Indicadores, estrategias y bibliotecas

This Indicator show Options Data on signal dashboard , that help trader to analyse the market. Options data consist of two things , Call and Put. Every Strike has its Call and Put price. So if user Opens any chart which is traded in options , dashboard will show total 16 Call and 16 Put strikes 8 Above from ATM and 8 Below from ATM. On left hand side of...

This indicator is the market breadth for Bank Nifty (NSE:BANKNIFTY) index calculated on the histogram values of MACD indicator. Each row in this indicator is a representation of the histogram values of the individual stock that make up Bank Nifty. Components are listed in order of its weightage to Bank nifty index (Highest -> Lowest). When you see Bank Nifty is...

ALWAYS TRADE THE DIRECTION OF THE TREND This indicator is useful for 5-minute Bank Nifty intraday trading. It compares the Open-Close value for a 5-minute bar with the current ATR value. When a bar has higher than the ATR value then it means that the current bar has a higher Open-Close than the ATR. This means that after a period of dull action, some action has...

The strategy combines three indicators: Exponential Moving Average (EMA), Weighted Moving Average (WMA), and Average Directional Index (ADX). The EMA and WMA are used to track the average price over different time periods. The ADX measures the strength of a trend in the market. The strategy generates buy signals when the EMA is higher than the WMA and the ADX...

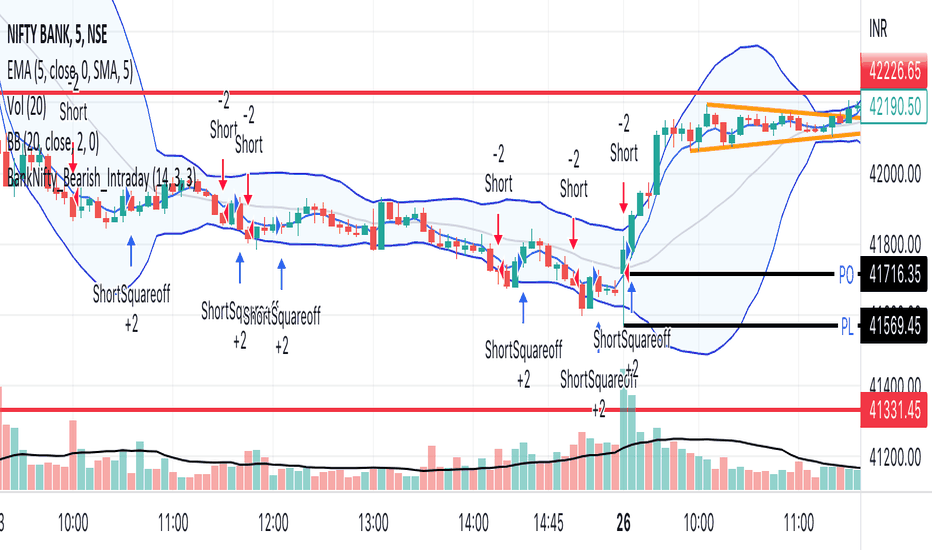

9:22 5 MIN 15 MIN BANKNIFTY Strategy with Additional Filters The 9:22 5 MIN 15 MIN BANKNIFTY Strategy with Additional Filters is a trend-following strategy designed for trading the BANKNIFTY instrument on a 5-minute chart. It aims to capture potential price movements by generating buy and sell signals based on moving average crossovers, breakout confirmations,...

Hello Guys using the below script you can check the nifty bank puller and draggers at live how to use it? it's straightforward in the table, we will see the points contribution by each bank to Bank nifty graph shows the overall strength of the buyers and sellers using graphs also you can trade but If you want to use a graph please note these important...

Original Idea Credit: Verified Market Waves Hi, After watching different videos online on how to get targets of BankNifty & Nifty decided to write this small script using VIX. Nothing great but I really like the concept of getting high and low targets for the day or weekly or monthly or yearly. What does the script do 1. We get closing of India Vix &...

The script is an advanced technical analysis tool specifically designed for trading in financial markets, with a particular focus on the BankNifty market. It utilizes two powerful indicators: the Fractal Adaptive Moving Average (FRAMA) and the CPMA (Conceptive Price Moving Average), which is similar to the well-known Chande Momentum Oscillator (CMO) with Center of...

This code is a TradingView indicator that analyzes the Bank Nifty index of the Indian stock market. It uses various inputs to customize the indicator's appearance and analysis, such as enabling analysis based on the chart's timeframe, detecting bullish and bearish engulfing candles, and setting the table position and style. The code imports an external script...

Library "BankNifty_CSM" TODO: add library description here getLtp_N_Chang(openPrice, closePrice, highPrice, hl2Price, lowPrice, hlc3Price, bankNiftyClose) Parameters: openPrice (float) closePrice (float) highPrice (float) hl2Price (float) lowPrice (float) hlc3Price (float) bankNiftyClose (float)

In India Weekly options expire on Thursday and that creates a different price action candle than the week timeframe. My previous script Weekly Options Expiry Candle has some limitations. This script overcame those limitations and added some features. You can use this in any intraday time frame candle. It will show: All expiry candle in box format Expiry...

What? In the price action, levels have a significant role to play. Based on the price moving above/below the levels - the underlying instrument shows some price-action in the direction of breakout/breakdown. There are plenty of ways level can be determined. Levels are the decision point to take a trade or not. But if we make the level derivation complex, then...

The script uses following mechanism to give a signal of BUY if multiple parameters evaluated are all passed. ENTRY- 1. 5 min MACD should be more than its previous tick 2. 15 min MACD should be more than its previous tick 3. 60 min MACD should be more than its previous tick 4. ADX should be more than 12 5. RSI should be more than 60 6. Stochastic %k should have...

The script uses following mechanism to give a signal of SELL if multiple parameters evaluated are all passed. ENTRY- 1. 5 min MACD should be less than its previous tick 2. 15 min MACD should be less than its previous tick 3. 60 min MACD should be less than its previous tick 4. ADX should be more than 12 5. RSI should be less than 40 6. Stochastic %k should...

Use this indicator on daily timeframe This indicator shows the performance of the top NSE Sectors for 4 time periods. User has the flexibility to define the time periods (ex. Yearly Monthly Quarterly Weekly Daily indicator shows the performance of the sector for those time periods along with 250d High/Low and distance from the High/Low User input is provided to...

Use this indicator on Daily Timeframe This indicator shows the important metrics of BANKNIFTY and its top 7 constituent stocks. This indicator is similar to Open Interest indicator but consolidates the data for NIFTY stocks For more information, look at the Open Interest Indicator

Use this indicator on Daily Timeframe This indicator shows important metrics of NIFTY and its top 7 constituent stocks (Banks are excluded as there is a separate dashboard for BANKNIFTY). This indicator is similar to Open Interest indicator but consolidates the data for NIFTY stocks For more information, look at the Open Interest Indicator

Use this indicator on Daily Timeframe This script works only on India NSE Futures (Indices and Fno Stocks) This script pulls Stock/Index Price/Volume Info + Futures Current/Next Price/Volume/Open Interest Info Calculates the Combined OI and identifies the OI Buildup based on the Price Change and color codes the info for easy reading This script also calculates...

![FRAMA & CPMA Strategy [CSM] BANKNIFTY: FRAMA & CPMA Strategy [CSM]](https://s3.tradingview.com/t/TbHmRsax_mid.png)