PROTECTED SOURCE SCRIPT

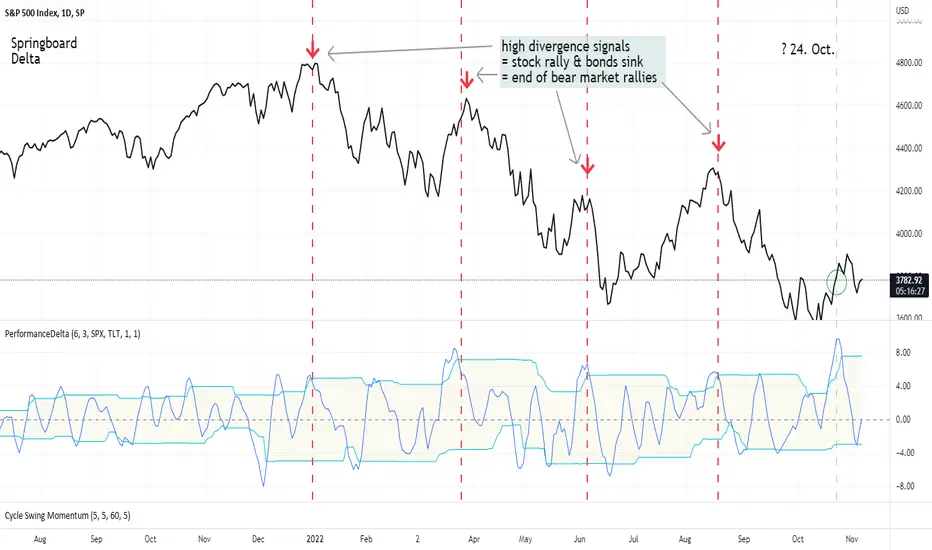

SpringBoard Delta (Bonds vs. Stocks Performance Oscillator)

Bonds and stocks move "in tandem" over the current market context. Higher yields cause bonds and stocks to decline. What's interesting is the timing of when the equity markets try to decouple from the bond market. That is, stocks begin to rise, but bonds do not.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script protegido

Este script se publica como código cerrado. No obstante, puede utilizarlo libremente y sin ninguna limitación. Obtenga más información aquí.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.