OPEN-SOURCE SCRIPT

BETA (against any benchmark index - defaulted to NSE:NIFTY)

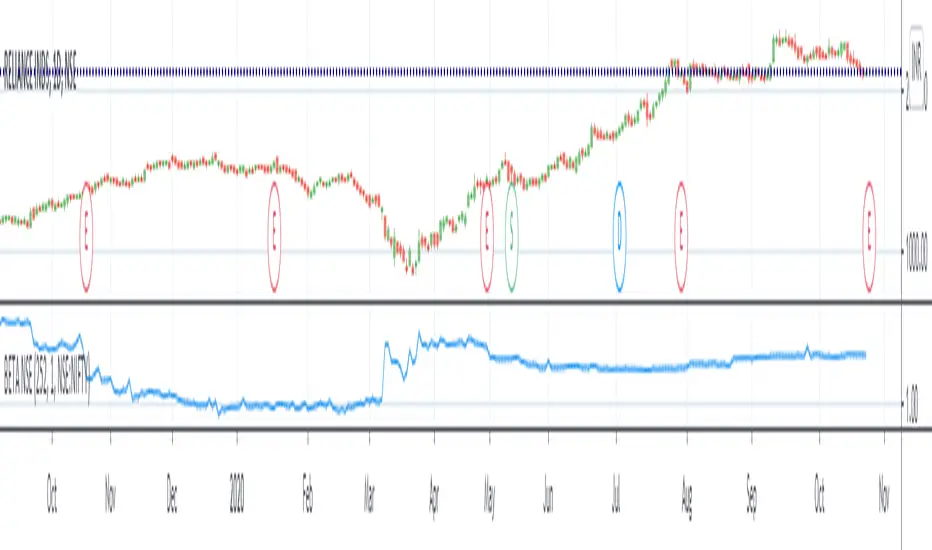

Beta value of a stock relative to benchmark index. Thanks to Ricardo Santos for the original script. This script is adapted from it.

To understand beta, refer Investopedia link: investopedia.com/terms/b/beta.asp

A beta value of 1 means the stock is directly correlated to benchmark index - volatility would be same as overall market.

Beta value less than 1 and greater than 0 means the stock is less volatile than the market.

Beta value more than 1 would mean the stock is more volatile than the market.

A beta value of 1.2 would roughly translate to the stock being 20% more volatile than the overall market.

A negative beta value indicates the stock is inversely correlated to market.

In the example chart, you can see the Beta value change in NSE:RELIANCE with respect to NSE:NIFTY.

To understand beta, refer Investopedia link: investopedia.com/terms/b/beta.asp

A beta value of 1 means the stock is directly correlated to benchmark index - volatility would be same as overall market.

Beta value less than 1 and greater than 0 means the stock is less volatile than the market.

Beta value more than 1 would mean the stock is more volatile than the market.

A beta value of 1.2 would roughly translate to the stock being 20% more volatile than the overall market.

A negative beta value indicates the stock is inversely correlated to market.

In the example chart, you can see the Beta value change in NSE:RELIANCE with respect to NSE:NIFTY.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.