Indicadores, estrategias y bibliotecas

32 VWAP levels with labels and a table to help you identify quickly where current price is in relation to your favorite VWAP pivot levels. To help reduce cognitive load, 4 colors are used to show you where price is in relation to a VWAP level as well as the strength of that respective level. Ultimately, VWAP can be an invaluable source of support and resistance;...

This Indicator aims to fill a gap within traditional Standard Deviation Analysis. Rather than its usual applications, this Indicator focuses on applying Standard Deviation within an Oscillator and likewise applying a Machine Learning approach to it. By doing so, we may hope to achieve an Adaptive Oscillator which can help display when the price is deviating from...

Machine Learning: VWAP aims to use Machine Learning to Identify the best location to Anchor the VWAP at. Rather than using a traditional fixed length or simply adjusting based on a Date / Time; by applying Machine Learning we may hope to identify crucial areas which make sense to reset the VWAP and start anew. VWAP’s may act similar to a Bollinger Band in the...

The Volume-Weighted RSI takes a new approach to the traditional calculation of the RSI in using a price::volume calculation. As some traders consider volume to be a leading indicator for price, the volume-weighted RSI can come in handy if you want to visualize volume easier. Usage This indicator builds the RSI from the square of the volume change and the price....

Moving Average Based Zig Zag differs from the traditional Zig Zag indicator in that pivot points are determined by a moving average, Volume Weighted Hull Moving Average, rather than looking for the highest or lowest point in a left / right period. Settings Source: the source for the pivot points. Moving Average Length: the length of the Volume Weighted Hull...

This is a vwap & vwma hybrid with upper & lower deviation bands that provide excellent price channels and reversal areas. It can be used on lower & higher timeframes, just increase the deviation % for higher timeframes. Try out the 1 minute timeframe with .5% deviation for great scalping levels. Here is the calculation used for the main line. (VWMA100 + VWMA500...

This indicator will give you an overview of the trading volume of 1 candle, useful for new traders (This indicator will be updated more in the future). The current calculation method does not give any any trading signals!If you find it interesting or want to support the development of this indicator ,You can support me a cup of tea via the following link: ...

Short Version: This is a fairly self-contained system based upon a moving average crossover with several unique features. The most significant of these is the adjustable volume weighting system, allowing for transformations between standard and weighted versions of each included MA. With this feature it is possible to apply partial weighting which can help to...

Price Pattern Analysis is the core of trading. But price patterns often fails. VRAI (Volume Risk Avoidance Indicator) shows Volume Pressure, so that you can avoid volume-based risks. For example, never short when you see green (buying pressure). Never long when you see red (selling pressure). You still need to pick good price patterns, because the...

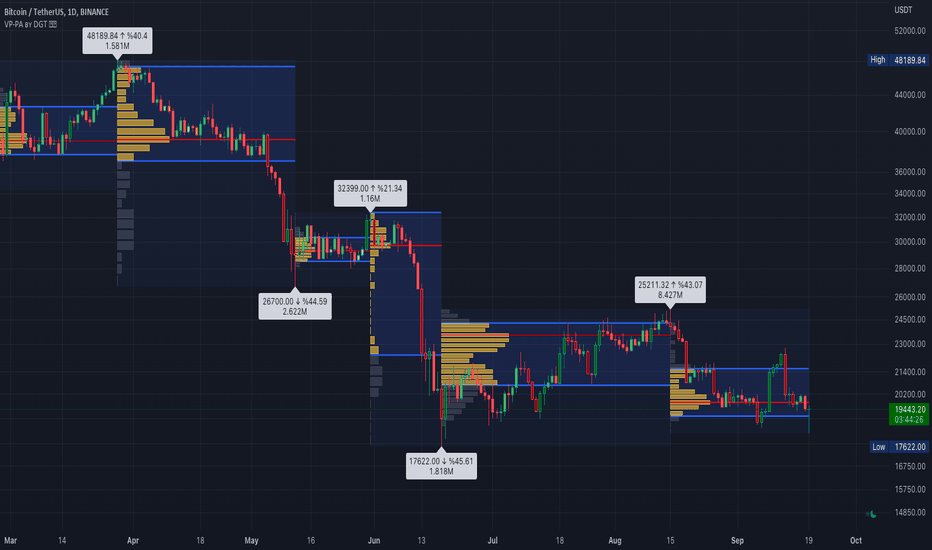

Volume Profile (also known as Price by Volume ) is an charting study that displays trading activity over a specified time period at specific price levels. It is plotted as a horizontal histogram on the finacial isntrumnet's chart that highlights the trader's interest at specific price levels. Specified time period with Pivots Anchored Volume Profile is...

Problem: (1) lag of traditional MA's, (2) lack of Volume data in traditional MA's, and (3) choppiness of traditional MA's. Solution: apply hull formula tick to tick, simply at a factor of 1:1. Result: Smooth and fast MA that has volume data baked in it. Benefit: See trend changes fast, and if it is supported by volume. Pleasant to the eyes. Explanatory note:...

Volume Profile (also known as Price by Volume) is an charting study that displays trading activity over a specified time period at specific price levels. It is plotted as a horizontal histogram on the finacial isntrumnet's chart that highlights the trader's interest at specific price levels. The histogram is used by traders to predict areas of support and...

The Volume-Accelerated Directional Energy Ratio (VADER) makes use of price moves (displacement) and the associated volume (effort) to estimate the positive (buying) and negative (selling) "energy" behind the scenes, enabling traders to "read the market action" in more details and adjust their trading decisions accordingly. How does VADER...

Produces deviation lines based upon linear regression of volume adjusted price with the option to clean the data of outliers. The regression line is more accurate than standard linear regression as each data point is effectively a volume unit (share) and the total number of data points is the total volume from the beginning to end.

Hi forks, I'm trader Baekdoosan who trading Equity from South Korea. This Baekdoo baseline will give you the idea of big whale's approximate average price. The idea behind this indicator is to combine volume and price. Here's one of the equation. ... HT4=highest(volume, 250) NewH4=valuewhen(volume>HT4 , (open+close+low+high+close)/5, 1) result4=ema(NewH4,...

RedK Volume-Weighted Directional Efficiency Index (DXF) is a momentum indicator - that builds on Kaufman's Efficiency Ratio (ER) concept. DXF utilizes a restricted +100/-100 oscillator to represent the "quality" of a trend, and does a good job in detecting the possibility of an upcoming trend change (in both direction and quality), improving our ability to make...

QUANTILE ESTIMATORS Weighted Harrell-Davis Quantile Estimator with Absolute Deviation Fences. DISCLAIMER: The Following indicator/code IS NOT intended to be a formal investment advice or recommendation by the author, nor should be construed as such. Users will be fully responsible by their use regarding their own trading vehicles/assets. The following...

Hello traders! In this script i tried to combine Kıvanç Özbilgiç's Volume Based Coloured Bars, Volume Weighted Macd V2 and Intraday Intensity Index developed by Dave Bostian and added to Tradingview by Kıvanç Özbilgiç. Let's see what we got here; VBCB, Paints candlestick bars according to the volume of that bar. Period is 30 by default. If you're trading stocks,...

![VWAP LEVELS [PRO] BTCUSD: VWAP LEVELS [PRO]](https://s3.tradingview.com/b/BD3tDX6K_mid.png)

![Machine Learning: STDEV Oscillator [YinYangAlgorithms] BTCUSDT: Machine Learning: STDEV Oscillator [YinYangAlgorithms]](https://s3.tradingview.com/4/4juIQs7S_mid.png)

![Machine Learning: VWAP [YinYangAlgorithms] BTCUSDT: Machine Learning: VWAP [YinYangAlgorithms]](https://s3.tradingview.com/v/vhEiWwdk_mid.png)

![Volume-Weighted RSI [wbburgin] BTCUSD: Volume-Weighted RSI [wbburgin]](https://s3.tradingview.com/c/cM6CWwGG_mid.png)

![Weight Gain 4000 - (Adjustable Volume Weighted MA) - [mutantdog] CRVUSDT: Weight Gain 4000 - (Adjustable Volume Weighted MA) - [mutantdog]](https://s3.tradingview.com/h/h7GWumy5_mid.png)

![PJBG - HMA Smoothed VWMA [HMASVWMA] NIKL: PJBG - HMA Smoothed VWMA [HMASVWMA]](https://s3.tradingview.com/l/Lu4Ki188_mid.png)