OPEN-SOURCE SCRIPT

Actualizado Market Delta Volume for Realtime Bars

What is it?

Market Delta Volume Tool for real-time bars

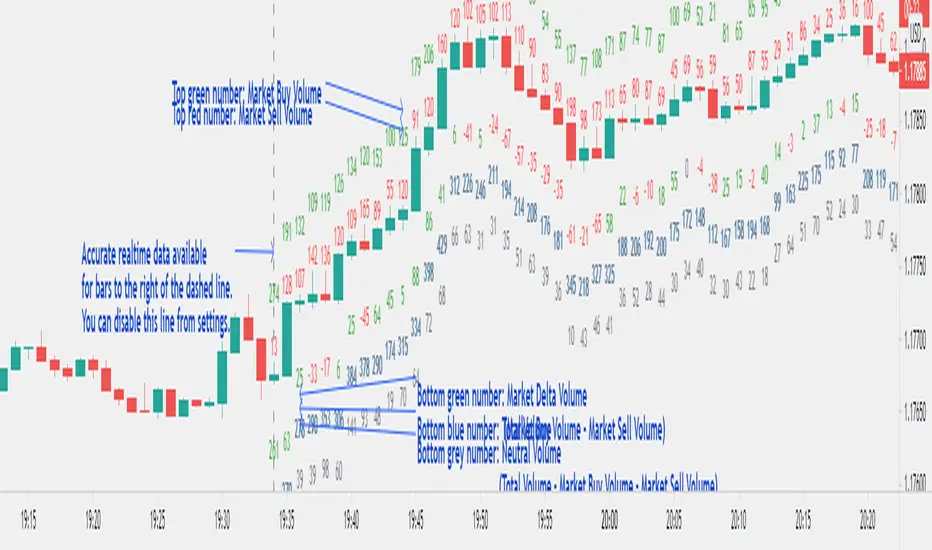

A market delta tool that shows, (1) the volume that got transacted on upticks - or the market buy volume; (2) the volume that got transacted on downticks - or the market sell volume (3) the market delta volume (i.e., market buy volume - market sell volume); (4) the total volume (market buy volume + market sell volume + neutral volume); and (4) the volume that got transacted without a change in price - or the neutral volume (total volume = market buy volume + market sell volume + neutral volume)

NOTE: THIS WORKS ONLY ON REAL-TIME BARS, NOT ON HISTORICAL BARS! The dotted line marks the start of real-time data (i.e., the bar from which the indicator started collecting and displaying data). You will see accurate data only for bars to the right of this line.

The longer you keep a chart open with the study enabled, the more data it collects and displays and the better your analysis can potentially be.

Note that the data gets reset every time any of the options is changed, the market is switched, the browser is refreshed, or the script is reloaded.

DATA ISN'T STORED. I.e., every time a new symbol is loaded/or the same symbol is reloaded, data gets refreshed.

Who is it for?

For traders who are used to analyzing buy/sell activity using market delta information. Especially, short-term trader/scalpers who are used to keeping the same chart open through the trading session.

Also for traders to see and study how anomalies in volume can give clues to buyer/seller absorption, initiative buying/selling etc.

Can be used to better understand VSA as well, although not necessary.

Essentially, this gives real-time delta volume information; use it however you see fit.

Market Delta Volume Tool for real-time bars

A market delta tool that shows, (1) the volume that got transacted on upticks - or the market buy volume; (2) the volume that got transacted on downticks - or the market sell volume (3) the market delta volume (i.e., market buy volume - market sell volume); (4) the total volume (market buy volume + market sell volume + neutral volume); and (4) the volume that got transacted without a change in price - or the neutral volume (total volume = market buy volume + market sell volume + neutral volume)

NOTE: THIS WORKS ONLY ON REAL-TIME BARS, NOT ON HISTORICAL BARS! The dotted line marks the start of real-time data (i.e., the bar from which the indicator started collecting and displaying data). You will see accurate data only for bars to the right of this line.

The longer you keep a chart open with the study enabled, the more data it collects and displays and the better your analysis can potentially be.

Note that the data gets reset every time any of the options is changed, the market is switched, the browser is refreshed, or the script is reloaded.

DATA ISN'T STORED. I.e., every time a new symbol is loaded/or the same symbol is reloaded, data gets refreshed.

Who is it for?

For traders who are used to analyzing buy/sell activity using market delta information. Especially, short-term trader/scalpers who are used to keeping the same chart open through the trading session.

Also for traders to see and study how anomalies in volume can give clues to buyer/seller absorption, initiative buying/selling etc.

Can be used to better understand VSA as well, although not necessary.

Essentially, this gives real-time delta volume information; use it however you see fit.

Notas de prensa

- Now you can view Market Buy/Sell and Neutral volume as a percentage of the total volume. Enable it from Settings. Default is Off. (i.e., will show actual volume data)

Notas de prensa

Added an option to adjust the font sizeScript de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

Script de código abierto

Fiel al espíritu de TradingView, el creador de este script lo ha convertido en código abierto, para que los traders puedan revisar y verificar su funcionalidad. ¡Enhorabuena al autor! Aunque puede utilizarlo de forma gratuita, recuerde que la republicación del código está sujeta a nuestras Normas internas.

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.