Indicadores, estrategias y bibliotecas

Introducing the Volume-Trend Sentiment by AlgoAlpha, a unique tool designed for traders who seek a deeper understanding of market sentiment through volume analysis. This innovative indicator offers a comprehensive view of market dynamics, blending volume trends with price action to provide an insightful perspective on market sentiment. 🚀📊 Key Features: 1. 🌟 ...

📊🚀 Introducing the "Median Proximity Percentile" by AlgoAlpha, a dynamic and sophisticated trading indicator designed to enhance your market analysis! This tool efficiently tracks median price proximity over a specified lookback period and finds it's percentile between 2 dynamic standard deviation bands, offering valuable insights for traders looking to make...

Description: The Momentum Bias Index by AlgoAlpha is designed to provide traders with a powerful tool for assessing market momentum bias. The indicator calculates the positive and negative bias of momentum to gauge which one is greater to determine the trend. Key Features: Comprehensive Momentum Analysis: The script aims to detect momentum-trend bias, typically...

Description: 🚨The BTC Supply in Profits and Losses (BTCSPL) indicator, developed by AlgoAlpha, offers traders insights into the distribution of INDEX:BTCUSD addresses between profits and losses based on INDEX:BTCUSD on-chain data. Features: 🔶Alpha Decay Adjustment: The indicator provides the option to adjust the data against Alpha Decay, this compensates...

Introducing the Volume Exhaustion by AlgoAlpha, is an innovative tool that aims to identify potential exhaustion or peaks in trading volume , which can be a key indicator for reversals or continuations in market trends 🔶. Key Features: Signal Plotting : A special feature is the plotting of 'Release' signals, marked by orange diamonds, indicating points...

Simple Neural Network Transformed RSI Introduction The Simple Neural Network Transformed RSI (ɴɴᴛ ʀsɪ) stands out as a formidable tool for traders who specialize in lower timeframe trading. It is an innovative enhancement of the traditional RSI readings with simple neural network smoothing techniques. This unique blend results in fairly accurate signals,...

Kernel Regression Oscillator - Overlay Introduction The Kernel Regression Oscillator (ᏦᏒᎧ) represents an advanced tool for traders looking to capitalize on market trends. This Indicator is valuable in identifying and confirming trend directions, as well as probabilistic and dynamic oversold and overbought zones. It achieves this through a unique...

Kernel Regression Oscillator - BASE Introduction The Kernel Regression Oscillator (ᏦᏒᎧ) represents an advanced tool for traders looking to capitalize on market trends. This Indicator is valuable in identifying and confirming trend directions, as well as probabilistic and dynamic oversold and overbought zones. It achieves this through a unique composite...

Hi Traders ! What is the Z score: The Z score measures a values variability factor from the mean, this value is denoted by z and is interpreted as the number of standard deviations from the mean. The Z score is often applied to the normal distribution to “standardize” the values; this makes comparison of normally distributed random variables with different...

Description: Introducing the Amazing Oscillator indicator by Algoalpha, a versatile tool designed to help traders identify potential trend shifts and market turning points. This indicator combines the power of the Awesome Oscillator (AO) and the Relative Strength Index (RSI) to create a new indicator that provides valuable insights into market momentum and...

Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market. It combines the concepts of Order Flow and Rate of Change (ROC) to provide valuable insights into market dynamics, momentum, and potential trade opportunities. By integrating these two components, the...

Description: The "Bollinger Bands Percentile (BBPct) + STD Channels" mean reversion indicator, developed by AlgoApha, is a technical analysis tool designed to analyze price positions using Bollinger Bands and Standard Deviation Channels (STDC). The combination of these two indicators reinforces a stronger reversal signal. BBPct calculates the percentile rank of...

Description: The "∂ Limited Growth Stock-to-Flow (LG-S2F)" indicator, developed by AlgoAlpha, is a technical analysis tool designed to analyze the price of Bitcoin (BTC) based on the Stock-to-Flow model. The indicator calculates the expected price range of BTC by incorporating variables such as BTC supply, block height, and model parameters. It also includes error...

Experience the power of multi-dimensional analysis with our Multi-Currency RSI Indicator (MCRSI). This innovative tool allows traders to simultaneously track and compare the Relative Strength Index (RSI) of eight different currencies in a single chart. The MCRSI calculates the RSI for USD (DXY), EUR (EXY), JPY (JXY), CAD (CXY), AUD (AXY), NZD (ZXY), GBP (BXY),...

The Triple Re-Anchoring VWAP (Volume Weighted Average Price) indicator is a tool designed for traders seeking a deeper understanding of market trends and key price levels. This indicator dynamically recalibrates VWAP calculations based on significant market pivot points, offering a unique perspective on potential support and resistance levels. Key Features: ...

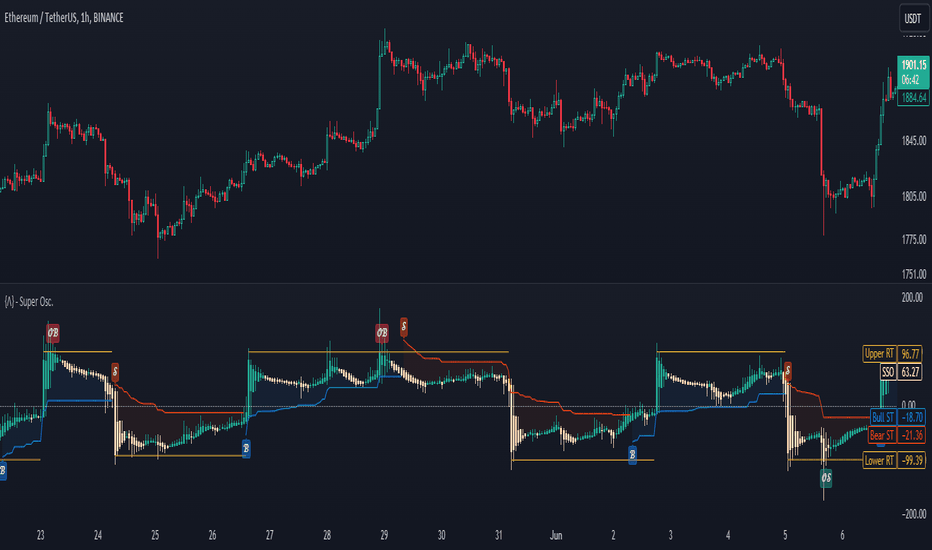

The Standardized SuperTrend Oscillator (SSO) is a versatile tool that transforms the SuperTrend indicator into an oscillator, offering both trend-following and mean reversion capabilities. It provides deeper insights into trends by standardizing the SuperTrend with respect to its upper and lower bounds, allowing traders to identify potential reversals and...

This script offers in-depth Z-Score analytics on price and volume for 200 symbols. Utilizing visualizations such as scatter plots, histograms, and heatmaps, it enables traders to uncover potential trade opportunities, discern market dynamics, pinpoint outliers, delve into the relationship between price and volume, and much more. A Z-Score is a statistical...

The Stablecoin Supply Ratio Oscillator (SSRO) is a cryptocurrency indicator designed for mean reversion analysis and sentiment assessment. It calculates the ratio of CRYPTO:BTCUSD 's market capitalization to the sum of stablecoins' market capitalization and z-scores the result, offering insights into market sentiment and potential turning points. Methodology:...

![Volume-Trend Sentiment (VTS) [AlgoAlpha] ETHUSDT: Volume-Trend Sentiment (VTS) [AlgoAlpha]](https://s3.tradingview.com/d/DCkbrrHB_mid.png)

![Median Proximity Percentile [AlgoAlpha] BTCUSD: Median Proximity Percentile [AlgoAlpha]](https://s3.tradingview.com/y/YEu4VVBj_mid.png)

![Momentum Bias Index [AlgoAlpha] ICPUSDT: Momentum Bias Index [AlgoAlpha]](https://s3.tradingview.com/o/oMZKratR_mid.png)

![BTC Supply in Profits and Losses (BTCSPL) [AlgoAlpha] BTCUSD: BTC Supply in Profits and Losses (BTCSPL) [AlgoAlpha]](https://s3.tradingview.com/a/AEhJ2yWg_mid.png)

![Volume Exhaustion [AlgoAlpha] EURUSD: Volume Exhaustion [AlgoAlpha]](https://s3.tradingview.com/u/u5QQ6rZT_mid.png)

![Simple Neural Network Transformed RSI [QuantraAI] BTCUSD: Simple Neural Network Transformed RSI [QuantraAI]](https://s3.tradingview.com/6/6qTxRYB1_mid.png)

![Triple Confirmation Kernel Regression Overlay [QuantraAI] BTCUSD: Triple Confirmation Kernel Regression Overlay [QuantraAI]](https://s3.tradingview.com/q/QbkEr6o9_mid.png)

![Triple Confirmation Kernel Regression Base [QuantraAI] BTCUSD: Triple Confirmation Kernel Regression Base [QuantraAI]](https://s3.tradingview.com/t/tQ7O9bpf_mid.png)

![Mean Reversion Watchlist [Z score] JPM: Mean Reversion Watchlist [Z score]](https://s3.tradingview.com/9/9PHoSp1Z_mid.png)

![Amazing Oscillator (AO) [Algoalpha] BTCUSD: Amazing Oscillator (AO) [Algoalpha]](https://s3.tradingview.com/g/g9j9piQE_mid.png)

![Trend Flow Profile [AlgoAlpha] BTCUSD: Trend Flow Profile [AlgoAlpha]](https://s3.tradingview.com/u/ui5VLe7A_mid.png)

![Bollinger Bands Percentile + Stdev Channels (BBPct) [AlgoAlpha] BTCUSD: Bollinger Bands Percentile + Stdev Channels (BBPct) [AlgoAlpha]](https://s3.tradingview.com/y/yxr6jElc_mid.png)

![Limited Growth Stock-to-Flow (LGS2F) [AlgoAlpha] BTCUSD: Limited Growth Stock-to-Flow (LGS2F) [AlgoAlpha]](https://s3.tradingview.com/c/cwSGZ60n_mid.png)

![Volume and Price Z-Score [Multi-Asset] - By Leviathan BTCUSDT.P: Volume and Price Z-Score [Multi-Asset] - By Leviathan](https://s3.tradingview.com/c/CBnACnmq_mid.png)