize the TSI to confirm the strength of existing trends. A consistently positive TSI suggests strong trend momentum, while a negative TSI may signal caution or a potential reversal.

• Volume Confirmation: The integration of volume changes helps in validating price movements. Significant price changes accompanied by corresponding volume shifts can reinforce the reliability of the trend.

• Entry and Exit Signals: Traders can use crossovers of the TSI with the neutral line (0 level) as potential entry or exit points. For instance, a crossover from below to above 0 may indicate a bullish trend initiation, while a crossover from above to below 0 could suggest bearish momentum.

• Combining with Other Indicators: To enhance trading strategies, consider using the TSI in conjunction with other technical indicators such as Moving Averages, RSI, or MACD for comprehensive market analysis.

Example Scenario

Imagine analyzing a stock with the following observations using the TSI:

• The TSI has been consistently above 0 for the past 30 periods, accompanied by increasing trading volume. This scenario indicates a strong and stable uptrend, suggesting that buying opportunities may be favorable.

• Conversely, if the TSI drops below 0 while the price remains relatively flat and volume decreases, it may imply that the current trend is losing momentum, and the market could be entering a consolidation phase or preparing for a trend reversal.

Conclusion

The Trend Stability Index is a valuable tool for traders seeking to assess the reliability and strength of market trends by integrating price and volume dynamics. Its customizable settings and clear visual indicators make it adaptable to various trading styles and market conditions. By incorporating the TSI into your trading analysis, you can enhance your ability to identify and act upon stable and profitable trends.

The Trend Stability Index (TSI) is a technical analysis tool designed to evaluate the stability of a market trend by analyzing both price movements and trading volume. By combining these two crucial elements, the TSI provides traders with insights into the strength and reliability of ongoing trends, assisting in making informed trading decisions.

Key Features

• Dual Analysis: Integrates price changes and volume fluctuations to assess trend stability.

• Customizable Periods: Allows users to set evaluation periods for both trend and volume based on their trading preferences.

• Visual Indicators: Displays the Trend Stability Index as a line chart, highlights neutral zones, and uses background colors to indicate trend stability or instability.

Configuration Settings

1. Trend Length (trendLength)

• Description: Determines the number of periods over which the price stability is evaluated.

• Default Value: 15

• Usage: A longer trend length smooths out short-term volatility, providing a clearer picture of the overarching trend.

2. Volume Length (volumeLength)

• Description: Sets the number of periods over which trading volume changes are assessed.

• Default Value: 15

• Usage: Adjusting the volume length helps in capturing significant volume movements that may influence trend strength.

Calculation Methodology

The Trend Stability Index is calculated through a series of steps that analyze both price and volume changes:

1. Price Change Rate (priceChange)

• Calculation: Utilizes the Rate of Change (ROC) function on the closing prices over the specified trendLength.

• Purpose: Measures the percentage change in price over the trend evaluation period, indicating the direction and momentum of the price movement.

2. Volume Change Rate (volumeChange)

• Calculation: Applies the Rate of Change (ROC) function to the trading volume over the specified volumeLength.

• Purpose: Assesses the percentage change in trading volume, providing insight into the conviction behind price movements.

3. Trend Stability (trendStability)

• Calculation: Multiplies priceChange by volumeChange.

• Purpose: Combines price and volume changes to gauge the overall stability of the trend. A higher positive value suggests a strong and stable trend, while negative values may indicate trend weakness or reversal.

4. Trend Stability Index (TSI)

• Calculation: Applies a Simple Moving Average (SMA) to the trendStability over the trendLength period.

• Purpose: Smooths the trend stability data to create a more consistent and interpretable index.

Trend/Ranging Determination

• Stable Trend (isStable)

• Condition: When the TSI value is greater than 0.

• Interpretation: Indicates that the current trend is stable and likely to continue in its direction.

• Unstable Trend / Range-bound Market

• Condition: When the TSI value is less than or equal to 0.

• Interpretation: Suggests that the trend may be weakening, reversing, or that the market is moving sideways without a clear direction.

Visualization

The TSI indicator employs several visual elements to convey information effectively:

1. TSI Line

• Representation: Plotted as a blue line.

• Purpose: Displays the Trend Stability Index values over time, allowing traders to observe trend stability dynamics.

2. Neutral Horizontal Line

• Representation: A gray horizontal line at the 0 level.

• Purpose: Serves as a reference point to distinguish between stable and unstable trends.

3. Background Color

• Stable Trend: Green background with 80% transparency when isStable is true.

• Unstable Trend: Red background with 80% transparency when isStable is false.

• Purpose: Provides an immediate visual cue about the current trend’s stability, enhancing the interpretability of the indicator.

Usage Guidelines

• Identifying Trend Strength: Utilize the TSI to confirm the strength of existing trends. A consistently positive TSI suggests strong trend momentum, while a negative TSI may signal caution or a potential reversal.

• Volume Confirmation: The integration of volume changes helps in validating price movements. Significant price changes accompanied by corresponding volume shifts can reinforce the reliability of the trend.

• Entry and Exit Signals: Traders can use crossovers of the TSI with the neutral line (0 level) as potential entry or exit points. For instance, a crossover from below to above 0 may indicate a bullish trend initiation, while a crossover from above to below 0 could suggest bearish momentum.

• Combining with Other Indicators: To enhance trading strategies, consider using the TSI in conjunction with other technical indicators such as Moving Averages, RSI, or MACD for comprehensive market analysis.

Example Scenario

Imagine analyzing a stock with the following observations using the TSI:

• The TSI has been consistently above 0 for the past 30 periods, accompanied by increasing trading volume. This scenario indicates a strong and stable uptrend, suggesting that buying opportunities may be favorable.

• Conversely, if the TSI drops below 0 while the price remains relatively flat and volume decreases, it may imply that the current trend is losing momentum, and the market could be entering a consolidation phase or preparing for a trend reversal.

Conclusion

The Trend Stability Index is a valuable tool for traders seeking to assess the reliability and strength of market trends by integrating price and volume dynamics. Its customizable settings and clear visual indicators make it adaptable to various trading styles and market conditions. By incorporating the TSI into your trading analysis, you can enhance your ability to identify and act upon stable and profitable trends.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.